Since there is no RMD required for 2020, then after you enter the 1099R say it was NOT an RMD and then that you rolled it over (even if back into the same account). Was any withholding taken out? If it was then did you replace the withholding with your own money? Otherwise the withholding will be a taxable distribution itself.

How to answer the RMD question is not intuitive. I think TT should have provided a LOT of guidance/help in dealing with this item. Inherited IRAs are supposed to get same treatment as regular IRAs but TT doesn't ask if you rolled over/redeposited the amount. I went back and changed in TT "no RMD required" for the regular IRAs and Inherited IRAs, it says regular IRAs distributions won't be taxed and if you go to the taxable summary it shows them as not taxed. However, Inherited IRAs (supposed to get same treatment as regular IRAs) but TT shows it as taxed in the taxable summary. Further, on the 1040-SR, it carries the the returned Inherited IRA distribution down to the AGI.

I don't feel comfortable with TT at the moment.

If you are a non-spouse beneficiary and you indicated that any part of the distribution from an IRA was an RMD, you must presently delete and reenter the Form 1099-R and upon reentry indicate that none of the distribution was RMD. TurboTax will then properly handle your indication that the distribution was rolled over.

Your suggestion looks like it works. I restarted TT and indicated that none of the distribution was an RMD. TT gave me a message saying that it wasn't taxable.

Thank you.

P.S. Last year a had a quirky situation with a Roth IRA and had to play around with some of the options to TT questions to get it to properly report my information.

I got that same message, but when going into Forms and checking line 4b on the 1040, it showed up as taxable income.

@BarryK123 wrote:

I got that same message, but when going into Forms and checking line 4b on the 1040, it showed up as taxable income.

Delete the 1099-R and re-enter. Say that is was NOT a RMD, and then that it was rolled over. Line 4a should have the box 1 amount and the word "ROLLOVER" next to it and 4b should be blank or 0.

Yes, we're good now. 1040 line 4 says ROLLOVER.

Rather than deleting the 1099-R and starting over, I edited it. That was the problem. Deleting and re-entering the info was required. Thanks.

@smreed48 I agree - the same thing is happening to me with an Inherited IRA RMD. What's up TT?

This is a somewhat unique situation for 2020 since RMDs were waived. Unfortunately, it seems that TurboTax did not use their previous experience with a similar waiving of RMDs in 2009 to guide them in implementing this in 2020 TurboTax.

Yes, I got my answer to my question, and the solution worked. In short, if one responds in TT that the original distribution was NOT and RMD the system will then prompt you by asking what did you do with the distribution. An optional response is that you rolled it into another qualified plan. That results in the distribution not being included on form 1040, line 4b (i.e., it's not taxable) and "rollover" being inserted.Note that you may need to edit the original entry for the 1099-R transaction to get the correct prompts for this to work.

FYI, I found Notice2020-51 on the IRS web site which says that the usual 60-day rollover period for certain distributions was extended to August 31, 2020.

Thank you all for your help.

I see several "work arounds" involving altering entries on 1099's. Won't that trigger a response from the IRS in that their copy of your 1099-R does not align with what you coded on the TT version of the 1099-R? On my 1099-R box 2a show the full amount is taxable, box 2b is checked off as Taxable amount to be determined, Box 7 show code 7 Normal Distribution with an"X" in the IRA/SEP/Simple. I played around with altering these entries and yes it does the job of presenting the "correct" disposition of the transaction on 1040 line 4b. But we should not have to play games with figuring this out. TT dropped the ball majorly on this one. Perhaps too many H1B "geniuses" in the mix back at coding central. TT needs to come up with an update that handles this cleanly This is FUBAR

Telling TurboTax that the distribution was not an RMD is not a workaround, it's the correct answer to the RMD question and is the answer required to be able to properly report this rollover. Enter the Form 1099-R as received, indicate that none of the distribution was RMD, indicate that you moved the money to another retirement account or back to the same account, then indicate the amount that was rolled over.

What do you have to alter? Is this for a RMD? You should not change anything on the 1099R. It's after you enter the 1099R, then Turbo Tax asks if it was a RMD. It was not since there is no RMD requirement. You are not lying.

@SanDieggo wrote:

I see several "work arounds" involving altering entries on 1099's. Won't that trigger a response from the IRS in that their copy of your 1099-R does not align with what you coded on the TT version of the 1099-R? But we should not have to play games with figuring this out. TT dropped the ball majorly on this one. Perhaps too many H1B "geniuses" in the mix back at coding central. TT needs to come up with an update that handles this cleanly This is FUBAR

It is not 'playing games" and there is nothing to "figure out", simply answer the question truthfully that "none of this distribution was a RMD" which is was not.

Nothing about the RMD answer goes on your tax return at all, the question is simply to determine if the rollover is allowed (RMD's are not allowed to be rolled over), but a return of a 2020 IRA distribution as a rollover is allowed because it was not a RMD in the first place.

It is handled cleanly when the RMD question is answered correctly.

(Some have asked and suggested that the RMD question be removed altogether, but there are some 1099-R's for certain pensions and distributions from defined benefit plans that did require a 2020 RMD and that RMD was not changed by the CARES Act. so the question and RMD is still required for some.)

I reversed my RMD after the CARES Act was passed also. TT tried to edit their instructions re: this but didn't succeed.

They did add parenthetical text to address the 2020 situation:

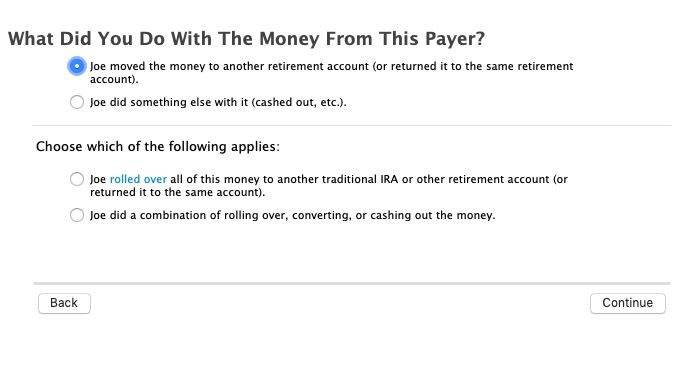

What did you do with the money?

__Moved the money to another retirement account (or returned it to the same account)

But then,

Choose which of the following applies:

__rolled over all of the money OR

__rolled over a partial amount of the money.

The problem is that TT defines "rollover" as "moving the money to a different retirement account." In my case, I moved it to the same account, but the software would not let me ignore the "Choose which " question since it doesn't address my situation.

As a guy who spent much of his career parsing contract language, I am not comfortable with checking "rolled over all of the money", but am just going to chalk it up to sloppy editing on TT's part and forget about it.

Just sayin'

@tho5 wrote:

I reversed my RMD after the CARES Act was passed also. TT tried to edit their instructions re: this but didn't succeed.

They did add parenthetical text to address the 2020 situation:

What did you do with the money?

__Moved the money to another retirement account (or returned it to the same account)

But then,

Choose which of the following applies:

__rolled over all of the money OR

__rolled over a partial amount of the money.

The problem is that TT defines "rollover" as "moving the money to a different retirement account." In my case, I moved it to the same account, but the software would not let me ignore the "Choose which " question since it doesn't address my situation.

As a guy who spent much of his career parsing contract language, I am not comfortable with checking "rolled over all of the money", but am just going to chalk it up to sloppy editing on TT's part and forget about it.

Just sayin'

A rollover does not specify the account that it was rolled to. It can be the same account an in the case of a returned RMD probably will be the same account. The only thing that goes on the tax return is the amount on line 4 of the 1040 for with the word ROLLOVER next it. The account is irrelevant.

"Rolled over all the money" simply means that all of the 1099-R box 1 amount was rolled over.

"Rolled over a partial amount' means that only some of box 1 was roller over and the rest was kept by you.

This part of the 1099-R interview has not changed for many years.

The desktop version looks like this - seems clear enough to me.

That's exactly what I did to get the result of not having the money reported as taxable income and the notation, "Rollover" on line 4b.

They did add parenthetical text to address the 2020 situation:

Where is this ?

I find there's a problem linking 1099R with 1040 ....1040 line 4a should be linked to 1099 1 Gross Distribution.

Also if you don't check 2b Taxable not determine, the amount on line 2a should go to 1040 L4a ...it doesn't.

Any amount in 1099 #1 to goes to 1040 L4b.

The proper way to report RMD partial reversal is to report the Gross L4a and taxable amount on L4a and write "Rollover" on L4b.

Any suggestions?

RMD's are not eligible for rollover, but there was not 2020 ROM, so yiu must answer the RMD questions that "None of this distribution was a RMD" or "RMD not required".

Then you should get the screen to roll it over.

Thanks ..... I did that before and it didn't work?

Delete and reenter the Form 1099-R. If you ever told TurboTax that it was an RMD, simply editing and changing the answer will not work.

It seems there are two ways to deal with this conundrum:

l. enter gross distribution on line 4a, 0 as taxable amount on 4b, and write "rollover" next to line 4b so the IRS knows why the numbers don't match. Problem here is in order to take this approach return must be sent by mail. this means any other state forms must also be sent by mail.

2. e-file the form showing 4a gross amount, 0 in 4b. Then wait to see if you hear from IRS as to why numbers don't match.

any other ideas would be appreciated.

Entered as described earlier in this thread there is no conundrum because TurboTax will include the gross amount of the IRA distributions on Form 1040 line 4a and will exclude from taxable income on line 4b the amount rolled over, with no need to alter anything produced by TurboTax.