OK, let's do the following:

1. Delete all HSA information to clear any lingering data

2. Restart Oregon

#1. To delete all HSA information and reset it, please do:

1. make a copy of your W-2(s) (if you don't have the paper copies)

2. delete your W-2(s) (use the garbage can icon next to the W-2(s) on the Income screen

*** Desktop***

3. go to View (at the top), choose Forms, and select the desired form. Note the Delete Form button at the bottom of the screen.

*** Online ***

3. go to Tax Tools (on the left), and navigate to Tools->Delete a form

4. delete form(s) 1099-SA (if one), 8889-T, and 8889-S (if one)

5. go back and re-add your W-2(s), preferably adding them manually

6. return to the HSA interview (do a Search for hsa and click on the jump-to result) and go through the interview.

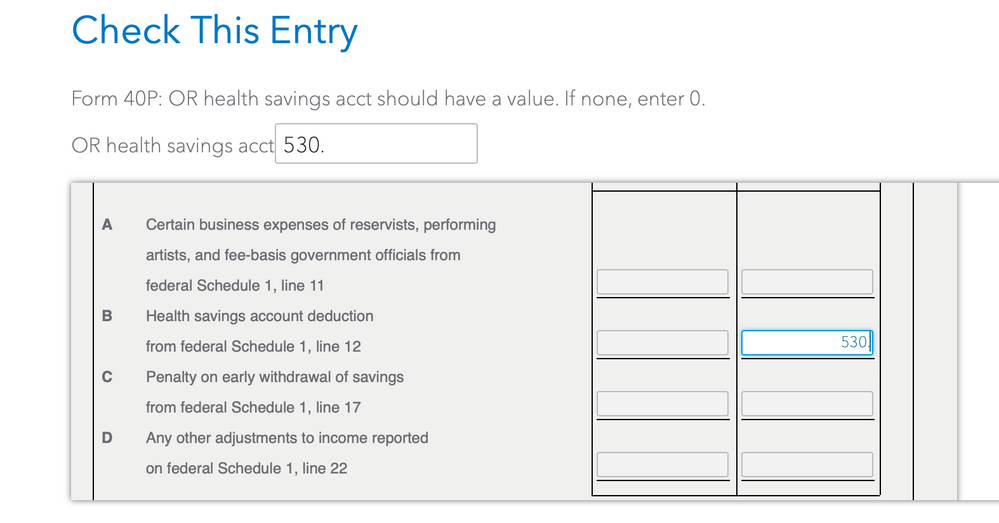

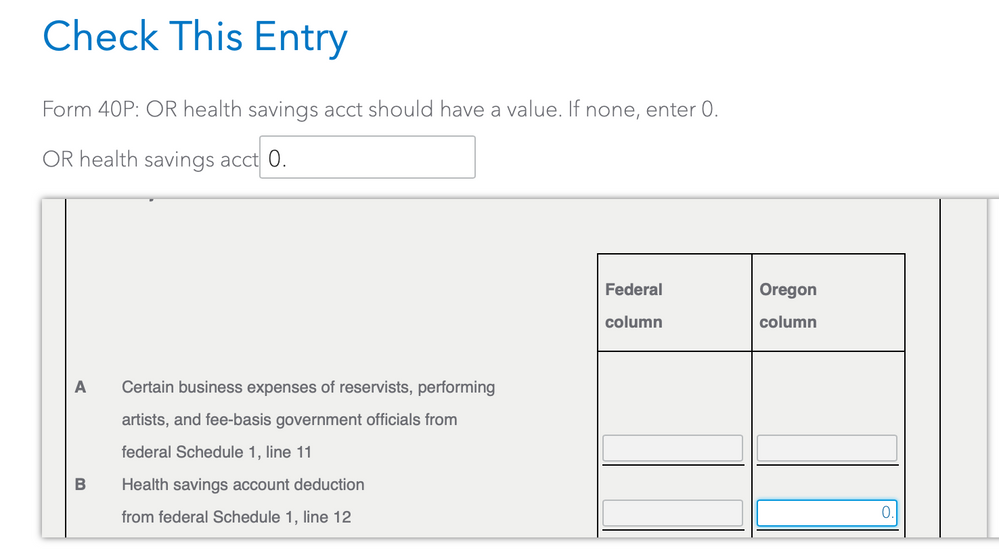

#2 Restart Oregon

If you can, delete Oregon and re-add it. NOTE: if you have the Online product and have already paid for it or registered, then you won't be able to.

Instead, do this:

*** Desktop***

1. go to View (at the top), choose Forms, and select the desired form. Note the Delete Form button at the bottom of the screen.

*** Online ***

1. go to Tax Tools (on the left), and navigate to Tools->Delete a form

2. delete form(s) Oregon Other Additions (Other Adds) and Oregon Other Subtractions (Other Subs).

3. go the the Oregon interview and start from the beginning.

Let me know if this works for you.