- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a letter from the IRS stating that I did not file in 2018 but I Efiled with TurboTax. I have a receipt and my return is on the website when I log in. Help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Paying the fees doesn't file the return ... when you log in what is the filing status ? Does it say "printed" or "Ready to mail" or Rejected ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

When did you efile? Was your return Accepted? When you efile you get back 2 emails. The first email only confirms the transmission. The second email says if the IRS (or state) Accepted or Rejected your efile. Just paying the fee doesn't file the return. After you paid did you continue on to the very end and hit the big orange Transmit Returns Now button?

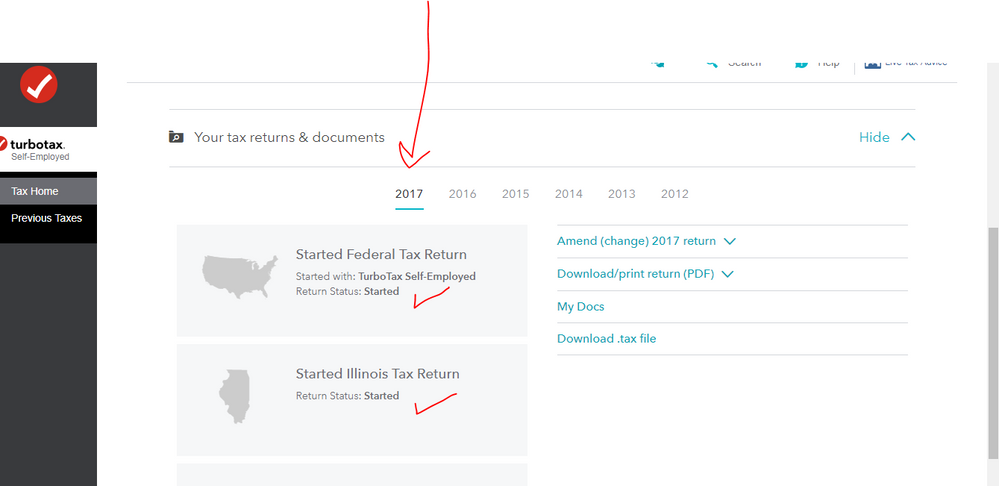

Maybe you didn't finish filing it or it Rejected. When you log into your account you should see the status and if it was Accepted or Rejected, Started, Printed, Ready to Mail, etc. what does it say?

You now have to print and mail prior year returns. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS or State received the return. Mail federal and state in separate envelopes.

You need to register a 2019 online account to access prior years

Depending on the reason it rejected you may need to fix something. How to finish a prior year online return