Yes when you are in TurboTax for the amendment, it will have your tax return information as you filed it. To remove the passive losses, just find the entry and zero them out.

Thanks for the reply, but unfortunately as far as I can tell TT does not allow the passive loss carryover field to be modified even when in an amended return. In "Amend" mode the ability to edit fields should be greater than when in normal filing mode...

If anyone knows a work around please chime in. Otherwise I am concluding that "by hand" will be the only way to amend one of the three years I am amending. As rare as my case may be - it is an unfortunate limitation of the software

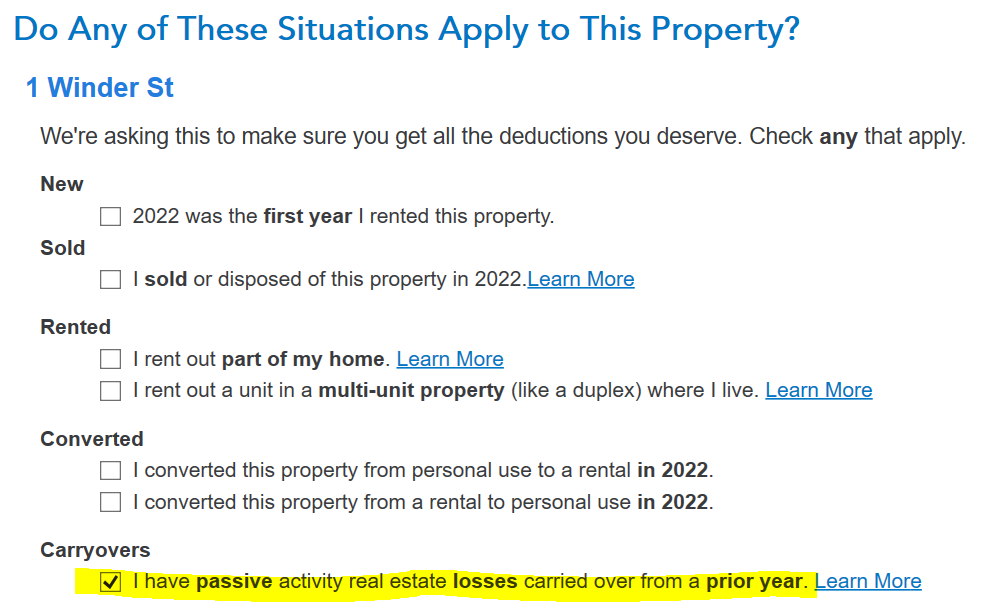

If the passive losses are from rental activities, you can Update the rental property profile and you will come to a page that says Do Any of These Situations Apply to This Property? and you will click the box next to I have passive activity losses carried over from a prior year. On the next page, you can edit or add the carryover losses. There are similar options in other passive income reporting screens, such as for a K-1 form entry.

I appreciate the reply - each reply helps me hone my question to be more precise. The Passive Loss Carryover is not from real estate. We converted a non real estate LLC business to a C corp in 2019 = final k-1 in 2019. I had to amend for that and now the K-1 is gone in 2020 amend. That LLC had some passive losses from 2018, since the C-corp is in the same business I believe those passive losses can still be carried forward... but I would need a place to enter them and I see no "other" passive loss carryover. It would seem Schedule E line 28A would be the place but TT does not allow entry in that field... Do I just lose out on those losses?

Your passive activity carryforwards from Schedule K-1 were probably reported on Form 8582. Check your 2018 and 2019 returns for the form.

If the K-1 is gone, you can still add Form 8582.

- Tap Forms in the top right corner

- At the top of the left column, tap Open Form

- Type 8582 and select Form 8582 p1: Passive Activity Loss Limitations, the Open Form

- QuickZoom to go to Form 8582 page 2 (Parts 5-8) at the top of the form

- QuickZoom to Schedule K-1 Partnership or S Corporation worksheet, depending on what the previous entity was to enter your passive losses

- Tap Step-by-Step where Forms used to be to return to the interview mode

If you indicated the property was sold then the passive losses where released to the Sch E so if the property was moved from the Sch E on the personal return to the C-Corp then you need to "unsell" the property and instead convert it to personal use. This may be one of those times when using a paid professional would be wise so you can get this correct the second time.