If you're using TurboTax Desktop, go to FORMS at the upper left when you are at the 'Enter Ending Inventory' page in the interview. You will be on a 'Schedule C Worksheet' where you can type in the amount of your 'Beginning Inventory'.

Turbo tax does not let you put starting inventory for a first year of business. It auto puts 0. That is my problem.

Put in zero for ending inventory also and enter 2,245 for Purchases. Your COGS will equal the same amount.

Thanks for taking the time to answer. Sounds like a work-around, but then I will have the same problem next year. Because I will still need a starting inventory and it will be 0 again if that is my ending this year. I was hoping to find out how people deal with starting inventory their first year.

Since a business doesn't start with assets or inventory, you need to be entering the "investment" of your inventory into your business.

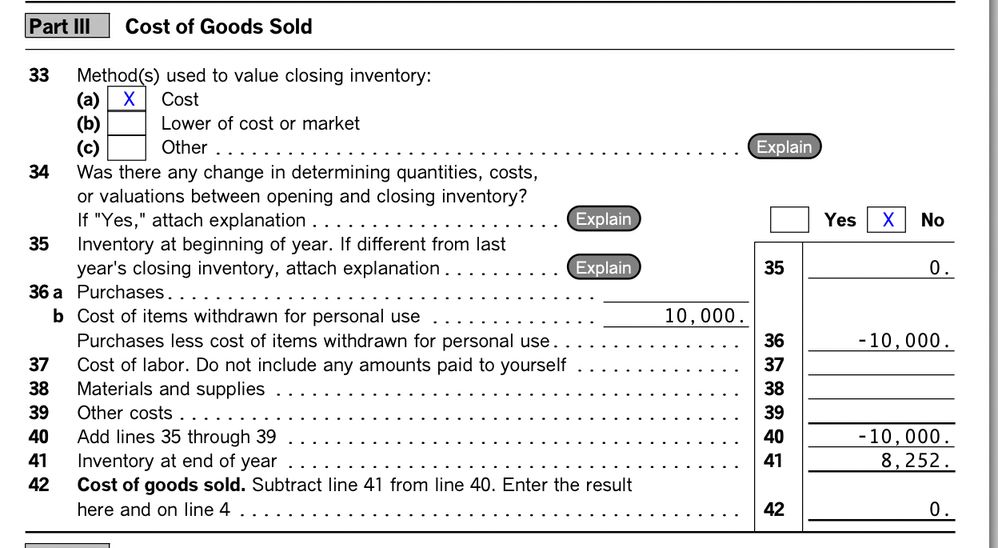

Enter the negative of your beginning balance value on the Purchases Withdrawn for Personal Use line within the Cost of Goods section of TurboTax. For example, if your starting inventory value is $10,000, enter -10000 on this line.

Thanks for answering. So I put $10,000 in Purchases? I thought that line was for purchases just in the tax year 2022. Will it be a red flag to have that much purchases in 1 year when my income is not that high now as semi retired? But it would work in terms of COG and ending inventory and reporting next year.

No, you are entering a negative (opposite) "Purchase Withdrawn for Personal Use". While you and your business are essentially the same things when you report as a disregarded entity (Schedule C), the business still needs to "buy" the items in order to resell them. It will not raise a red flag because it will be a large "purchase" from yourself and you are only expensing what you actually sold in 2022 when you enter your ending inventory value.

Thanks again Alicia for trying to help me, but when I put -$10,000.00 next to "cost of items withdrawn for personal use" and then put ending inventory, it still comes out with COG as 0.

So, your ending inventory is $10,000 and you didn't sell anything? If so, your COG is correct at $0. If you sold any items your inventory value went down and needs to be adjusted.

Sorry, I am obviously not getting it. Thank you for your patience. These are not real numbers but lets say end of inventory is $8252 so COG should be $1748 ( if I started with 10,000). See screenshot from turbo tax attached. COG still 0.

You have entered the amount on Line 36b as a positive number. Enter this as a negative so the number on line 40 is a positive number. After deducting ending inventory, this should result in the correct COGS.

Thank you Patricia! That did work. I don't understand why it worked ha ha. I guess it knows I had to have 10,000 in purchases in order to withdraw that much for personal use. Still very odd. Thanks to Alicia also!