What is the error?

On the previous screen, you put an amount in the first line "Federal Exempt Non-Arizona Municipal Interest Income". This is what triggered the screen asking for the payors and the amounts.

Either enter the payors as requested or go back to the previous screen ("Arizona Municipal Interest") and blank out the first line where you listed Federal Exempt Non-Arizona Municipal Interest Income.

I can't enter the information when I try to enter the Information on line 13 in the box next to 'Explain'. And I have tried to go back to delete the amount and I can't

When I go to the 140 Form line 13, there is a text box beside the amount entered. It has the word "Explain" just to the left.

When I try to enter the Payor I can enter any text in the box

You are using the forms mode for the desktop. Entries don't work the same that way. You should have an explanation statement right under the 140, delete that.

You can right click next to line 13 and do a data source to see this is coming from Sch B. Entries made in Forms Mode will void the accuracy guarantee. It is best to use the step by step method and let the program do the work.

The internet help response was not helpful. Cannot get into explanation statement to correct entries.

Explanation statement cannot be deleted.

"Cannot get into explanation statement to correct entries." When you are in step-by-step mode, what happens when you put an amount in the first line of "Federal Exempt Non-Arizona Municipal Interest Income"? Is the next screen not the screen asking for Payors and amounts?

If so, what happens when you try to make entries on this second screen?

When in step by step mode, the first line "Federal Exempt Non-Arizona Municipal Interest Income" is taken directly from the federal taxes. The list of payors and amounts is again taken from the the federal taxes input but with incorrect amounts. There is no way to input or correct the data given.

Going to the forms I can add lines of payors and amounts to force the Explanation Statement to match the "Federal Exempt Non-Arizona Municipal Interest Income".

Could you give me an example of "with incorrect amounts"?

Is this because a federal entry contains both Arizona and non-Arizona interest on the same 1099-INT?

In the 1099-INT interview, after you entered the 1099-INT itself, what did you answer when TurboTax asked you for the state? In this case, did you answer "from multiple states?"

I see that this hardcodes the description and the amount on the list we are looking at, yet, as you say, since the interest is both Arizona and non-Arizona, the amount is not correct, because the Arizona amount should not be added back to Arizona income.

Does this describe your situation?

If so, you may have to assume that "from multiple states" means "from multiple states other than Arizona". This would mean that you would have to break out the Arizona municipal interest and make two 1099-INT entries: one just for Arizona interest and one for all other states.

I will stop here and see if this is what you are seeing.

Note that if anyone ever questions why you broke one 1099-INT into two 1099-INTs, just explaining that this is what you had to do to get the software to report the interest correctly both on the federal and state returns. So long as the totals are correct, the taxing authority should accept this explanation.

In the federal 1099 interview, I did enter the amount from the 1099. Then when asked if it was from more than one state, I checked the box the it was from more than one state. Then I entered the Arizona amount and the remainder as from more than one state.

The Arizona step by step numbers were not correct, so I added lines to the explanation statement to force a match from my 1099s to the non Arizona municipal interest income (which includes both interest and dividends).

While I don't like the work around, my Arizona interest is not taxed by Arizona - Good.

Questioned answered previously

Thank you for the response

Bob

I just switched from guided to forms under view, click on forms. Then click on Explain and a box will open. I'm not sure what to write there, but it does open the box that needs to be filled!

Do you have updated info on this? 2023 shows Line 15 and 'explain' button does not do anything.

thanks

You are commenting on an old post. We'd love to help you complete your tax return, but need more information. Can you please clarify your question and tell us what state?

This is happening to me, how do I break it out and add the 1099 in my state return? Turbotax is only flagging the issue, there is no way to fix it.

Go back to your 1099-INT in your Federal Return. In the interview, you'll get a screen 'Tell us more about your exempt interest', where you can choose Arizona and enter the amount.

Here's more info on Arizona Municipal Interest.

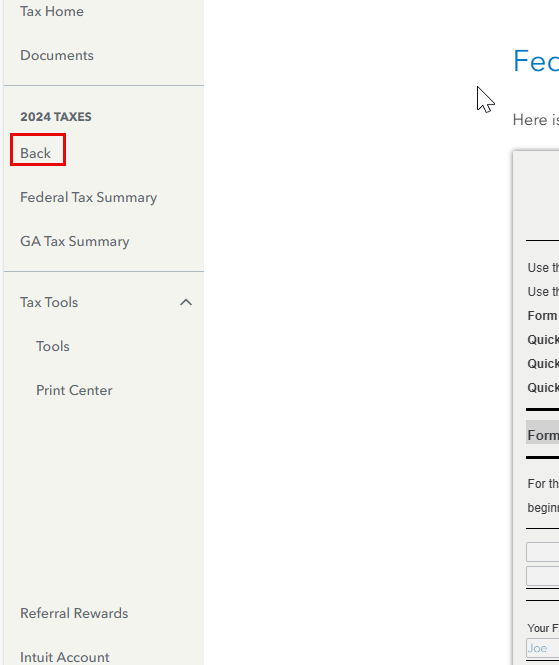

If you are using TurboTax Online, simply go the menu on the left side of your screen and select back.

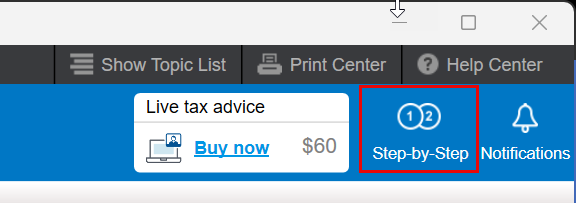

If you are using TurboTax Desktop, select step by step in the top right.