mattoxpools

Level 3

posted Feb 16, 2020 8:56:24 AM

Error Check Message Section 199A Inputs

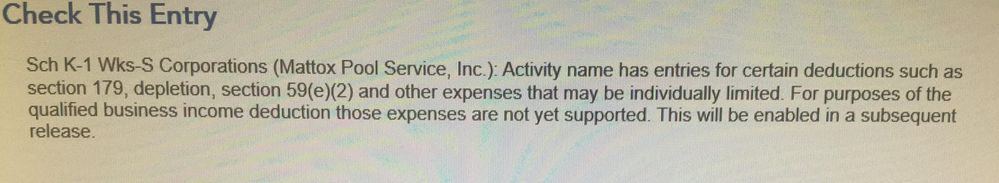

I am using TurboTax Premier for my personal taxes. I have finished all the entries and am getting an Error Check message that states the following:

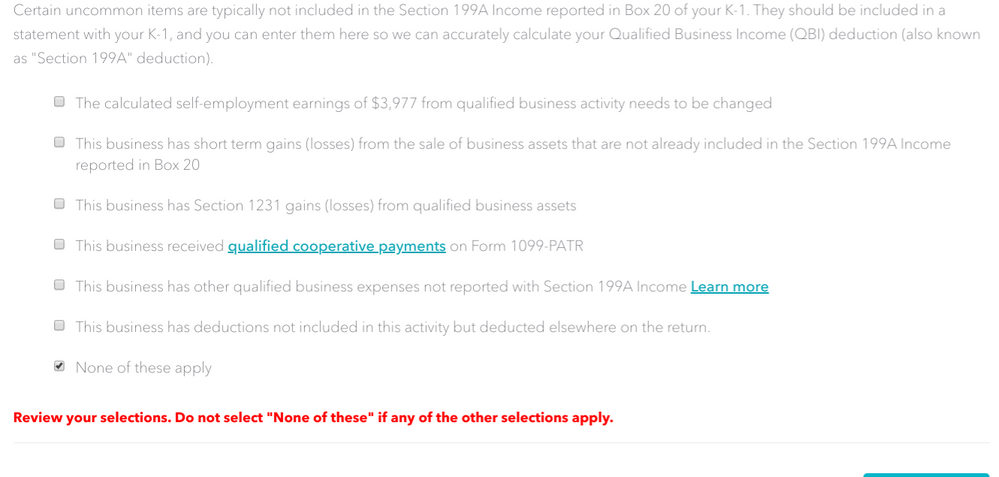

I have entered all the K-1 Line 17 code V items on the table for Section 199A QBI. I had no issues last year. This year I have a Section 179 depreciation item that makes the overall income a net loss. Does this message mean that an upcoming TurboTax update will complete this item or is this something different?