One possibility is on the screen that says Were you an exempt employee at (name of employer) you answered I was an exempt employee by mistake. You will see that screen after you indicate that you have overtime earnings after you enter your W-2 form.

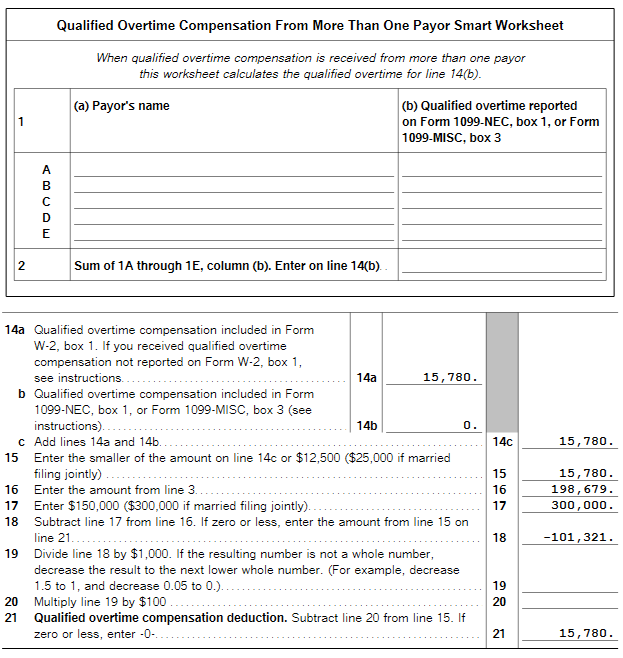

Hello - I am having the same issue, however I am filing as Head of Household. My modest overtime *should* be fully deductible since my MAGI is around $200,000 and complete phase out is not until MAGI of $275,000. But Turbo Tax deluxe is saying my deductible OT is $0 due to phase out limits, which appears incorrect to me. How do I fix this?

Check the calculations on Schedule 1-A for your Overtime Deduction calculation. If you think it's incorrect, step through the interview section again to check your entries/selections.

Thank you for your response, @MarilynG1

I looked for this in the "Forms" section Schedule 1-A is not there at all, oddly.

Does Turbo Tax leave it out completely if it thinks I do not qualify? There seems to be an error behind the scenes in calculation, TurboTax @intuit

If MAGI is $200,000 my overtime should still qualify (and deduction should not be $0 as indicated). And, Schedule 1-A should appear in the forms.

How do I fix this?

I will look at Schedule 1-A on the IRS website and do a manual calculation using the PDF

No, the entire form should still be there even if you don't qualify for the Overtime Deduction. It's titled 'Additional Deductions'. Part I is MAGI, Part II is No Tax on Tips, Part III is No Tax on Overtime, Part IV is No Tax on Car Loan Interest, Part V is Enhanced Deductions for Seniors.

In FORMS mode, choose 'Open Form' at the upper left and type in 'Schedule 1-A' and if it doesn't show in the popup window, you can create it.

You could also step through the interview sections for any or all of these deductions and the form will be created.

@veggiegal Are you figuring your MAGI the same way as Schedule 1-A? See Schedule 1-A top lines 1-3 to figure the MAGI for Schedule 1-A

https://www.irs.gov/pub/irs-pdf/f1040s1a.pdf