- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

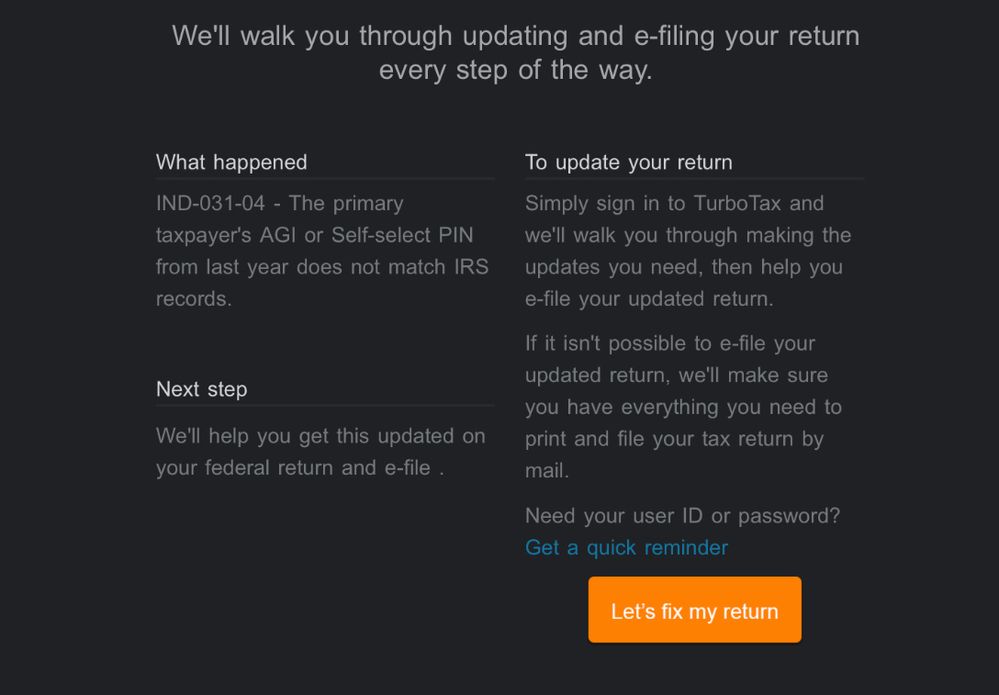

Tax return rejected

We know the pin is correct.

Why is it asking for one taxpayers AGI when they file jointly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You'll both use the same adjusted gross income (AGI) from your originally filed 2019 joint return. To prevent a rejection, don't split or allocate the AGI, even if doing so seems more logical to you. The IRS requires your 2019 AGI to verify your identity for e-filing. If you're paper-filing your return, you won't need your AGI because those are manually processed. If you tried to enter "0" and were not successful at processing your return, you can see the information here for steps to correct your AGI. If you can wait a few days then resubmit your tax return and see if you are successful at that time. If it doesn't work you will need to mail in your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"