What is the TurboTax Desktop $10 credit available at wholesale clubs?

Select TurboTax Desktop products include a one-time $10 credit for in-product add-ons. Offer valid for tax year 2025 TurboTax Desktop products only and expires April 30, 2026.

Eligible TurboTax Desktop products

The following Desktop products purchased in-warehouse or online from Costco, Sam’s Club or BJ’s Wholesale include the one-time $10 credit. The one-time $10 credit is limited to one credit per license code and applies to the first in-product add-on purchase only.

TurboTax Deluxe (Federal Only)

Note: TurboTax Deluxe (Federal only) is only available on your warehouse website, and isn't available in the warehouse.

TurboTax Deluxe (Federal + State)

TurboTax Premier

TurboTax Home & Business

TurboTax Business

Note: TurboTax Business is available on your warehouse website and isn't available in the warehouse.

Eligible in-product add-ons

The $10 credit can be used toward one of these optional, paid add-ons:

State e-file fees: Save time by e-filing your state return (State e-file fees do not apply to TurboTax Business products).

State product: If you need to add other states beyond what your product includes (if any), you can purchase them directly within TurboTax.

Audit Defense: Receive full-service representation from a dedicated audit advisor in the event of an IRS audit or notice.

Product upgrade: You can upgrade directly within TurboTax to a higher Desktop version and pick up where you left off. (Product upgrade doesn't apply to Home & Business or TurboTax Business products.)

Live Tax Advice: Connect directly with a tax expert and receive one-on-one answers and advice.

How to redeem your credit

The one-time $10 credit is recognized through your unique License Code. There’s no need to manually enter a promotional code. Here’s how it works:

Install and activate TurboTax with your license code provided either in your package or in your email confirmation. To activate your installed software, you will need to sign in to your Intuit Account or create one if you don't already have one.

Add one of the optional add-on features or services listed above directly within TurboTax. Additional features and services require internet connectivity.

A $10 credit will be automatically applied to the first add-on feature or service purchased. Intuit reserves the right to provide your $10 credit through other reimbursement methods, including a paper check sent by US mail to the address you provided at the time of e-file.

Limited to one credit per license code and applies to the first in-product add-on purchase only regardless of number of product installations.

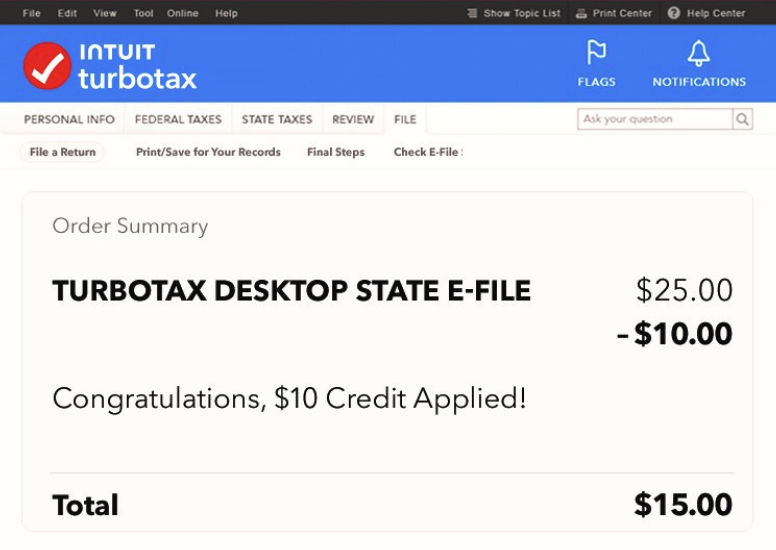

Credit may not show on screen, but the $10 discount will be applied to your final purchase and will look like this screen.

How do you know you purchased an eligible product?

Eligible products are sold in warehouses and online at Costco, Sam’s Club, and BJ’s Wholesale, and feature this insert.

Other terms and conditions

The $10 credit will automatically be applied to your first add-on feature or service. No promotional codes are needed. The one-time $10 credit is limited to one credit per license code and applies to the first in-product add-on purchase only, regardless of the number of product installations.

This credit is only valid for products purchased in-store or online at Costco, Sam’s Club or BJ’s Wholesale Clubs. The $10 credit has no cash value and will not be refunded if not used or if the product is returned. Offer valid for tax year 2025 TurboTax Desktop products only and expires April 30, 2026.

In-product add-on prices are subject to change. The price of e-file is based on the date on which you e-file and is subject to change without notice. E-file fees may not apply in certain states. See turbotax.com/desktop-pricing for further details.

Product upgrade does not apply to Home & Business.

State e-file fees do not apply to Business product.

Product installation and activation requires an Intuit Account and internet connection.

Limit of one account per license code.

You must accept the TurboTax License Agreement to use this product.