Feb 14, 2020 11:48:10 AM

The error may be due to the input on your HSA account. Please try the following:

Review your W-2 Form to determine if the amount is pulling through from your wage input.

On your W-2, it would be reflected in Box 12, as Code W.

If you see this entry, that could be what is generating your HSA form.

You may need to enter additional information to complete the HSA calculation as follows:

Go to the Federal section of the program and select "Deductions & Credits".

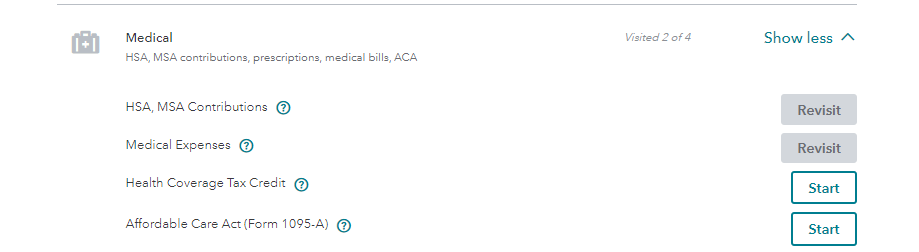

- Select Medical (you may have to select see all if you do not see this option)

- Under Medical, select "HSA, MSA Contributions"

- Follow the screens and answer the questions

- Enter any information from any 1099-SA forms.

- Confirm whether the distributions were used on medical expenses.

- Confirm if you or your spouse were covered under a "High Deductible Health Plan" (HDHP). If you answer no here, the program may result in a lapse of coverage warning, so please verify your answer here to avoid the error.

- Please confirm the year as you answer the questions.

- If it refers to the coverage under an HDHP in 2018, please answer None in all of the following situations:

- You had an HSA in 2018 but did not contribute

- You had HDHP coverage for all of 2018

- You had no HDHP coverage for all of 2018

- You did not have an HSA in 2018

- By answering None to all of the options in 2018, the error message regarding the lapse in coverage will go away and you will be able to proceed with your return.