The IRS typically starts looking for a return after the LLC applies for an EIN.

You can easily change the date in that field, otherwise.

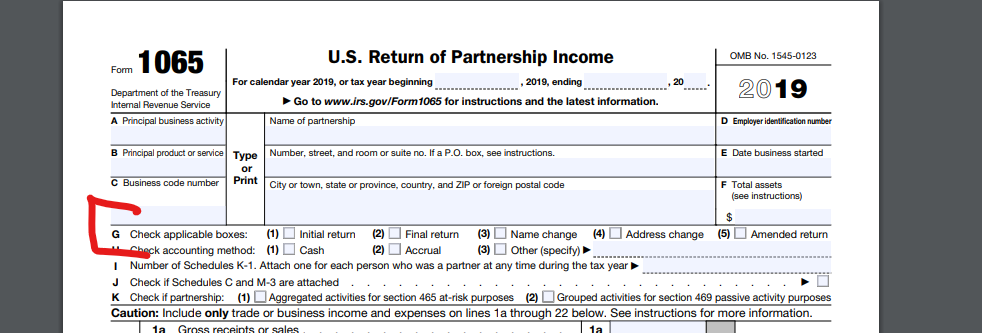

On the 2018 Form 1065

U.S. Return of Partnership Income

Department of the Treasury

Internal Revenue Service

Line "G", Which box is checked?

It depends. If you didn't have income or expenditures you can deduct or get a credit for in 2017, you do not have to file Form 1065 for 2017.

The IRS Instructions for Form 1065 at this link have these instruction for Who Must File":

".......every domestic partnership must file Form 1065, unless it neither receives income nor incurs any expenditures treated as deductions or credits for federal income tax purposes."

For the date the business started, the IRS instructions Form IRS Form SS-4 at this link suggest that you should use the date you created the business.

DavidS nailed it. No need to file if no business activity in TY 2017.

The first Year I filed I selected initial. This year the boxes are all blank.