Norm85

Level 1

posted Mar 5, 2025 11:51:29 AM

NJK-1 income allocation

I'm an NJ resident and received a K-1 (from my father's finalized estate which would require filing a 1041).

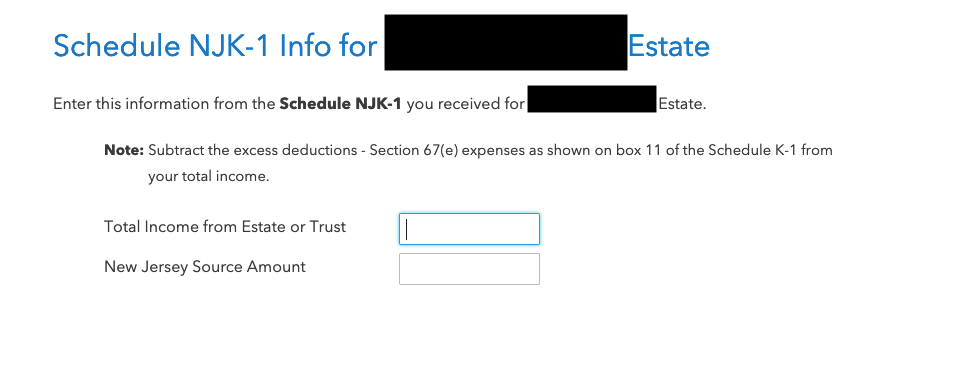

I was able to input the K-1 into the federal portion of turbotax fine, but arriving at the NJ portion, it asks to enter income from the trust/estate as well as the NJ source amount (see image 1).

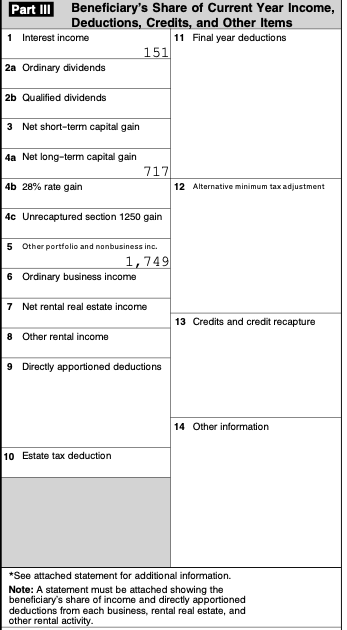

I'm not too sure what amounts I should be entering in which box. The Note says to subtract the excess deductions as shown on box 11 - but there is nothing listed there (see image 2). Do i just leave it blank? Or do I enter 1,749 (from box 5) in both lines?

Thanks in advance.