- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the free version of TurboTax cover recovery rebate credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, the Free online edition will support the Recovery Rebate Credit on the Form 1040 Line 30.

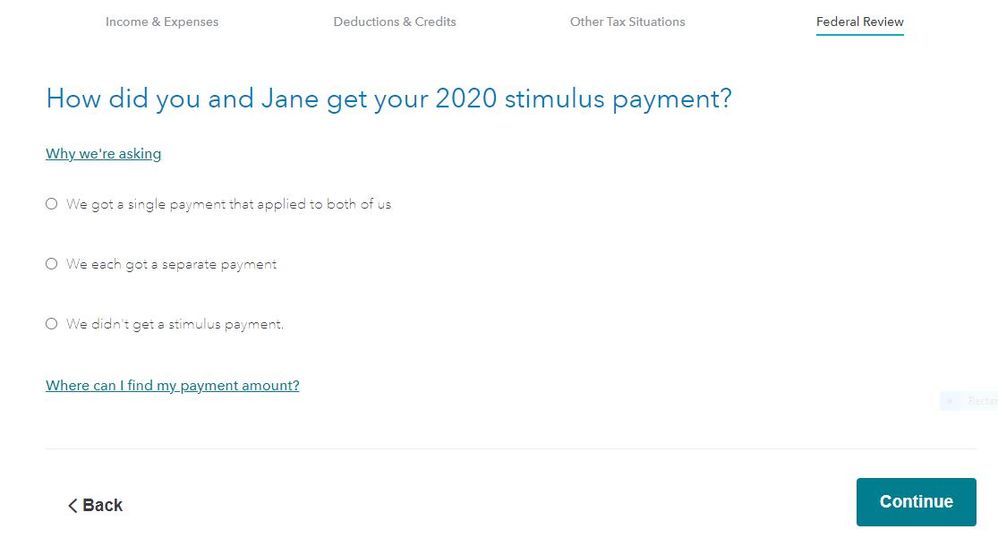

After completing the Other Tax Situations section of the program you will be asked about a stimulus payment received or not received in 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes it will.

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check this year, you can get it when you file your 2020 return in early 2021—if you are eligible.It will end up on line 30 of your 2020 Form 1040.

https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

What if i received the first stimulus of $1200 but did not receive the second stimulus of $600?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@Chris091090 wrote:

What if i received the first stimulus of $1200 but did not receive the second stimulus of $600?

Not everyone will receive the $600 second stimulus immediately. The distribution will be completed on or before January 15, 2021.

Go to this IRS website for stimulus information - https://www.irs.gov/newsroom/treasury-and-irs-begin-delivering-second-round-of-economic-impact-payme...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I should have stated that I did not file a 2019 tax return. I got the first round of stimulus of $1200 based on my 2018 tax return through direct deposit. I haven’t received anything like a notice 1444 yet.

Will I still be able to receive the second round of $600? Or will I have to file a recovery rebate? Will the free version of TurboTax add on a recovery rebate credit of $600 if I don’t receive it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@Chris091090 wrote:

I should have stated that I did not file a 2019 tax return. I got the first round of stimulus of $1200 based on my 2018 tax return through direct deposit. I haven’t received anything like a notice 1444 yet.

Will I still be able to receive the second round of $600? Or will I have to file a recovery rebate? Will the free version of TurboTax add on a recovery rebate credit of $600 if I don’t receive it?

You will just have to wait to see if you receive the $600 second stimulus on or before 01/15/2021.

Yes, the Free online edition can be used to report stimulus payments received or not received on the federal tax return Form 1040 Line 30.

However, it may be late January or early February before the software is updated to include the second stimulus payments. So you should not try to file your 2020 federal tax return until at least mid-February to ensure any stimulus owed you is entered on the 2020 tax return.