Here are the qualifications:

Q3. Am I a qualified individual for purposes of section 2202 of the CARES Act?

A3. You are a qualified individual if –

- You are diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019 (COVID-19) by a test approved by the Centers for Disease Control and Prevention;

- Your spouse or dependent is diagnosed with SARS-CoV-2 or with COVID-19 by a test approved by the Centers for Disease Control and Prevention;

- You experience adverse financial consequences as a result of being quarantined, being furloughed or laid off, or having work hours reduced due to SARS-CoV-2 or COVID-19;

- You experience adverse financial consequences as a result of being unable to work due to lack of child care due to SARS-CoV-2 or COVID-19; or

- You experience adverse financial consequences as a result of closing or reducing hours of a business that you own or operate due to SARS-CoV-2 or COVID-19.

Under section 2202 of the CARES Act, the Treasury Department and the IRS may issue guidance that expands the list of factors taken into account to determine whether an individual is a qualified individual as a result of experiencing adverse financial consequences. The Treasury Department and the IRS have received and are reviewing comments from the public requesting that the list of factors be expanded.

The tax that you will owe is the tax on ordinary income at your margional tax rate so to avoid an underpayment penalty you can make estimated tax payments.

The penalty is an additional 10% of the distribution amount that is added to the tax unless you are over age 59 1/2 or were over age 55 when you left service.

Only you can certify if your financial hardship was COVID-related as defined by the CARES act. No one else can do that for you.

is there a way to go back and pay the penalty after you've already taken the withdrawal?

As I said, by paying estimated tax.

@Coilylecross wrote:

is there a way to go back and pay the penalty after you've already taken the withdrawal?

All the taxes and penalties are figured on your income tax return. Any tax you have withheld is only an estimate -- if too little was withheld, you will pay more when you finish your tax return, if too much was withheld, you will get the difference as a refund.

On your tax return itself, you will report the 1099-R and you will be asked if this is a qualifying distribution under the CARES act, you will answer yes or no and the tax and penalties will be figured accordingly.

If you think that you will not certify this as COVID related, then you will owe regular income tax plus a 10% penalty. Since you said "we" it sounds like you are married, your income tax is probably in the 15% bracket or it could be the 22% bracket. That would mean a total tax of 25% or 32%, or about $6300 or $8000. If you had less than that withheld, and want to make an estimated payment now so you aren't in the hole on April 15, you can make a payment to your account at www.irs.gov/payments. Be sure to select "2020 estimated tax" as the reason for the payment. When you prepare your tax return, be sure to list the estimated payment and the date in the tax program. You will get credit for the payment and your ultimate refund or tax bill will be determined. (Note that if you usually get a refund of $3000 and your tax situation didn't;t change, you might only need to make an estimated payment of $3200 or $5000 to square up.)

You can use the TaxCaster or the IRS withholding calculator to estimate your tax that will be due.

https://turbotax.intuit.com/tax-tools/calculators/taxcaster/

https://turbotax.intuit.com/tax-tools/calculators/tax-bracket/

https://www.irs.gov/individuals/tax-withholding-estimator

If you owe the 10% Early Withdrawal Penalty it will be added on your tax return. If you want you can send in an extra estimated payment now to cover it. Estimated payments are like withholding. You will get credit for it when you file so don't forget to enter it if you send some in.

Here are the blank Estimates and instructions…..

http://www.irs.gov/pub/irs-pdf/f1040es.pdf

Or You can pay directly on the IRS website https://www.irs.gov/payments

Be sure to pick the right kind of payment and year.....2020 Estimate

Where is there a question "you will be asked if this is a qualifying distribution under the CARES act" portion in my return? Do not see that listed anywhere in Turbo Tax Deluxe

@BillAnderson13 wrote:

Where is there a question "you will be asked if this is a qualifying distribution under the CARES act" portion in my return? Do not see that listed anywhere in Turbo Tax Deluxe

If you are referring to retirement plan distributions under the CARES act -

The IRS is finalizing a new Form 8915-E, Qualified 2020 Disaster Retirement Plan Distributions and Repayments (Use for Coronavirus-Related Distributions)

The form 8915-E and instructions are still in a draft state. The IRS has not communicated when this form will be finalized for use with the 2020 federal tax return. When that occurs TurboTax will incorporate the form and instructions into the software.

Estimates are that this form will be available sometime in February.

I have the same issue. The post says "On your tax return itself, you will report the 1099-R and you will be asked if this is a qualifying distribution under the CARES act, you will answer yes or no and the tax and penalties will be figured accordingly." Why is this being reported as the correct reply. It is bad information.

I did not get the prompt on my Turbo Tax program I installed yesterday to choose the Cares Act option.

Help please

@swim7070 wrote:

I did not get the prompt on my Turbo Tax program I installed yesterday to choose the Cares Act option.

Help please

The IRS has a new Form 8915-E for COVID-19 related retirement account withdrawals. This form has not been finalized by the IRS for filing with a 2020 federal tax return. The IRS has not announced when this form will be available. Once available it will be included in the TurboTax software.

We estimate the form may be available sometime in February.

Same question here, thanks for the response. I could not find anything online.

Any word on this new form? All I have is a 1099-R, and it seems like im being taxes way too much.

Form 8915-E will be available in Turbotax February 24

Turbotax now indicates February 24, and that the form will be e-filable. The FAQ has been updated, and you can sign up for e-mail notifications.

However, I always tell people not be hasty because updates are sometimes applied in the afternoon or evening rather than the morning.

The IRS finalized and released form 8915-E on Feb 11, 2021. Why is it still not coming up in Turbo Tax Deluxe as Feb 28, 2021?

Same question for Turbo Tax Home & Business version... the IRS finalized and released form 8915-E on Feb 11, 2021. Why is it still not coming up in Turbo Tax Home & Business as Feb 28, 2021?

@chuckmc wrote:

The IRS finalized and released form 8915-E on Feb 11, 2021. Why is it still not coming up in Turbo Tax Deluxe as Feb 28, 2021?

It was there in the 2/26 update. Are yiu using online or desktop?

What code is in box 7 on your 1099-R?

Is the IRA/SEP/SIMPLE box checked?

I'm using desktop verse for Home & Business. Box 7 on 1099-R is code 1 and IRA/SEP/SIMPLE box is not checked.

Also, I spoke with Turbo Tax. They said they are aware of the problem in the software. Said available if print and mail forms, but that they are working to resolve the issue for e-filing. I was told Mar 11th is estimated fix date. Was surprised the date is so far out. Hoping they can do better than that, so checking on regular basis in case fix goes in sooner.

@chuckmc wrote:

Also, I spoke with Turbo Tax. They said they are aware of the problem in the software. Said available if print and mail forms, but that they are working to resolve the issue for e-filing. I was told Mar 11th is estimated fix date. Was surprised the date is so far out. Hoping they can do better than that, so checking on regular basis in case fix goes in sooner.

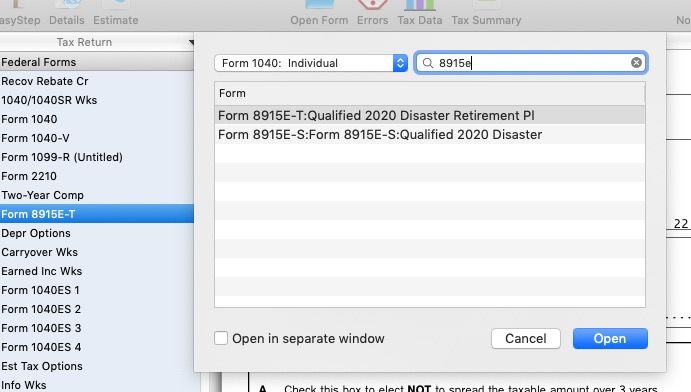

Fix for what? The 8915-E form is in all desktop versions now. Switch to the forms mode and use the open forms box and search for 8915E.

If not there then you are not up to date on version r19 of the software and need to update.

My version is up-to-date. Yes Turbo Tax knows that the form is there, but the issue is that the form is not working correctly for e-filing. The software does give an option to identify the withdrawal as Coronavirus Disaster related. As a result, the software is incorrectly calculating a 10% penalty on the withdrawal.

I do not manually complete forms, but out of curiosity, I followed the instructions you provided in case it might allow me to get around the issue. When I opened form 8915E-T, the form says to check the box for Coronavirus Disaster related withdrawals, however the box grays out and will not allow me to mark it.

@chuckmc wrote:

My version is up-to-date. Yes Turbo Tax knows that the form is there, but the issue is that the form is not working correctly for e-filing. The software does give an option to identify the withdrawal as Coronavirus Disaster related. As a result, the software is incorrectly calculating a 10% penalty on the withdrawal.

I do not manually complete forms, but out of curiosity, I followed the instructions you provided in case it might allow me to get around the issue. When I opened form 8915E-T, the form says to check the box for Coronavirus Disaster related withdrawals, however the box grays out and will not allow me to mark it.

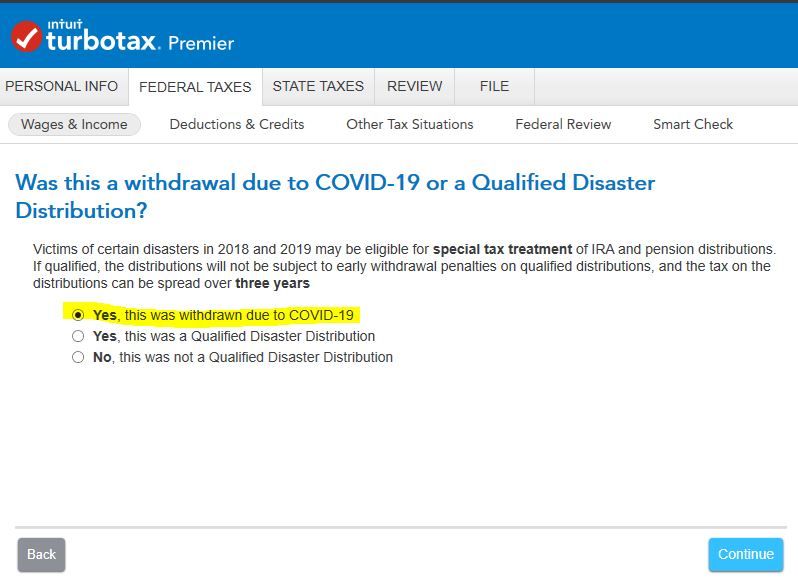

So after entering the Form 1099-R and answering questions concerning the withdrawal you do not see this screen-

There is an additional issue within TurboTax with regard to the penalty tax.

I was given the option to select that I am declaring the Covid Disaster, which reduced my taxable amount; however, I am still getting an error message:

"Form 1 Penalties on IRA We're still working on updates related to penalties on IRAS, retirement plans, MSA distributions (Form 1099-R) that qualify for disaster or covid relief. You can keep working on your return, and we'll remove this message when it is ready."

It is currently charging .33 on 10% of the withdrawl taken. ($30,000 withdrawl times 10% times .33 = $990 penalty.)

When will this be fixed, and ready for me to file my taxes?

@mditty4193 wrote:

There is an additional issue within TurboTax with regard to the penalty tax.

I was given the option to select that I am declaring the Covid Disaster, which reduced my taxable amount; however, I am still getting an error message:

"Form 1 Penalties on IRA We're still working on updates related to penalties on IRAS, retirement plans, MSA distributions (Form 1099-R) that qualify for disaster or covid relief. You can keep working on your return, and we'll remove this message when it is ready."

It is currently charging .33 on 10% of the withdrawl taken. ($30,000 withdrawl times 10% times .33 = $990 penalty.)

When will this be fixed, and ready for me to file my taxes?

This thread and question was about a 2019 tax return and it a year old.

The 2020 Federal tax return for COVID distribution is complete but some states still need need more work.