- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My federal refund was accepted 2/10/2021and it says still processing tax topic 152. Why's it taking so long? Should I worry!?

My federal refund with EITC was accepted 2/10/21 and my state was accepted 2/12/21. I received my state 2 weeks ago but for some reason the status now says still processing and tax topic 152 when people who filed after me already got theirs. Ive been calling IRS but it keeps hanging up due to high call volume. Is tax topic 152 something to worry about? When should they get approved since its been more then 21 days?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

https://www.irs.gov/taxtopics/tc152

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Every article I read a few hours ago about Tax topic 152 says every refund goes under the topic that best suits it and that topic 152 means its being processed and will be getting it within 10-14 days after tax topic popped up. And I believe I screenshotted something else saying i should have it between the 10-12th so idk. Its crazy I got a letter to verify my identy for and I still got that 12 days after it was accepted. Did you have child credits also?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

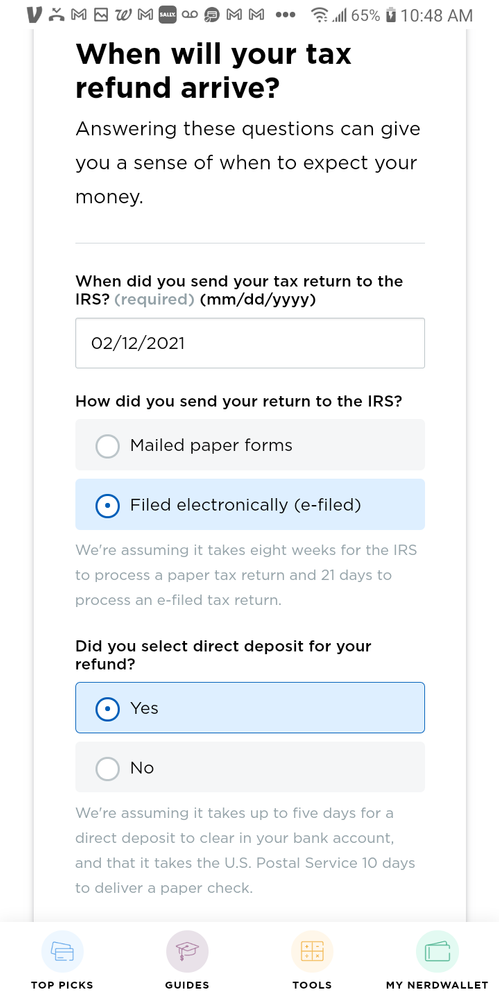

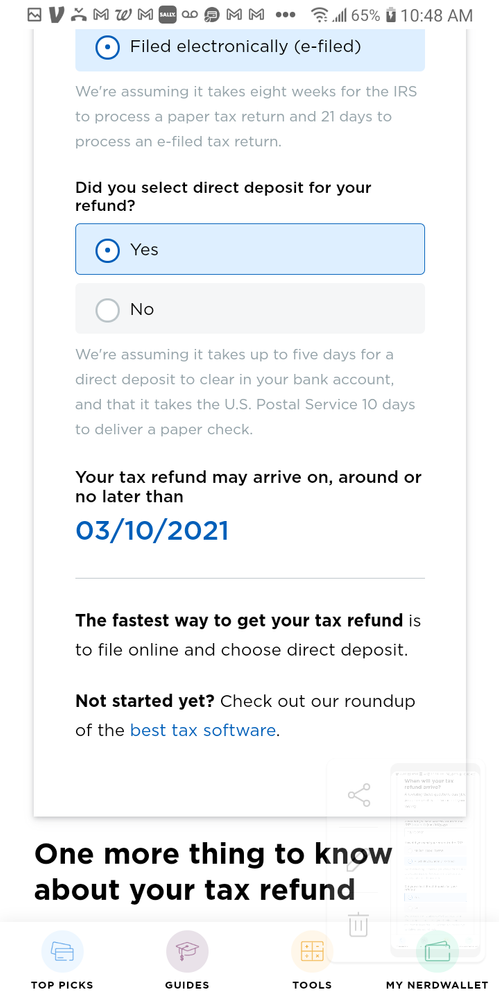

This is the one I found that had me put my filing info and the date is now saying 3/10 so fingers crossed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

My federal refund was accepted on the 11th lost all bar told by the irs that my refund was in the error department lost all bar an had tt152 for 2week then all of a sudden I got a refund date for 3/23

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

where did you find that portal? i would love to see what mine will say... PLEASE!!! i have had the TOPIC 152 for 25 days now, so much for 10-14 business days like it says... and can someone please clear something up for me The I.R.S. say there working sunday to sunday.. that there are no business days.. there working round the clock so weekends count.. but someone on the website told me NO, that’s not true. WHATS GOING ON??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

that’s great!! did you claim the earned income and child care? if i may ask?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Did you receive your refund yet?? please say you did... that will give me some hope!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Has anybody got there return I filled it was accepted on 2-12-21 got tax topic 152 still no return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Tax Topic 152 is related to refund timing. You can find more information about it here. Once the IRS has accepted your return, it then goes into processing status until they review and approve your return. Since it has been more than 21 calendar days since the acceptance of your return, you can try to call the IRS at 1-800-829-1040, but prepare for potentially long wait times.

Also, the IRS is experiencing delays in the processing of returns due to a later than usual start to the tax season, a backlog of mailed returns, current tax season returns, and the current round of stimulus payments. Please see this post here by ToddL99 for further explanation of why returns are delayed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

This is the same exact situation I’m having!!! Filing dates and all! I received my state but federal has been pending as of two days ago it said the 152 code. I have been beyond frustrated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Tax Topic No. 152, means that some tax returns may require further review and could take longer. Different factors can impact the processing time of your refund, however, an IRS representative will be able to access your return and provide insight into why your return may be delaying. Please click here for IRS contact information. Also, please visit the IRS Tax Season Refund Frequently Asked Questions help article below for more information.

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

**Mark the post that answers your question by clicking on "Mark as Best Answer"