1 Best answer

Apr 5, 2023 3:46:07 PM

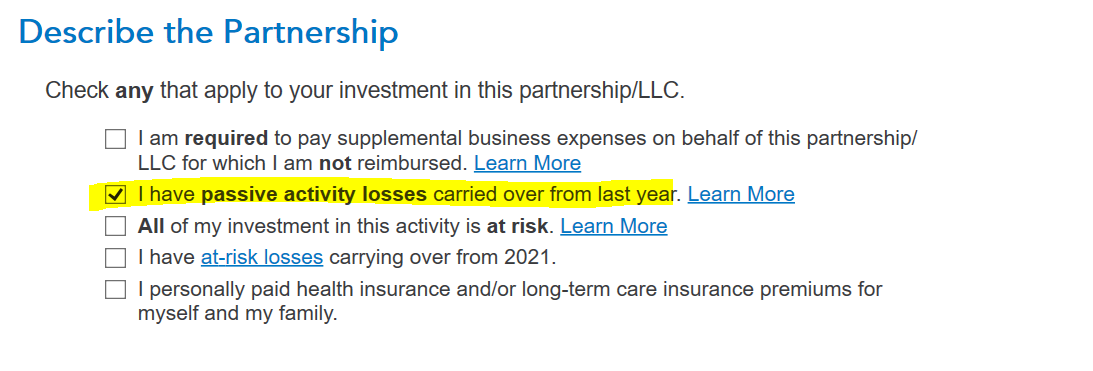

When you enter your K-1 schedule for the partnership in TurboTax, you will come to a screen that says Describe the Partnership and you need to choose the option I have passive activity losses carried over from last year.

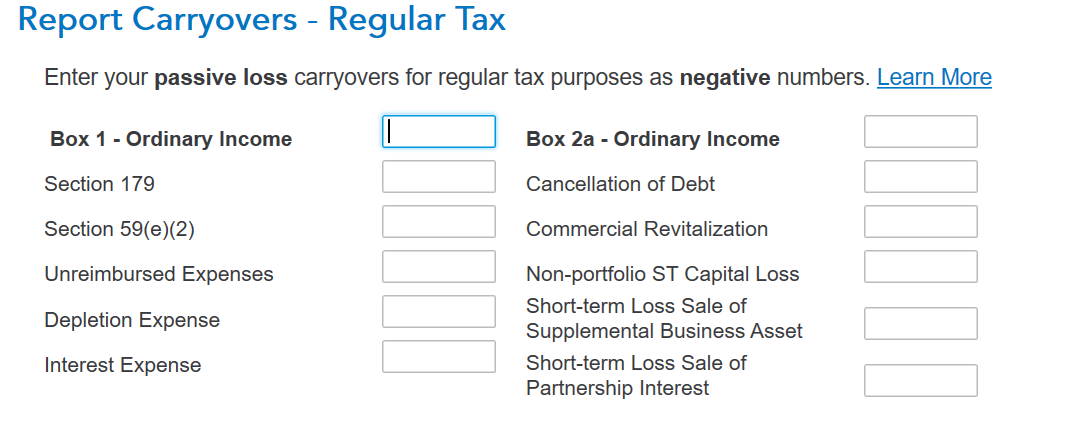

Later, you will see a screen where you can enter or adjust your passive loss carryovers from the prior year. Those entries will transfer to your form 8582.