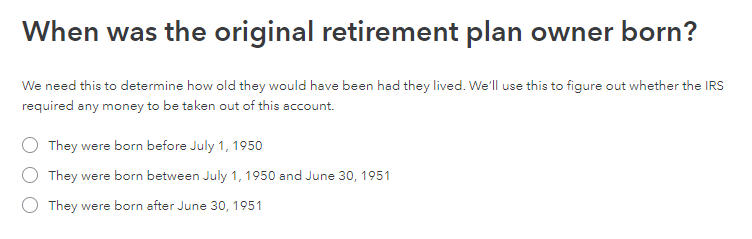

I do not quite understand your question. Are you saying the choices to make (screenshot below) are all grayed out preventing you from make a choice? If not and you know the age of the person from whom you inherited the plan mark one of the circles to continue.

Code 4 will not subject you to a penalty; it is ordinary income in each year you receive the amount.

My 2 choices for the age of the original owner are:

1) This person was born on or before 6/30/50

2) This person was born on or after 7/1/50

The choices are not grayed out. There is a circle in front of each choice. The software does not allow me to choose one of them. The software does not allow me to go further in completing this 1099-R.

TurboTax is trying to determine whether the decedent had been required to be taking RMDs.

how old was he or she?

if you can't select an option , you have a browser problem.