Mar 2, 2021 8:40:19 AM

It depends.

The IRS may send you a notice of adjustment in the mail to reflect the second stimulus payment. Your overall tax liability or refund will be adjusted accordingly.

You can also prepare an amended return to correct your return as well.

Please see the link below for instructions on how to amend your return.

If you decide to prepare the amended return, your input will be corrected in the Federal Review interview section of the program.

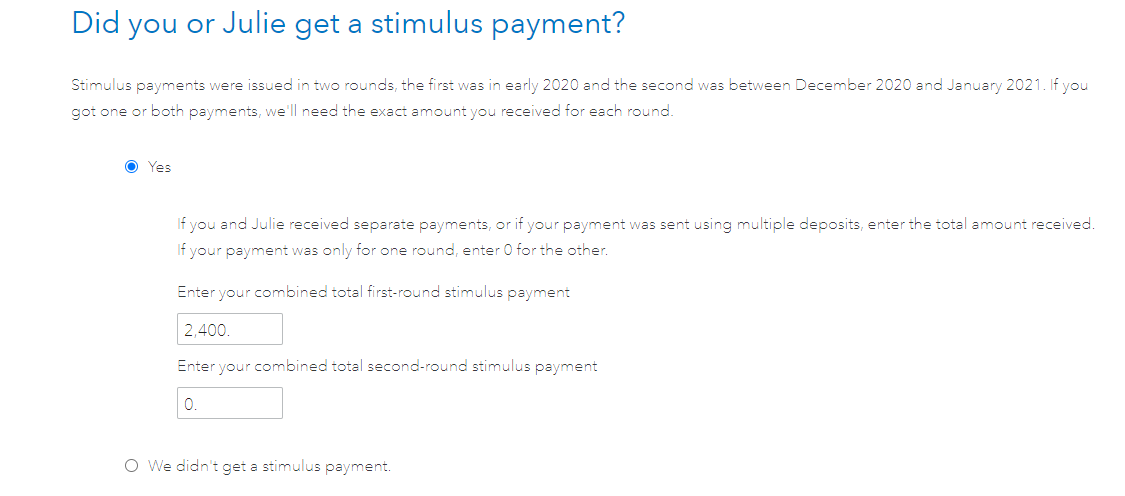

Be sure to indicate the actual amount of each stimulus payment you received on the page that asks if you received a stimulus payment. There will be two boxes and both will need to be completed.