Feb 17, 2023 3:23:31 PM

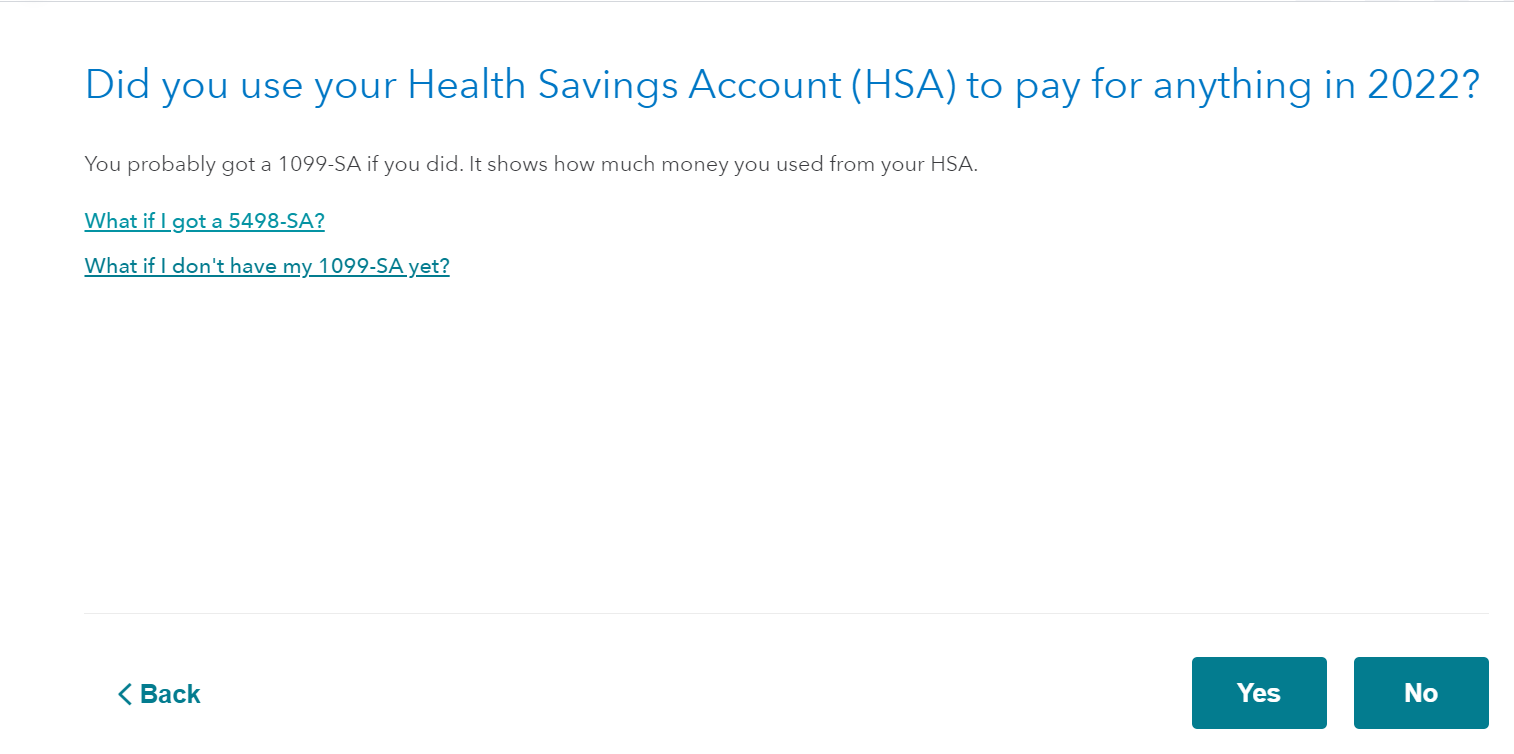

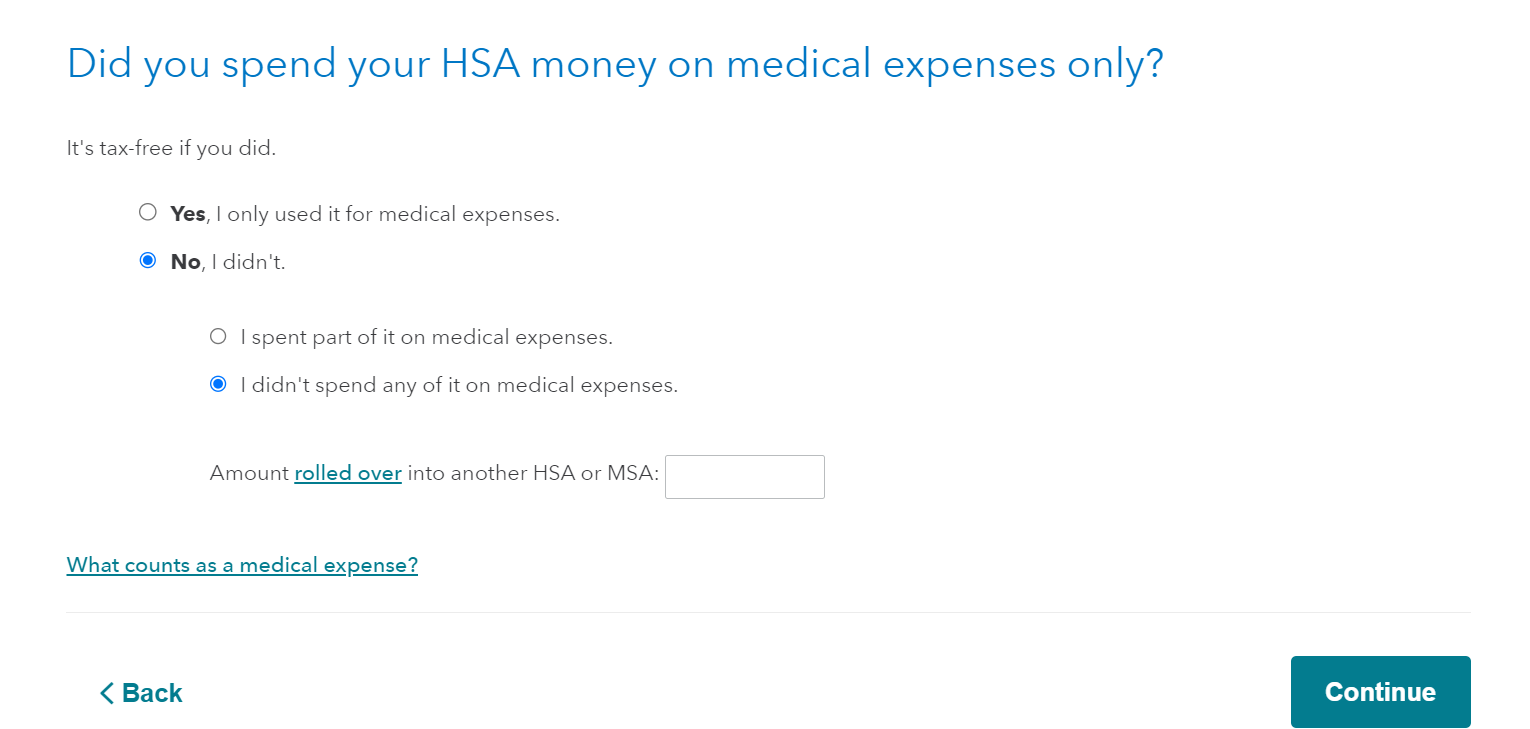

You will have to go through the 1099-SA section. On the question that asks "Did you use your Health Savings Account (HSA) to pay for anything in 2022?" you need to answer Yes. Then on the "Did you spend your HSA money on medical expenses only?" choose No and I didn't spend any of it on medical expenses to get the Rollover box. (See below)