1 Best answer

Mar 21, 2022 7:14:50 AM

You should enter all four numbers in TurboTax so that TurboTax can calculate your QBID (qualified Business Income deduction).

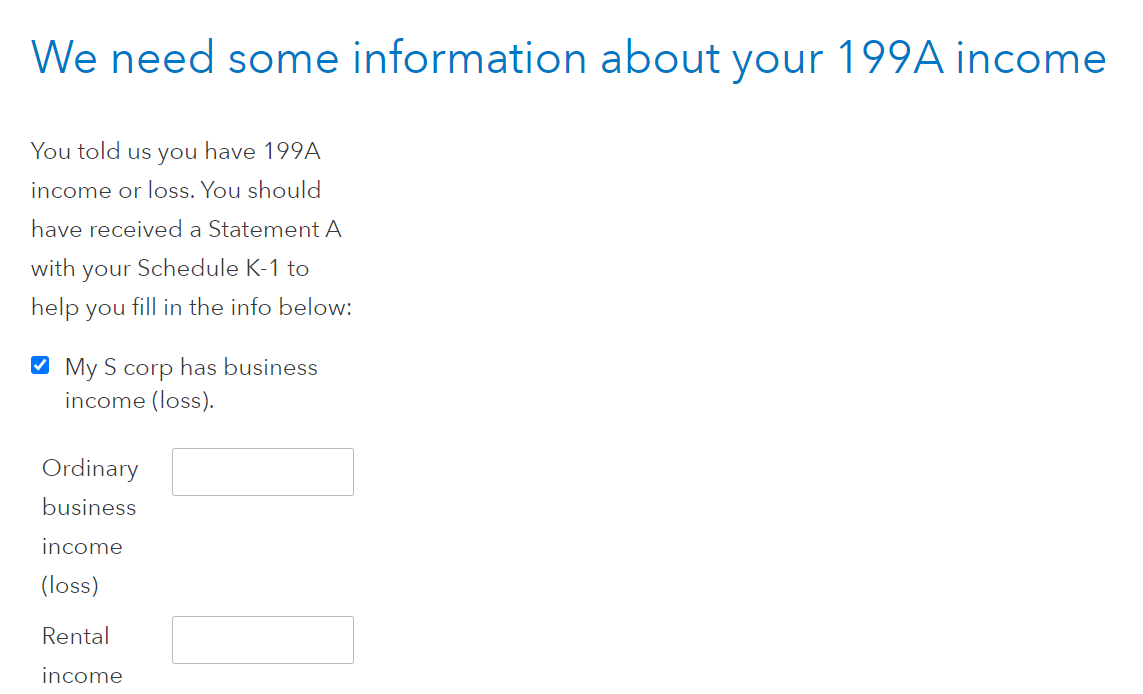

When entering your Schedule K-1, follow the TurboTax interview until you arrive at a page titled We need some information about your 199A income (see screenshot).

On that page, put a checkmark on the item you wish to enter and a box will appear so you can enter the item.