WhatsUpChknButt

Level 2

posted Apr 15, 2024 7:44:40 AM

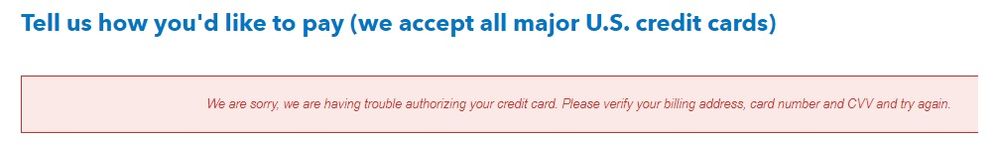

Unable to pay for state e-filing

Hello,

I have TurboTax for business and home. Unfortunately, I am not able to pay to e-file my state and state return. May I ask if anyone is having the same issue? I was hoping the system would be fixed overnight, but I got the same error message. I've tried multiple credit cards as well. Thankfully, I can mail my state return, but would like to have the data transfer from my business federal to my business state.