I suggest you delete that entry and enter it as a summary.

To enter it as a summary, you need to answer "No" to getting a 1099-B.

If you are able to get a summary, or summarize them yourself, you can enter as "Stocks Bonds, Mutual Funds"

(Long Term ((MORE THAN ONE YEAR)) Short Term ((ONE YEAR OR LESS)) Gain/Loss) (Date of Purchase- various)

If you are e-filing, paper-mail Mail Form 8453 with the statement you have showing the transactions, within 3 days of an acknowledgement of the acceptance of your e-filed Federal Return.

Mail Form 8453 to:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254

(If you are mailing in a paper 1040, include the statement only with the paper return)

Be sure to separate any earned income (Mining, Air Drops) from trades. Enter any "Earned Income" on your Schedule C.

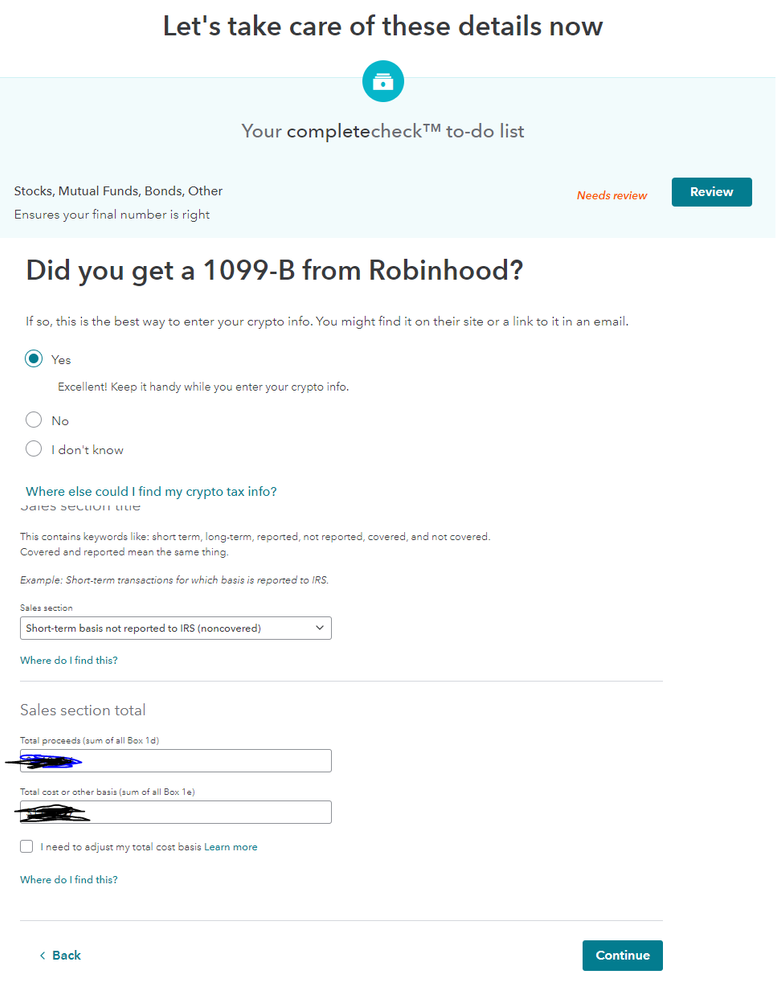

TurboTax (Online) does have a separate section for reporting Virtual Currency trades, but that is just a convenience for the customer. It all goes to Capital Gains/Loss.

Personal

Personal Income

I'll choose what I work on

Scroll down to "Investment Income"

"Stocks, Mutual Funds, Bonds, Other" START

Did you get 1099-B?" NO

Select "I'll enter a summary for each sales category"

If you have both Short Term and Long Term, you will need to enter each on a separate screen.

FORM 8453