material participation is not required. this is the reason some taxpayers may elect to amortize

Intangible drilling cost (IDC) is either capitalized and amortized or written off as an expense in the current year. If written off, there is a possibility that a portion of the entire excess IDC amount is included as a tax preference item subject to the alternative minimum tax. If capitalized and amortized, there is no tax preference on IDC.

How do you make the election expense Intangible Drilling Cost or Amortize in Turbo Tax?

I don't think you make an actual election. Rather, you simply entire the entire amount of the intangible drilling costs reported to you or you enter 1/0th that amount if you decide to amortize over 10 years. If you deduct 100% in year 1, it is treated as a preference item so you want to make sure that does not cause you an AMT issue.

Sorry, I didn't understand how you enter this information into Turbo Tax. Were exactly would you do this, in the program?

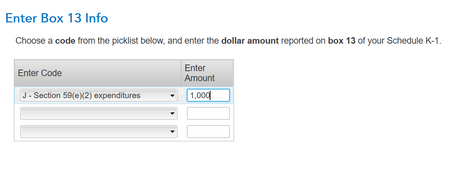

For me, I received a k-1 showing intangible drilling costs. The IDC expense was in box 13J of the k-1 and I entered the number in TurboTax when I was entering all my k-1 info for this particular partnership.

![]()

See here, this is how it would be entered.

Following this, you'll see this screen

Hit edit, then you get to this screen

Hit edit, then you get to this screen

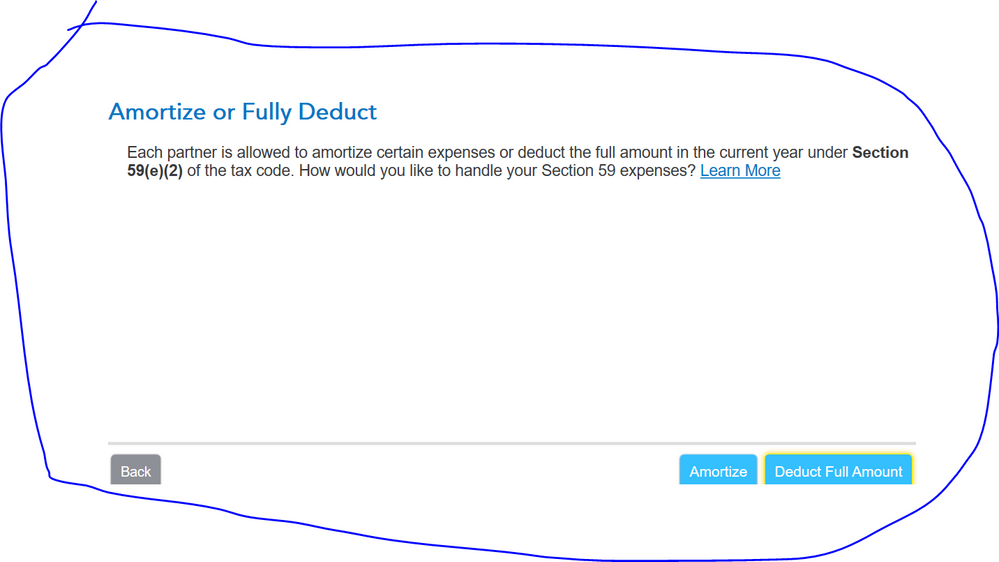

And then finally to this screen which will give you the option to amortize of fully deduct.

And then finally to this screen which will give you the option to amortize of fully deduct.

Section 59(e)(2) expenditures can be taken in full in the current year for regular tax purposes. However, they have to be amortized over a certain amount of time for AMT. If no type code is selected, the default is mining costs. For AMT purposes, mining costs are required to be amortized over 10 years. @atrabul

Thanks alot... all these types of investments, the investors should receive a schedule K I assume?

Yes, you are correct. An investment in a partnership means that your share of income, intangible drilling costs and other expenses or credits will be reported to you on your own 1065-K1.

Due Date:

Generally, a domestic partnership must file Form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of Form 1065. For calendar year partnerships, the due date is March 15. Check with your partnership to see when you could expect your K1.

I believe that IDC can be amortized over 60 month period. The election is made on form 4562. The problem with deducting the entire amount is that they are a tax preference item subject to the Alt Min Tax. Does Turbotax suggests the best decision or do you have to run it both ways?

It depends on your personal tax return situation to see which method would be most beneficial to you. You would need to run both scenarios to decide which is best. An AMT adjustment is required if costs are not amortized over 60 months.

As mentioned, Intangible Drilling Costs may be fully deducted as a business expense by electing to do so, or capitalized and recovered through depreciation or depletion. These costs are defined as costs related to drilling and necessary for the preparation of wells for production, but that have no salvageable value. These include costs for wages, fuel, supplies, repairs, survey work, and ground clearing. They compose roughly 60 to 80 percent of total drilling costs. Intangible drilling costs are 100% tax-deductible in the year incurred. It doesn't matter if the well produces or strikes oil; as long as it is operating by March 31 of the following year. the intangible costs are 100% deductible.

See additional information that might be helpful to you in the link below:

I see that the 59(e)(2) worksheet is calculating Excess intangible drilling costs on line 11. This doesn't match what was reported on the K1 Box 17 code F. Form 1065 is erroring out because the calculated number auto populates but doesn't match the K1 number.

Please clarify what version of TurboTax you are using and where you are entering IDC.

It would also help to know the amounts from K-1 - Box 13 code J and Box 17 code F - and from the 59(e)(2) worksheet Line 11. Did you elect to expense the IDC?

Version: Premier

Where: K1 entry form - Box 13

13 - J: 3,540

17 - F: 3,530

worksheet line 11: 3,186

yes, expense.

I'm unable to reproduce the form errors you mentioned. Entering the K-1 line items as listed generates Excess IDC of $3,186 (90% of total), but this has no effect on the loss reported on Schedule E p2. Please advise if you have a different experience, especially during SmartCheck.

These steps are enormously useful. Thank you.

When I go thru those steps and enter the IDC amount for Box 13, let's say $37.5k, and choose that I want to amortize in a single (this) year, I do NOT see any reduction of my overall tax liability.

Do I need to take any other manual steps to make sure that IDC amount takes effect and reduces my AGI?

TIA!

-G

I'm experiencing the same as @gyaqwe .

What I did:

- Entered the number in box 13 'other deductions'

- selected code J

- selected deduct this year instead of amortize

but I didn't see any deduction applied.

Is this a bug or I did it wrong?

One thing I noticed is that although I selected code J for box 13, the next screen shows CODE I:

When you went through the interview, there is a question asking you if you materially participate in the venture. If you indicate you did not, you won't get credit for the deduction.

This would be the first place i would look.

This was indeed the problem @DaveF1006 Thanks!. I assumed that the software knows that Working Interest in OnG is always non-passive. Well it doesn't. I had to select it while entering the data and then it took effect. @c0nstant1ne - see if that works for you.

-G

Thanks @DaveF1006 for the suggestion. Glad that it worked for you @gyaqwe.

I just got back to finishing my tax return this weekend, but I don't think I was ever asked about whether I materially participated while entering the K-1.

At which step this is asked?

I'm using turbotax premier. I tried both the online version and desktop, neither asks this question.

Type of partner: General partner or LLC manager, Domestic

Your help is much appreciated.

The question "Did You Participate?" appears after the page "Choose Type of Activity" where you check one of Box 1, 2, or 3. This has been tested in TurboTax Online and Desktop.

Hi Patricia,

Thanks for the reply.

Box 1,2,3 are empty on my K-1 and I had to select ‘other’ based on the instructions, and it didn’t ask me this question.

On my K-1, only box 13,14 and 17 are not empty

Your best option may be to check Box 1 to trigger the material participation question. You can leave the Box 1 amount blank. After you enter the rest of the K-1, you should a see confirmation of the IDC deduction.

I too have Box 1,2,3 empty. Box 13 is populated. Here's my steps:

Choose Type of Partner: General Partner, then Domestic Partner.

(I was getting tripped up by selecting type of Activity - other - which wasn't working).

Choose type of activity - Choose Option 1 - Business.

Next question: Did you Materially Participate: Yes

Box 13 - My code is J-Section 59(e)(2) expenditures. Yours is the same? Put the amount here.

for the rest of the boxes put in your info as per the K-1.

See if the above helps. GL