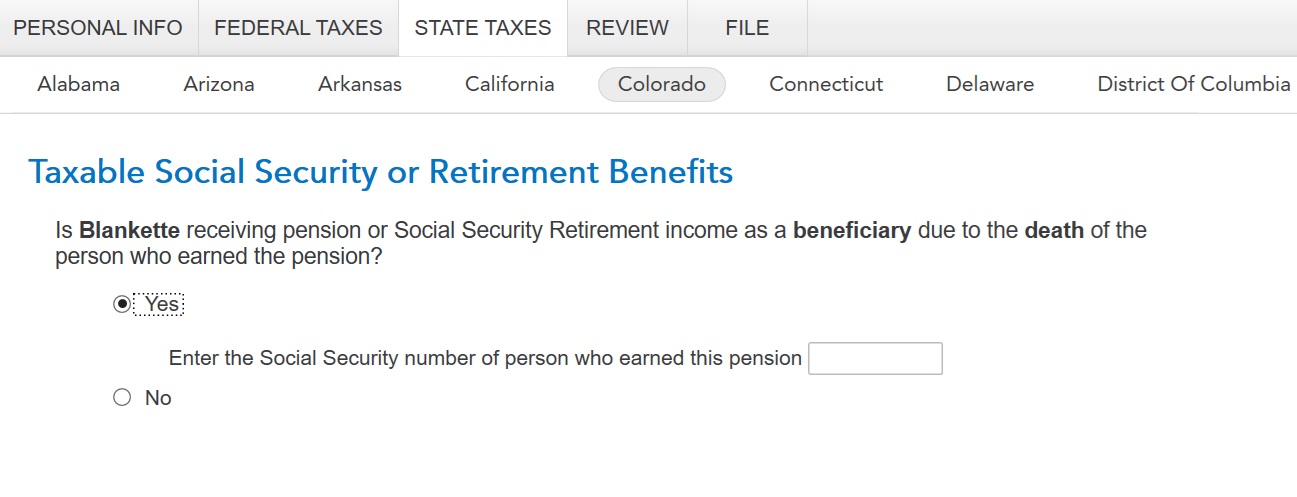

The SSN in question is that of the deceased person that you or your spouse inherited the pension from. Also, you need to be under 55 to see the trigger question. If you meet these requirements, you will see this question. And that's how the SSN gets on to the form.

The person I inherited from is in fact deceased. I am over 55. I don't understand why my age has anything to do with whether the SSN is required.

These are the Colorado instructions for line 4 (and by extension, line 6) on form 104AD:

- Age 65 or older, then you may subtract $24,000 minus any amount entered on line 3, or the total amount of your taxable pension/annuity income, whichever is smaller; if the amount in line 3 of this form is greater than $24,000, you may not claim any subtraction for pension and annuity income on line 4; or

- At least 55 years old, but not yet 65, then you may subtract $20,000 minus any amount entered on line 3, or the total amount of your taxable pension/annuity income, whichever is smaller; if the amount on line 3 of this form is $20,000, you may not claim any subtraction for pension and annuity income on line 4; or

- Younger than 55 years old and you received pension/annuity income as a secondary beneficiary (widow, dependent child, etc.) due to the death of the person who earned the pension/annuity, 19 then you may subtract $20,000 minus any amount entered on line 3, or the total amount of your secondary beneficiary taxable pension/ annuity income, whichever is smaller; if the amount on line 3 of this form is $20,000, you may not claim any subtraction for pension and annuity income on line 4.

Colorado form 104AD, line 4 and 6, only cares about the SSN or ITIN if the pension is inherited from someone else. This is not the case for taxpayers over 65 or between 55 and 65 (in the instructions), hence only taxpayers under the age of 55 are asked the question about the SSN or ITIN.

Will Colorado deny my subtraction from income if I cannot enter the "deceased SSN" on line 4, form 104AD?

I am 53 year old Colorado taxpayer, who received a 1099-R pension distribution with box 7 distribution code 4 (meaning a death benefit). Neither the insurance company nor the estate executor will give me the deceased person's SSN.

The CO instructions are unclear on what is required vs optional.

I have looked through all the state documentation as well as the TurboTax support data base, and I don't see what happens if you can't supply the SSN. I suggest that you try to file with the field blank, and hopefully the State will accept it.

Note: if there is an e-file reject by Colorado, you have the option of printing and mailing - the e-file checks sometimes have no sense of humor. But I would try to e-file with the field blank; if the State does not like it, they will send you a letter, and you can explain to them why you would need a court order at least to get such confidential information.