Please let me know if you get this figured out. I’m having the exact same issue.

Same exact issue. I hope they post an official "Correct" answer to this soon.

To be accurate, you should enter Box 20 Code AJ twice - once for Gross Income and again for Total Deductions.

Note, however, that this information will be used only if your net losses from all businesses are more than $289,000 ($578,000 if filing a joint return).

See also:

Still get this gasification page after I enter it twice. Really need help with this. @PatriciaV

@Lalo86 I am having the same issue. I have spent several hours on trying to figure out what I was missing. Have you had any luck?

I spent about an hour on a chat with a “tax expert” and then they finally needed to transfer me to a business “tax expert” more familiar with the k-1’s. I allowed them access to my k-1’s, in order for them to try and find a work around. Still waiting for an answer from the Business Tax Expert. When I get one I’ll try and pass it along. @kmadsen12

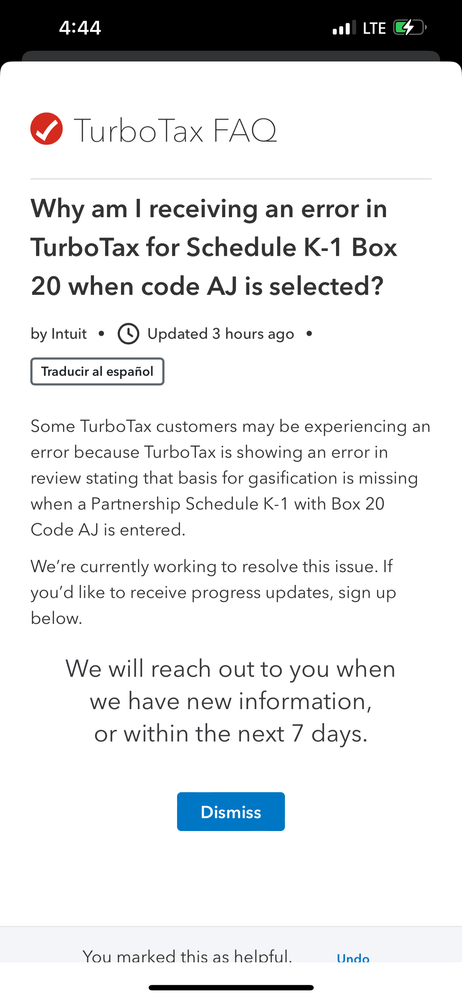

Hey @kmadsen12 it looks like turbo tax is aware of the issue now, and working to resolve it. Found a page you can sign up for updates regarding this issue on turbo tax. I believe if you search the question in the picture it’ll come up, and you can sign up for updates. Hope this helps 🙂

On the AJ code with suggestion to enter twice: once for Gross Income and again for Total Deductions.

The AJ option does not distinguish between these two which would seem to be necessary for proper allocation should you meet any criteria for them to take effect.

Is this an open issue that Intuit is aware of or an unimportant detail or ???

Thanks

Same issue.

Do we enter AJ twice for each value?

Do we put both numbers as positive? Or one as negative? How does TurboTax know what the difference between these two are?

The entry and handling of Schedule K-1 Box 20 Code AJ will be updated as referenced in the TurboTax FAQ Why am I receiving an error in TurboTax for Schedule K-1 Box 20 when code AJ is selected? The estimated release date is March 7, 2024.

Because updates are released after business hours Pacific time, we recommend waiting until the day after, updating TurboTax (if using Desktop), then try entering Schedule K-1 again.

Thanks for the update about the bug fix-- just to clarify, will the new release include guidance on how to denote the different descriptions of values entered under code AJ?

There are two issues for box AJ. Can I get confirmation which will be fixed in the patch?

1) AJ is not able to determine Gross Income vs Total Deductions. K-1s this year have both as a statement for that box. We need guidance on where to put Gross income and Gross Deductions in the box.

2) Filling out AJ produces a gasification error.

Please advise which is being fixed: Both, or issue 1, or issue 2. I'm pretty close to paying my business accountant to do this, because I'm losing trust in Intuit's ability to handle new tax code.

I am in the same boat, with both issues. They’ve been working on this for a week. As much as I would like to continue giving Turbo Tax our business, this has me considering paying an accountant, or using another company to do our taxes also if this is not resolved by the end of the week. @TurboTax

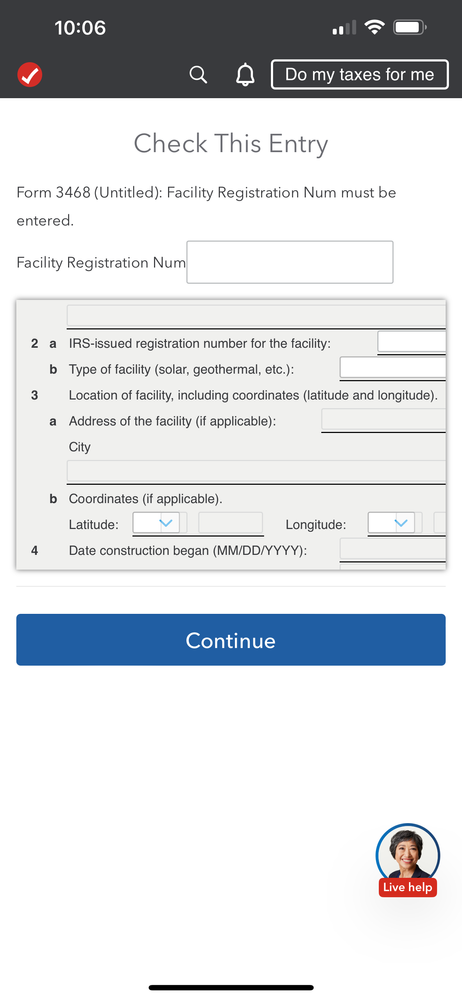

It appears as though the original problem was solved (the gasification section no longer is prompted to be completed) but now it's taking me to several sections of form 3468 which do not seem to apply either. It's getting really frustrating.

Yup, this is what shows up for me now. This is getting ridiculous @TurboTax I would really like to just be done with my taxes.

@Lalo86 have you figured out any workaround for this? The last time the correction updated, it made a significant difference my amounts. I'm hesitant to ignore this afraid it will be wrong in the total calculations. This is so frustrating to have these issues and no support from turbo tax in acknowledging the problem or any resolutions.

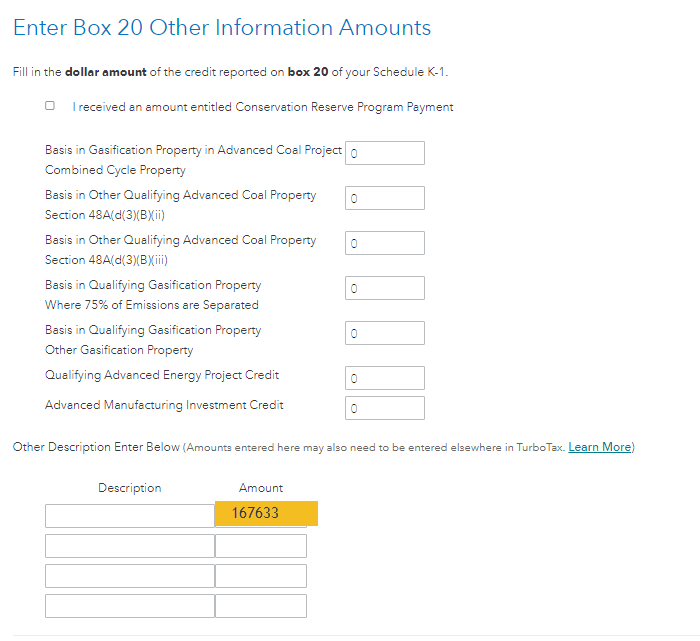

I’m still waiting. It now allows you to insert your numbers in “other”, and I tried that, distinguishing each amount Income/Deductions. But doing that, as you said, made a big difference in my return which I am about 90% sure is incorrect. Not to mention that took me down a rabbit hole of new questions that also seem not to relate to my tax return. The most sensible advice I’ve received by one of the tax experts is to leave the sum of Income/Deductions in the gasification box. And push it through. I’ve had the most success doing that than anything else I’ve read in here, and my return is closer to what I was expecting as well. I’m going to continue waiting it out but, this has just been unacceptable. @kmadsen12 @Intuit @turbotax

The link indicates that the problem is solved. Today, 3/9/24, I updated the software, and am still getting the error message. I'm getting annoyed as I will probably miss the lower cost filing of state returns due to this error.

Today, 3/9/24 I'm still getting the gassification error and the description for code AJ does not match what I have on my K1 or the description on the IRS webpage

Disclaimer: I am not an accountant or a tax expert; only the poor schlump that has to figure out my wife's and my taxes. So here is how I finally resolved this (in the Desktop version).

The problem: information in your K-1 for the code AJ is reporting two figures: An aggregate for income and and aggregate for deductions. Note that these are only relevant if the K-1 is reporting an overall loss for the business, which is going to end up on your schedule E, along with other potential losses from other businesses, like on a Schedule C. If there is a loss, and it the loss is also subject to the excess business loss rules (explained by PatriciaV), you would have to figure that limitation separately on Form 461, which TurboTax does not include. However, TurboTax does not give a guide to how to enter the information you've received.

Actually, what TurboTax is giving you is a record-keeping mechanism for recording the information you received on your K-1, to be used if needed to fill out a Form 461. If you have no losses, the AJ information is not going to appear on any forms the IRS will see in your submission. However, for the sake of completeness, you still might want to get these numbers into TurboTax.

So, in order to keep TurboTax consistent with the K-1, here's what I did:

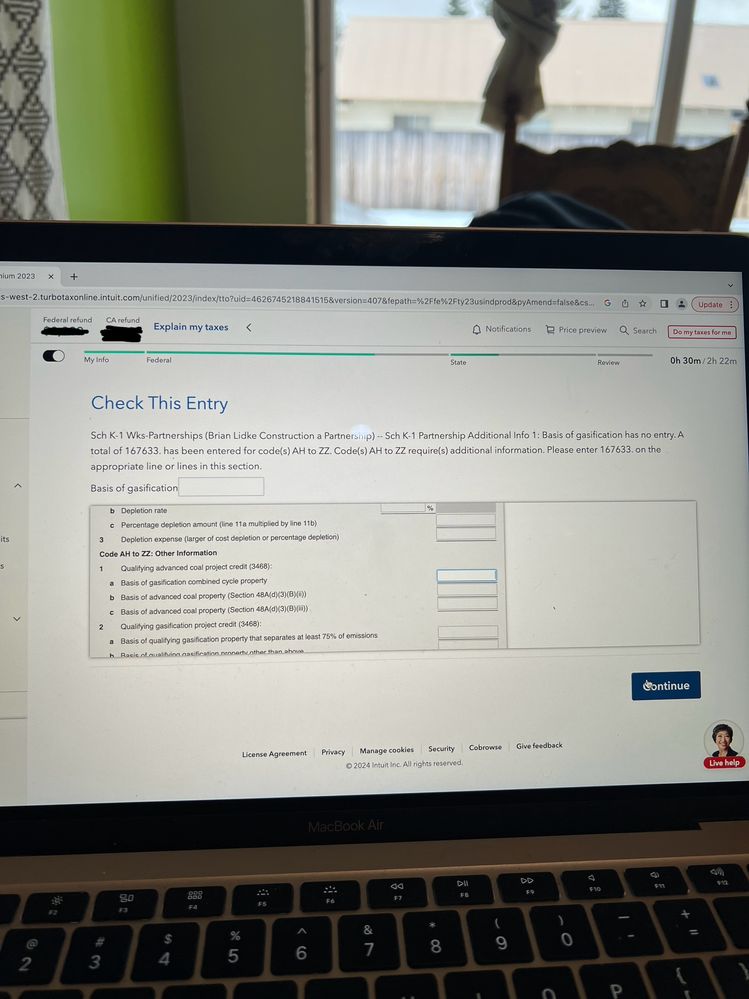

- In the Step-by-Step, enter two AJ line entries in the Box 20 info for the two figures provided in my K-1 Statement explanation for the Aggregate Income and Aggregate Deduction. If this is all you do, you will get the error about the gasification amount.

- When the Step-by-Step asks for Other Box 20, information, I put two line items, which I labeled "AJ - Aggregate Business Income" and "AJ - Aggregate Business Deductions" with the appropriate amounts from the K-1. Now, TurboTax reports no errors.

This can also be accomplished (or double-checked) in the desktop version by going into the forms and putting the information in the relevant places. This would include the K-1 Partner form Part III item 20 and/or the K-1P Addl. Info, same section.

You can clear the error by going back to the K1 entry in the interview and on the page that ask you about gasification enter 0 in all the fields in the top part. In the bottom where it says other leave the text field blank but put the numbers required in the error screen in the number field. Click continue and the check federal review to see if it cleared your error.