For both individual and corporate Turbotax Desktop programs, you will need to import last year's data BEFORE you start your return.

The process of importing starts before you enter any data. Sorry, there is no other way.

I was able to import my personal return. It did not allow me to import my corporate return.

@Anonymous wrote:

I was able to import my personal return. It did not allow me to import my corporate return.

A prior year tax data file or PDF for a personal tax return can only be transferred to the current year personal editions of TurboTax.

A prior year tax data file from the TurboTax Business edition can only be transferred to the current tax year Business Edition.

It's a PDF from my CPA. In doing more research it says I cannot import it, only in Turbotax Business. I bought Turbotax home AND business. Why does this not import then?

@Anonymous wrote:

It's a PDF from my CPA. In doing more research it says I cannot import it, only in Turbotax Business. I bought Turbotax home AND business. Why does this not import then?

TurboTax Home & Business is a personal tax program. The Business portion of Home & Business is for a Schedule C used by self-employed independent contractors or sole proprietors which is included with and part of a personal tax return, Form 1040.

The TurboTax Business Edition is used from filing tax returns for Partnerships, C Corp, S Corp and Multi-member LLC's.

Aha! Thank you so much! Need to also buy the Business version. And to the 2 soft wares work together once business is filed?

Wish it would have been explained better.

Thanks for your help!!

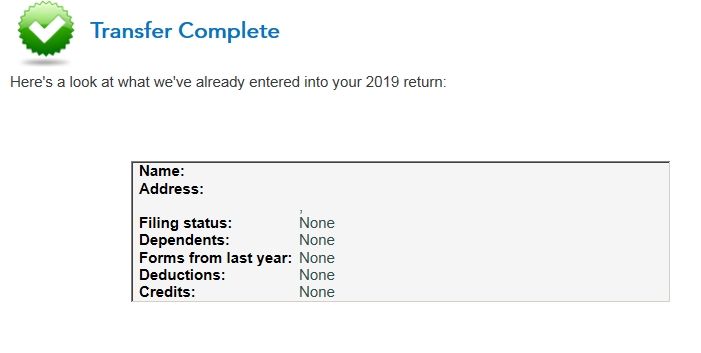

I have found my 2018 TurboTax return file, and I select this file (XXXX.tax2018) to import the information into TurboTax 2019...and I get squat for information?

What is up with this?

You can try downloading the .tax file again and import the fresh tax file into your desktop software. Also be sure your software has all recent updates installed. Click on "Check for Updates" and update your software if needed. If that doesn't work you can manually update your software.

YUK YUK YUK!! Please find a way to do this next year (or maybe up date the program this year?) or put in a BIG STOP sign at the beginning or a check of some kind so you can verify you have done so. I though I had imported my previous info and evidently didn't!! Now I have to reenter it all...

YUK YUK YUK!!

If you are using the online version and log in to the same account you used for the prior year, the import of prior year is automatic. If you are using the desktop software, it prompts you to import prior year information.

Thank you. I am using desktop version of TurboTax Business as well as TurboTax Home & Business.

This is my 1st time doing my own taxes without outsourcing to a CPA entirely.

This is the pits. as noted in previous comments, this is not acceptable. a warning should be up and acknowledged prior to data entry for new year. I have used TT in many versions since it was first introduced (think large floppies) and do not recall any problems before. the problem did not surface until I was done entering many hours of data. not a happy user.

[email address removed]

I did 2017 Turbotax on a desktop from a Turbotax CD. We got the taxes filed. I think it was premiere but it could have been home and business.

Then that computer broke.

My wife did 2018 taxes using turbotax online, (downloading Premier) but did not import any of the data from the 2017 taxes.

We got the computer fixed.

I am wondering if I can go back and amend my 2018 taxes and import the 2017 data from the now repaired computer...Is this possible?

That's absurd. New IRS statements say you can claim LIFO for crypto trading, which is great! huge benefit. SO, now I need to amend 2017,2018,2019. Due to this completely stupid oversight I actually just amend 2017, but i have to do 2018, 2019 completely from scratch!.

What a horse **bleep** design idea that was.

You are commenting on a very long old thread. Which part are you needing assistance with? It may be best to start a new thread of your own for the best assistance.

How did you import? I'm not computer savy, please be specific if you can.

Thank you

This is a terrible flaw in TurboTax. We started our return without having the previous year's tax file. When we were able to get the previous years file, we learned that it would wipe out all of our work on the current tax year. This is a very big flaw. This will be the last year I rely on TurboTax. There must be a workaround.

@clandret Sorry--no there is not a work around. If you want to transfer the previous year data into your new tax return you have to do that at the very beginning before you start to enter any new 2020 data. The only way to "fix" it is to clear and start over.

How to transfer last year’s return? https://ttlc.intuit.com/questions/1900883

https://ttlc.intuit.com/questions/1900883-how-do-i-transfer-last-year-s-return-to-turbotax-online

CLEAR AND START OVER

https://ttlc.intuit.com/questions/2586254-how-do-i-clear-and-start-over

I never got a payment of 1,849 or got any type information from the IRS on my recent return from last year tax. You stated that I got 1,849 but what happen to the money?

@csmalls1959

To find out where your refund is, first check your e-file status. If it's been accepted, you can begin to track your refund at the IRS Where's My Refund? site. You'll need your Social Security number or ITIN, filing status, and the exact amount of your refund to check your status. If it's been more than 21 days since your e-filed 2021 return was accepted, you can call the IRS directly to check on your refund status.