There is no such thing as *our* RMD. IRA's are individual, never joint. If you each have a 1099-R then you probably did not select which spouse it was for. Edit them to change that.

Thank you for your response. An unfortunate choice of words "our rmd" . We each received a 1099-R and we did specified that one belonged to me and the other to my wife.

You only get a 8606 if the IRA has an non-deducible basis in the that TurboTax will ask for.

Yes, we do have a basis for each of our IRAs. In fact the 2020 turbotax return has that info in the IRA info work sheet. It pulled that info from our 2019 return when we generated the 2020 return.

we had same problem. I used override but I am not satisfied with that. checked all our 1099 and they are correct. we had 8606 forms for 2019 with basis

@whitz wrote:

we had same problem. I used override but I am not satisfied with that. checked all our 1099 and they are correct. we had 8606 forms for 2019 with basis

What are you entering for 2020?

Explain the problem on detail.

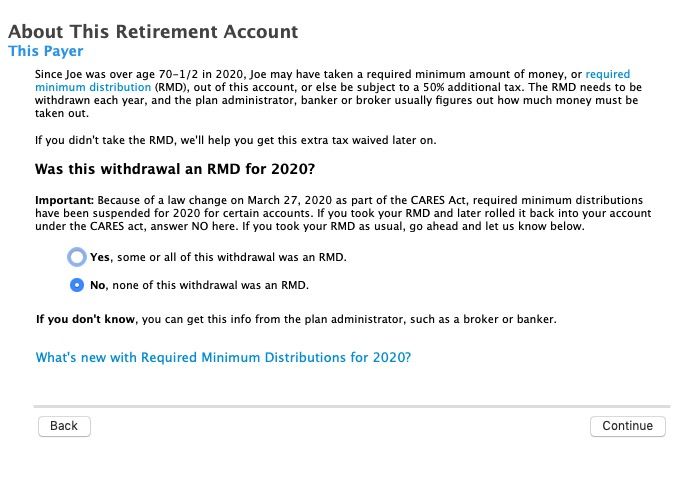

Did you generate another 8606 using override? Since both my wife and I returned our 2020 rmds we would have to include 8606s in our 2020 return that are the same as the ones in our 2019 return?

@dlt99 wrote:

Did you generate another 8606 using override? Since both my wife and I returned our 2020 rmds we would have to include 8606s in our 2020 return that are the same as the ones in our 2019 return?

If you rolled over the distribution that you took because it was not a RMD, then there should NOT be ANY 8606 because you did not take the distribution or do anything to require a 8606. The last filed 8606 remains in effect.

You only generate a new 8606 if the non-deductible basis in the IRA changes and a rollover does not change it.

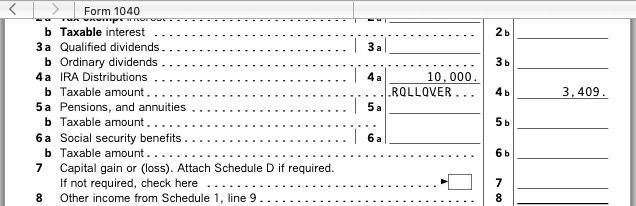

We had distributions and reported them under 1099 part of TurboTax. We were eligible under CARES act to rollover part of these distributions back which we did. We still had leftover distributions. In questions portion of step by step reported correct amounts for rollovers and remaking distributions. TurboTax generated 8606 for spouse but not me but, I have same exact situation. My basis has to be used to correctly annotate taxable amount. My spouse had correct taxable amount. Where else can that come from but 8606. I had TurboTax generate one. No info in blocks so had to overwrite based on data from 2019 form. I knew amounts to put in, so I did. Very frustrating! I spent more time on this then rest of return no counting this very annoying help function.

Thanks for the explanation. If my 2020 return does not have a 8606 what happens when i file my 2021 return will turbotax ask the questions that will generate the 8606s.

If you had any distribution at all that was not rolled back then you must have a 8606.

I suggest deleting the 1099R and re-enter as below.

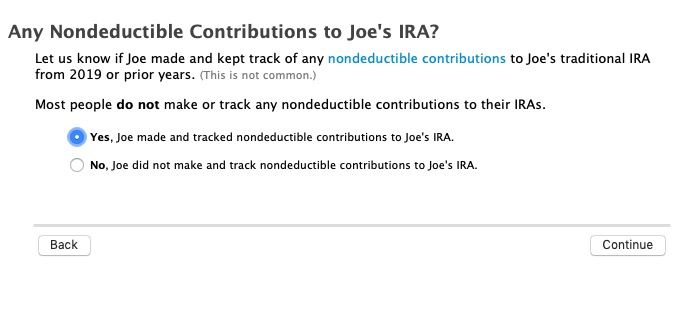

When you get the "tracked non-deductible contributions" question does the 2019 carry forward amount populate?

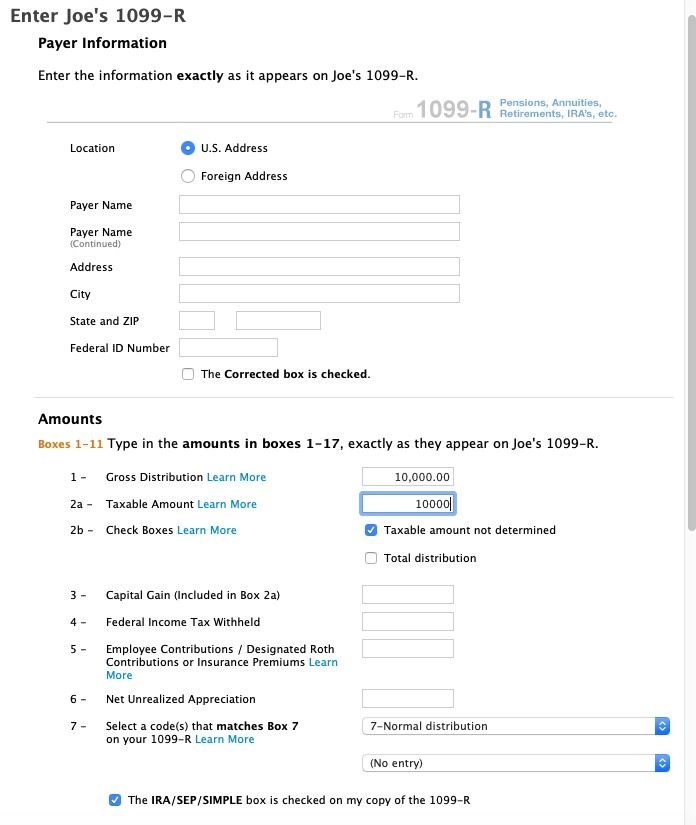

Perhaps 2019 has an error and the carry forward Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

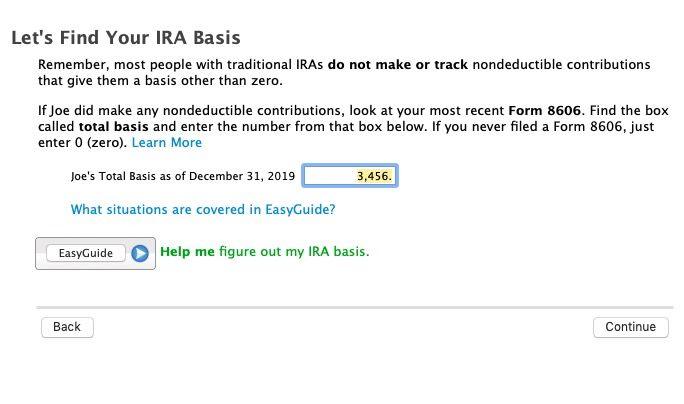

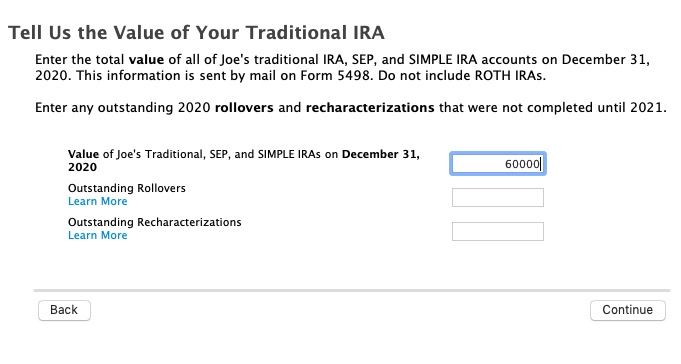

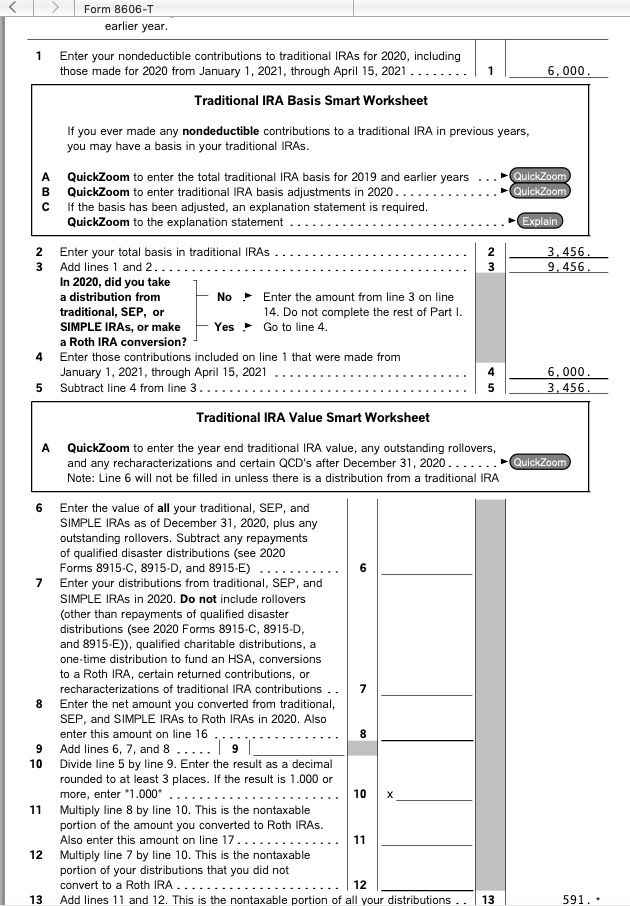

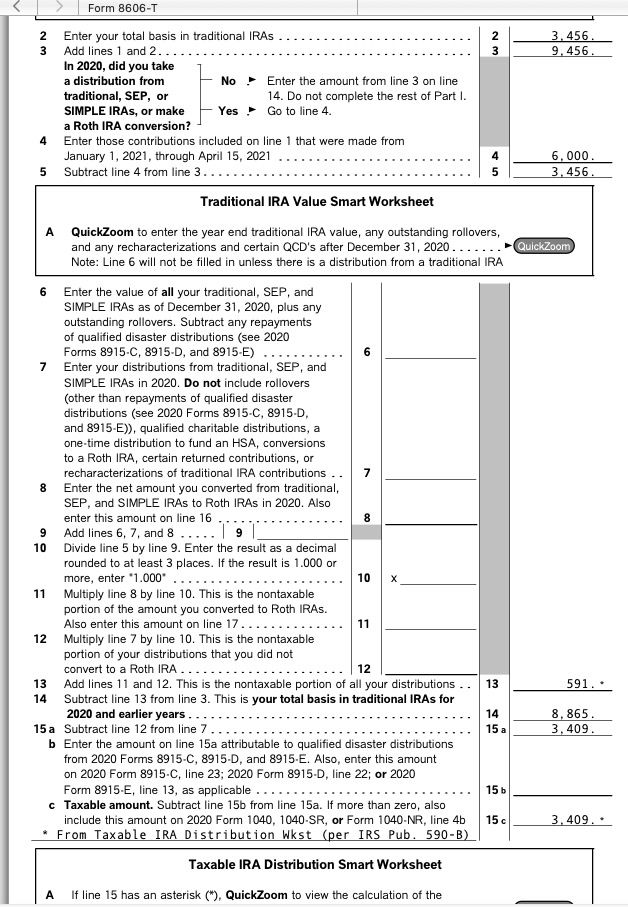

You will be asked of you had and tracked non-deductible contributions - say yes. The enter the amount from the last filed 8606 form line 14 if it did not transfer. Then enter the total value of any Traditional, SEP and SIMPLE IRA accounts that existed on December 31, 2020.

That will produce a new 8606 form with the taxable amount calculated on lines 6-15 and the remaining carry-forward basis on line 14.

NOTE: If there is an * next to line 15 then 6-15 will be blank and the calculations will be on the "Taxable IRA Distributions worksheet instead.basis was not in box 14 on the 2019 8606.

you didn't pay attention to what I've posted. I've been thru all these steps and in some cases several times. I also called and went thru them with a service rep. No help. The fact that my spouse gets the form and I do not with exactly the same situation means that turbotax has a bug but you don't want to admit it. I've overwritten my 8606 in order to get to the correct position. having to do that to get an accurate return is not a positive thing but I need to have the form done and obviously you do not have a way around the problem.

@whitz wrote:

you didn't pay attention to what I've posted. I've been thru all these steps and in some cases several times. I also called and went thru them with a service rep. No help. The fact that my spouse gets the form and I do not with exactly the same situation means that turbotax has a bug but you don't want to admit it. I've overwritten my 8606 in order to get to the correct position. having to do that to get an accurate return is not a positive thing but I need to have the form done and obviously you do not have a way around the problem.

It works fine for me - what are you doing that is different?

Be sure you choose the correct spouse.

I have the same problem. My wife and I both have a non-deductible IRA basis that is carried forward each year on a Form 8606. This year the IRA worksheet shows it properly updated for our 2021 taxes, but only my 8606 is generated for our tax return. She has no 8606 form to print out for our records, I can only get to it thru the IRA worksheet. I'm concerned the IRS won't get her 8606. Is this a TurboTax bug? Any suggestions?

You are correct that the spouse's 8606-S should appear but doesn't if you indicate that all of the spouse's IRA contribution is deductible. A workaround is this: on the screen that asks if you want to make your IRA contributions deductible, for your spouse answer "Yes, make part of [spouse's name]'s IRA contribution nondeductible."

A new line will appear asking how much to make nondeductible. Enter "1" (as in one dollar).

Now your spouse's 8606 will appear, and you haven't changed your tax much (if at all).

Your 8606 is still there (8606-T, your spouse's will be 8606-S).

@CCDAve wrote:

I have the same problem. My wife and I both have a non-deductible IRA basis that is carried forward each year on a Form 8606. This year the IRA worksheet shows it properly updated for our 2021 taxes, but only my 8606 is generated for our tax return. She has no 8606 form to print out for our records, I can only get to it thru the IRA worksheet. I'm concerned the IRS won't get her 8606. Is this a TurboTax bug? Any suggestions?

Did your wife make a new non-deductible 2021 contribution or have a 2021 distribution? 8606 forms are only generated if the non-deductible basis changes, otherwise the last filed 8606 remains active until the basis changes.

You don't normally enter a 8606 itself. It is automatically created when:

1) You make a new non-deductible Traditional IRA contribution.

2) You take a distribution from a IRA that has a after-tax "basis".

3) You make a conversion of a retirement account to a Roth IRA

4) You have distribution from Roth IRA.

[For more information:

See IRS 8606 instructions

https://www.irs.gov/pub/irs-pdf/i8606.pdf

"Who must file" page 1.]

If none of those occurred, then the last filed 8606 remains in effect

There are some circumstances when a 8606 must be files for other reasons and might require filing a stand-alone 8606.

https://ttlc.intuit.com/questions/1899503-what-is-form-8606-nondeductible-iras-used-for

I followed your suggestion and it did force TurboTax to generate my wife's 8606. I wish this problem would be addressed by Intuit, last year and this year were the first times in many years I've had problems using TurboTax. Thanks for your help!

@CCDAve wrote:

I followed your suggestion and it did force TurboTax to generate my wife's 8606. I wish this problem would be addressed by Intuit, last year and this year were the first times in many years I've had problems using TurboTax. Thanks for your help!

There is no problem with TurboTax. You only need a 8696 if there was a new non-deductible contribution or a distribution from an IRA and in both cases you must specify which spouse it is for and that determines which spouse the 8696 is for.

do you plan to file a form 8606 with your basis going up one dollar each year because you want to force a Form 8606.?

Hint: it is not a good suggestion.