Workman's Compensation is not entered on a tax return. If you entered it somewhere on the tax return remove it.

These types of income are not taxable and are not reported on your tax return.

Both Workmen's compensation and SSDI are not considered when you prepare your tax return. If you receive an injury at work or suffer an occupational disease, the benefits you receive under the these plans are not taxed under federal law. I am not aware of any state that taxes them either.

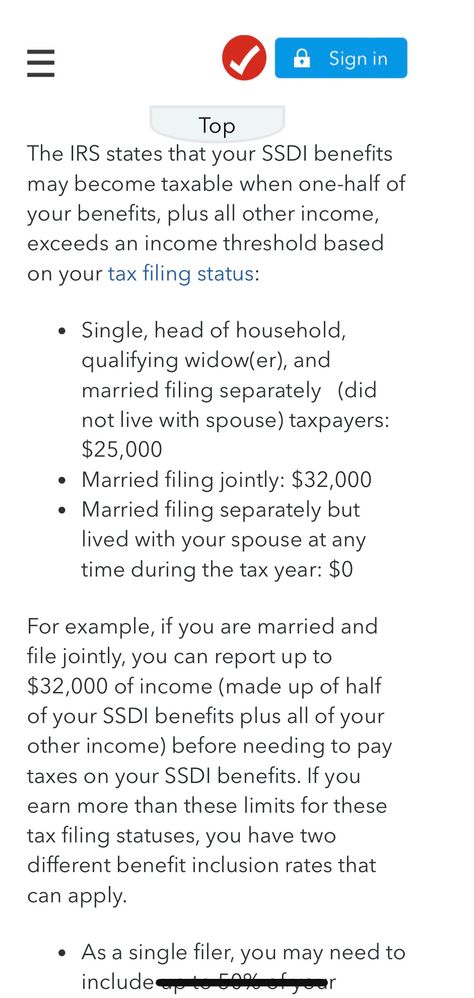

My WC puts my SSDI over the threshold and makes my SSDI partially taxable.

up to 25,000 not taxed

25,000 to 34,000 taxed on 50%

Over 34,000 taxed on 85%

I need to know where to put the WC. And get to the correct worksheet.

@pennla wrote:

My WC puts my SSDI over the threshold and makes my SSDI partially taxable.

up to 25,000 not taxed25,000 to 34,000 taxed on 50%

Over 34,000 taxed on 85%I need to know where to put the WC. And get to the correct worksheet.

As already been stated not, twice. You do not enter anywhere on a tax return the income you received from Workmen's Compensation.