If the Schedule K-1 packet you received included additional information about states where the partnership operates and generates income, you may need to report that income by filing non-resident returns in those states. Generally, you’ll need to file a nonresident state return if you made money from sources in a state you don’t live in. Some examples are:

- Out-of-state rental income, gambling winnings, or profits from property sales

- S Corporation or partnership income

- Beneficiary income from a trust or estate

- If your employer withheld taxes for the wrong state

You should only have to enter the federal K-1 on your federal return and indicate in the personal section that you made money in other states (add Illinois and Wisconsin) to the ''Other State Income'' section. Detailed instructions for this step can be found here. TurboTax will transfer the K-1 information to each state return. Then when you go through the state returns, you will enter any adjustments/differences needed to report each state-specific K-1.

You should complete any nonresident returns (IL and WI) before you complete your resident Iowa return because IA will give you credit for any state taxes you may owe in the nonresident states. Print out or view your returns before filing to ensure you have not doubled up any K-1 income on your state returns.

Thank you!

When I look at the forms view for each state, I only see a K-1 in the Illinois return. Should I be seeing K-1’s in the Iowa return and the Wisconsin return?

There just doesn’t appear to be anywhere to put in the BAR and the All Source Modifications for Iowa.

In terms of the Wisconsin return, the s-corp paid the taxes on my behalf and I don’t see where to enter that information.

Usually, when I get stuck, I flip from EasyStep to the Forms view and just make sure the forms match what was sent to me but without an Iowa or Wisconsin K-1 form as part of the return, I am struggling to figure it out.

Nevermind … I got it figured out and I am good to go! Thanks again!!

AmyJ50, I have the same exact situation you are describing. I am a part owner of an S-Corporation and receive K-1s reporting income in multiple states where I am not a resident. My corporation pays the taxes on my behalf via a composite return for most of these states. You obviously got this to work properly in TurboTax, so that you don't have to file new non-resident returns in these other states. You are able to report that you paid income tax in the non-resident states so that you get credit for this for your resident state taxes. May I ask, how did you figure this out (i.e., what was your solution)?

By the way, I purchased and am using TurboTax Deluxe, and in the prior year, I had to purchase the state returns in the other non-resident states, and then create "mock" returns to report the taxes paid. Should I be using Turbo Tax Premier, or TurboTax Self-Employed to get this multi-state K-1 situation to work properly? If so, this would be cheaper than buying the additional states at about $50/each.

Correction--I am using TurboTax Home and Business (not Deluxe). Am I using the correct version to deal with this multi-state K-1 situation?

You should be able to complete your multi-state K1 requirement with TurboTax Deluxe.

You will still need to purchase additional states to fulfill any state filing requirements you have.

TurboTax Self-Employed or Home and Business do not provide additional states.

Ed or Amy,

Did you guys ever figure this out. I have a similar situation and am struggling a little bit.

-Peter

@bpamiri If you have income from various states, you need to determine if you are required to file in those nonresident states based on income. If some state tax was already paid for you, it can go in as a credit on that state return.

Hello,

I'm in a similar situation where I an a passive shareholder in multiple K1s which have all declared multiple state schedule k1 adjustments for Shareholder/Partner/Beneficiary Pass Through Income, Loss and Credits.

None of these partnerships currently have reported an income either for federal or the state, and have declared "Other Deductions" (Box 13, Code W).

Since I have no incomes either through these K1s or other sources, should I file state taxes in other states where I'm a non-resident? I'm worried that this is 10+ states, I'd have to file state taxes individually.

Thanks for your help

@yashrohan In most states, you don't have to file a tax return unless your income in the state is above a minimum filing level. You would have to research each state's regulations on their filing requirements to be sure, but based on what you describe, you would not have to file out of state returns since you have no income to report in other states.

I have a Schedule K-1 that provides a form for the Federal return and for 3 other non-resident states. However, for one non-resident state form, the totals of Net LT capital gain and other income is about the same as the values listed for the Federal return. So when I combine the taxable income of all three non-resident states, the total is +150% greater than the total taxable income on the Federal form. I realize that my resident state will reduce my state income taxes for taxes paid in other states, but the total of the non-resident states' "incomes" will exceed the Federal income (by+50%) on the same funds! Can someone help me with this "new" math?

Similar to the others above, my wife has K-1's to file in multiple states, and the K-1s will not be issued until September 2021. This year we are owed a federal tax refund and there is only a small loss associated with her shares on the K-1s. I've filed a federal extension and this automatically applies to most--but not all-- of the states for which she'll get K-1s.

My question is this-- for the states that don't automatically issue an extension, do we need to file a request for an extension even though we'll claim a small loss this year and have no actual income in those states? If so, how do we do this? The standard extension requests I've reviewed (DC, LA, NH, NY, & NJ) all request the personal income and state income tax withheld in their respective state. Since we didn't earn anything in these states, are owed a federal refund, and did not pay personal income tax in these other states, what do we put on these forms to request an extension?

Thanks in advance for any help here!

How to know which extra States to buy for K-1 that lists many States?

I have in the K-1 about 10 States, this is private real estate fund that pass through income and gains, as well losses per each State.

Some States has minimum that doesn't need to be reported and in my K-1 I have less income then the minimum.

Other States have no income tax.

How to split income and gains per state that is part of Fed K-1? is it part of each none resident State? is there adjustment to copied from Fed numbers to each none resident State?

btw - I asked this question in new message topic, but it isn't visible

How to insert K-1 that has multiple States?

tnx

you can do the research yourself. go to each state's department of revenue website and look at the filing instructions for nonresidents. they will even have a phone number to call, if needed.

.

I was hoping that Turbotax can help me with that, instead go to each State to read and calculate manually

can TT help for this matter?

tnx

Amy, great answer. In my case, the tax was paid by the trust to District of Columbia. So how do I get my credit for that tax paid from my home state?

@mike296 Make sure to do the DC tax return as a non-resident first and then start your home state tax return. TurboTax will transfer the tax paid to your resident state return.

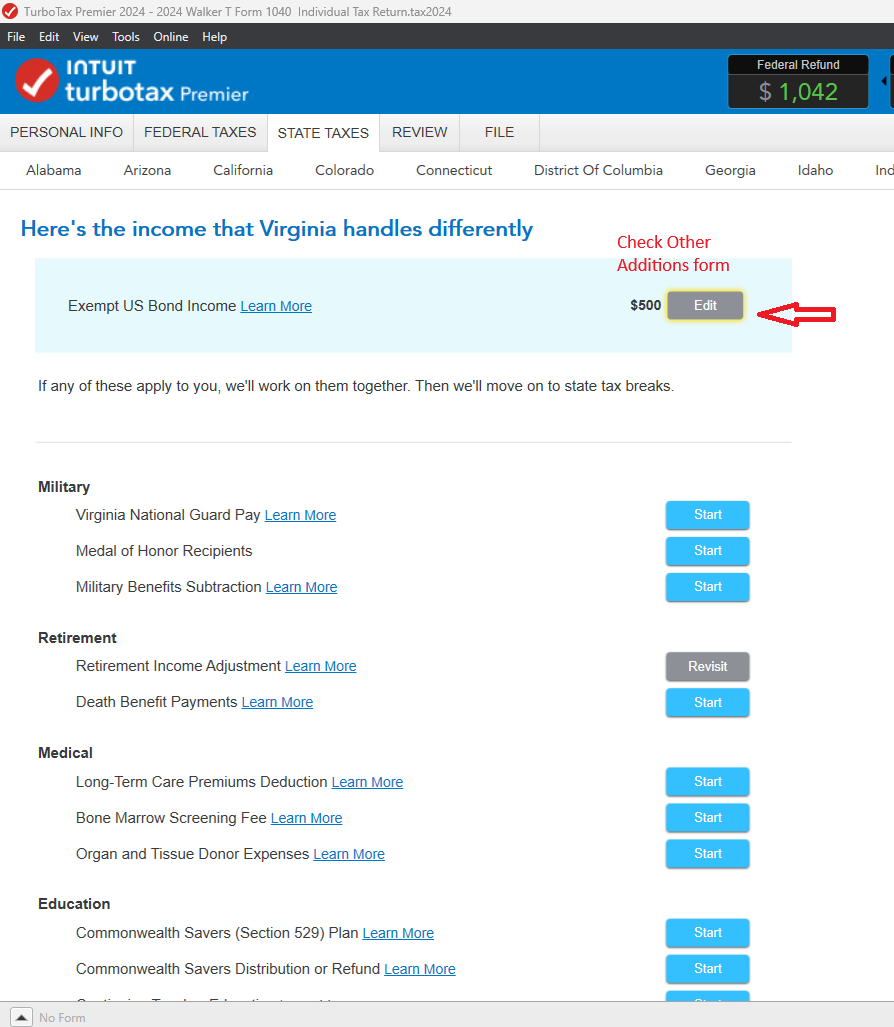

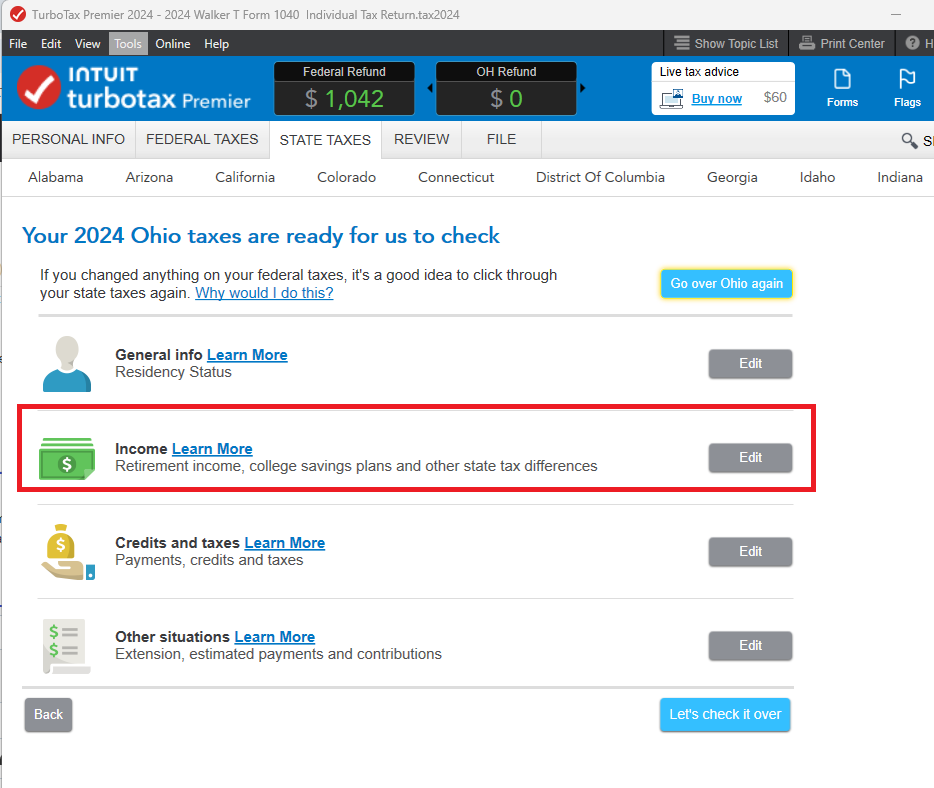

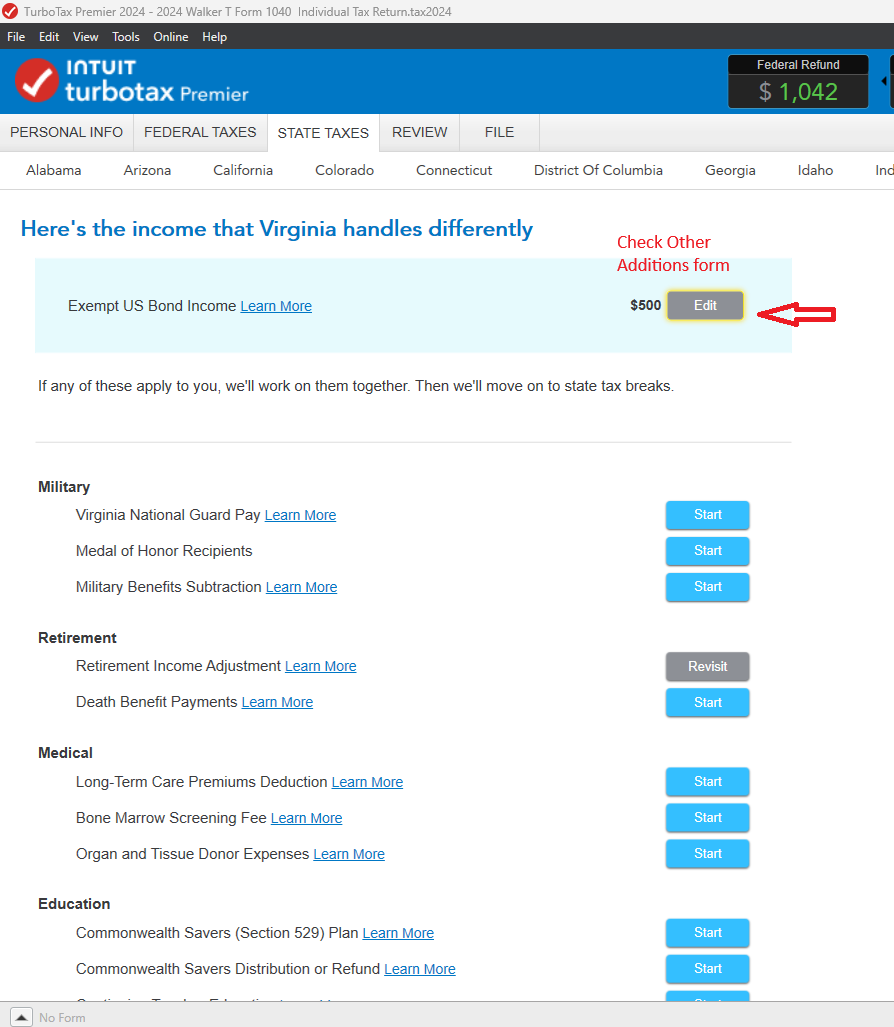

I am struggling to figure out how TT is pulling the income on US treasury notes from my K1 and dividing it between my two state returns. To be clear, pretty sure my issue is user error. I lived part year in Ohio and the rest of the year in Virginia. It appears to be deducting my income on US treasury notes from both states equally. Not the roughly 1/3 2/3 like it should.

In most state interviews, TurboTax presents different income items and asks you to allocate the amount from your Federal return to that state (or to allocate what does NOT belong to that state; watch the wording on that screen).

If you have calculated the amounts that should belong to each state, you can enter them yourself. You may need to step through each state interview to locate where it asks about income on US Treasury notes.

Otherwise, make sure the dates you reported that you lived in each state are correct.

Here's more info on Allocating Income for a Part-Year Resident..

The Interest income from U.S. Treasury notes is exempt from state and local income taxes but is subject to federal income tax.

What is the reason to split per States that income?

I think it should not be reported to a State, or should it?

Each state will get copy from Federal return , where the Interest income from U.S. Treasury notes is reported and taxed.

p.s. my original question remains - how to split single K-1 across multiple States without creating so many K-1 per State and per Box 1 and Box 2?

In your state interviews, info is carried from your Federal return. Each state has its own filing requirements, so you may not need to file in all states if the income is below that. You can look up filing requirements from this state DOR Link

If the interest income from US Treasury Bonds is exempt from tax in any state, you can deduct it out in your State Return, if your state did not automatically exclude it (if you're required to file in that state).

Go through the state interview carefully. Look for a screen that says 'Here's the income that xxxx handles differently'.

Here's more info on How to File a Non-Resident State Return and Why Would I File a Non-Resident Return.