Mar 30, 2021 10:58:44 AM

They should actually be entered under the Assets section so you can amortize those costs. This will also ensure they are carried forward each year and amortized accordingly.

You can do this by logging back into your TurboTax Business account.

- Select the Federal Taxes tab

- Select Deductions

- Scroll down and select Assets under the section titled Depreciation of Assets

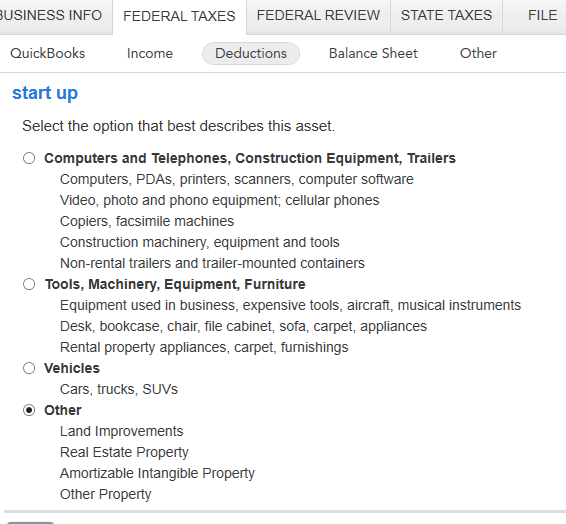

- Proceed to enter your information as prompted. You will eventually be able to select Other and mark your asset as being startup costs as shown in the sample below.