- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should I enter interest earned from a land contract that I hold?

Topics:

October 10, 2021

9:33 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

In the interest section unless you are also getting principal payments ...

October 10, 2021

9:41 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Enter it like you got a 1099 INT for interest and put the amount in box 1

Enter a 1099-Int under

Federal

Wages & Income

Interest and Dividends

Interest on 1099-INT - Click the Start or Update button

October 10, 2021

9:42 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

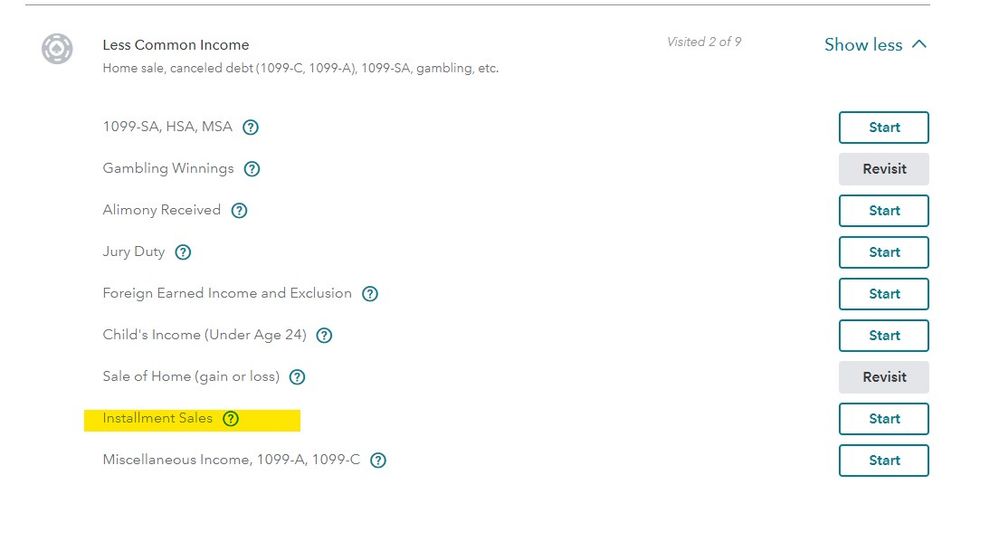

Interest and principle payments for installment sales go here :

October 10, 2021

9:43 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content