If you override the charitable contributions amount, you won't be able to E-file. For this year, even if you don’t itemize, you may take a charitable deduction of up to $300 ($600 if married filing jointly) for cash contributions made in 2021 to qualified organizations.

Here are some possible solutions so your tax return reflects the $600 charitable contribution:

- Make sure you compete the entire interview,

- Do a final review,

- Make sure you enter that the contribution was money, and

- Make sure you are claiming the standard deduction.

Related Information:

I have the same problem, and soon many other users will as well. This is a software defect, and it will impact any Turbo Tax user with filing status of Married Filing Jointly, who takes the Standard Deduction, and who made more than $600 in charitable contributions.

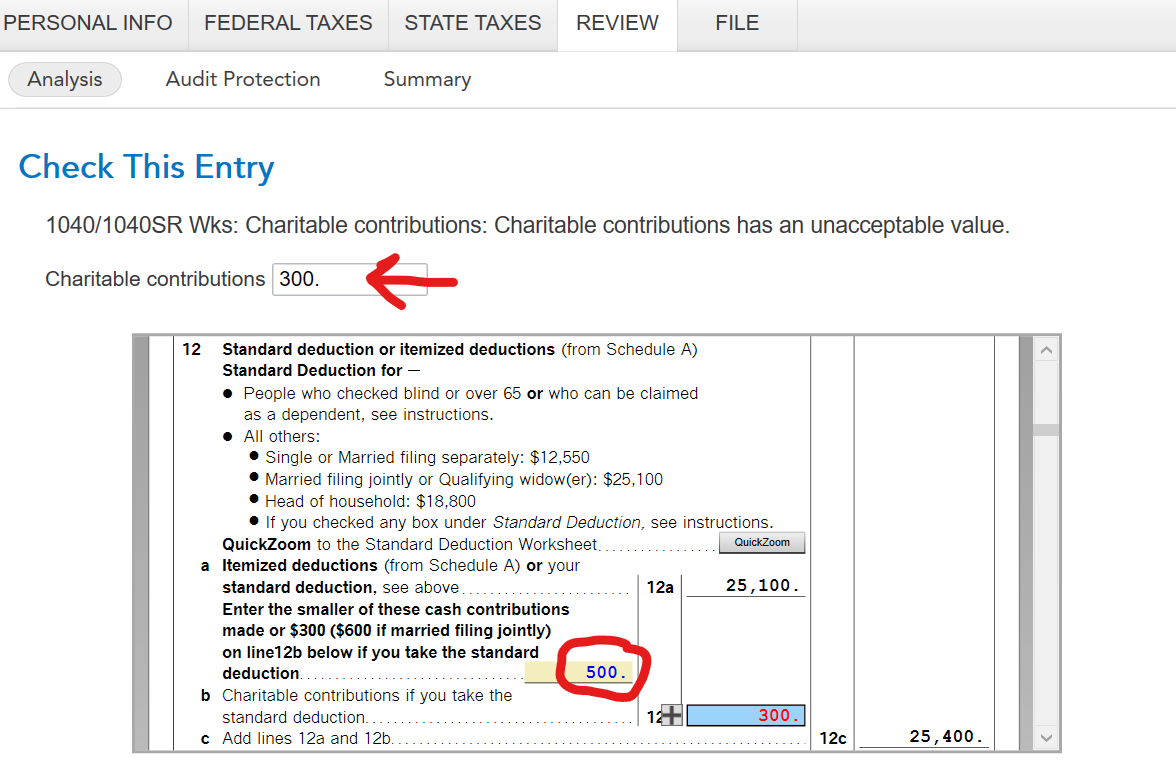

It pops up in the Smart Check review, where Turbo Tax flags an error. In the screen shot below, you can see that Turbo Tax had incorrectly entered $300 on line 12b of the 1040 worksheet. Smart Check catches it, identifies the entry as an incorrect value, and prompts for an over ride. I enter 600 at the prompt, and it seems as though I am good to go.

When I run Smart Check again, I get the same error. When I view the error I find I am back where I started - Turbo Tax has inserted 300 in the worksheet and Smart Check has flagged it as an error! Intuit needs to fix this.

Do you qualify for the standard deduction or itemized deductions?

TurboTax knows this by reaching the screen Based on what you just told us, the Standard Deduction is best for you. At the section Deductions & Credits, scroll to the bottom of the page and click on Wrap up tax breaks.

Federal 1040 line 12b Charitable Cash Contributions under CARES Act can be entered at either:

- Deductions & Credits / Donations to Charity or

- at the screen Charitable Cash Contributions under CARES Act immediately following Based on what you just told us, the Standard Deduction is best for you.

However, always pass all the way through both Deductions & Credits and Other Tax Situations.

At Deductions & Credits, scroll to the bottom of the page and click on Wrap up tax breaks.

At Other Tax Situations, scroll to the bottom of the page and click on Let’s keep going.

[Edited 01/30/2022 12:19 PST]

Thank you for your prompt reply and advice. To be clear, I am using the downloaded Turbo Tax Premier on a Windows 10 PC. The module name and version number are shown below:

My filing status is Married Filing Jointly. Turbo Tax says that the standard deduction is best for me. I made $5050 cash donations to charities last year, and I want my $600 CARES Act deduction :-). As an exercise, I followed your directions and deleted the charitable deduction entry. My return passed Smart Check and my Federal tax bill increased by $62, as expected.

Then I went back and reentered my charitable deduction, to see if I could repeat the problem I had experienced. When I reviewed my federal return, Smart Check said all was well, per the screen shot below. Note the Federal refund amount.

Next I went over to the final review phase. Here's a screen shot at the point where analysis was complete and I'm about to review the results:

Here's the results window. Note that the Federal refund number changed to $103:

When I hit the Continue button, I get to the problem I described in my first post:

Here is where it gets weird. I go back to the Federal Review section, and run the Federal Review. Here's what I see when I am about to start. Note the Federal refund number:

Here's that I see when I hit the Continue button and Turbo Tax takes me to the next window. The Federal refund number changes as I watch! I can verify in my 1040 form that the CARES Act deduction number changed from $300 to $600. (I have redacted my income numbers here.)

Now Turbo Tax is ready to check my Federal Return:

And I am back where I started:

I can repeat these steps at will, and get the same results every time. The final check introduces an error, and the Federal check fixes it. Every time.

I strongly suggest that indicates a defect in the version of Turbo Tax that I am running. Someone from the Intuit development team should investigate this defect.

To be able to get the full $600 for Married Filing Jointly on both the Online and Desktop visions, you must not have any entry in the itemized charitable donation posted

In both cases:

-

Go to Deductions & Credits

-

Scroll to the very bottom

-

Select

-

Wrap up Tax Breaks (Online)

-

Done with Deductions (Desktop)

-

Continue through the interview to

-

-

Charitable Cash Contributions under Cares Act

-

Enter your donation.

Thank you! Your suggestion works.

Now Line 11 on my Schedule A says that I have made no charitable deductions, and Line 12b on my 1040 says I made $600 in charitable deductions. I note that the IRS instructions for Form 1040 state that people taking the standard deduction don't need to provide a Schedule A or supporting documents. Your instructions make sense in light of that guidance.

I still maintain that there is a defect in Turbo Tax. At the very least, Turbo Tax should correctly handle the case where users key in charitable contributions as part of the normal data entry process, are told that the standard deduction works best for them, and then take the CARES Act deduction.

Schedule A should be blank if you are taking the above the line charitable contribution deduction with the standard deduction. The Schedule A is for itemized deductions and if you are taking the standard deduction, you can't take itemized deductions as well. @JackBlundell

The CARES ACT cash donation deduction is only for those taking the standard deduction.

Thank you! Your explanation makes perfect sense from a tax perspective. I completely agree with you.

I am concerned about the behavior of the Turbo Tax user interface. I should not get an error when I follow the step by step instructions. I expect Turbo Tax to make the correct decision when it determines that I need to take the standard deduction, as it did last year, and to put in the correct values. It almost succeeds in doing that. The code puts $300 in Form 1040 Line 12B during the QC analysis, when it should put $600. That indicates a software problem that should be easy for Intuit to fix.

@JohnB5677, I am having the same. I am not clear on how to fix this. I am using the standard deduction as well, based on it is slightly higher than itemizing. Do I delete all my itemized charitable contributions? I followed your steps but dont see any CARES act options during the interview. Any advice? I am on the online version.

Thanks

Federal 1040 line 12b Charitable Cash Contributions under CARES Act can be entered at either:

- Deductions & Credits / Donations to Charity or

- at the screen Charitable Cash Contributions under CARES Act immediately following Based on what you just told us, the Standard Deduction is best for you.

If you delete all of your charitable contributions, you will access the second Charitable Cash Contributions under CARES Act option listed above.

At Deductions & Credits, scroll to the bottom of the page and click on Wrap up tax breaks

At the screen titled Charitable Cash Contributions under the CARES Act, make sure that the box contains the amount of the deduction for which you qualify.

At Other Tax Situations, scroll to the bottom of the page and click on Let’s keep going.

Go to Tax Tools / Tools / View Tax Summary / Preview my 1040 to view line 12b for the charitable deduction.

Thanks. Still seems not correct. If I actually choose ITEMIZE, my fed goes down but state goes way up. The net is an increase of about $1000 if I itemize. But, even if I choose that option, the final checks go thru and highlight this as an error still. I am a bit concerned that my return is not accurate and that there is an error. I am at a loss as to what to do next? shoud i contact support? Thanks

When I preview the 1040 and switch back and forth between Standard or Itemized, the $600 is NOT removed when I choose Itemtized. That is a bug.

And it seems everytime I do the final checks (fed and then again state) it puts a number back into that box. so, I blank it out, preview and it is gone. seems like a bug to me.

I'm having the line 12b charitable deduction error message. I am qualified to take itemized deductions. But the software wants me to input a value equal or less than 600 (filing jointly). I'm not taking the standard deduction but the software wants something there.

I’m having the same issue. If I do as suggested by removing the itemized charitable contribution then they do not roll over to the state return. Definitely a bug in the program

"I should not get an error when I follow the step by step instructions."

Well, it's FEB 4 and the IRS made this change many months ago. Did you really expect TT to handle this properly??? Too bad for you. Too bad for many thousands of other MFJ people who are not smart enough to figure out the stupid workaround.

The solution to the $300/$600 charitable contribution was addressed a while ago, but here it is again.

First, you must clear all donations from the Deductions & Credits input screen

In the Desktop version:

-

Go to Deductions and Credits

-

Scroll to the bottom of the page

-

Select Done with Deductions

-

Let's check your Deductions .. Continue

-

Here are your 2021 Deductions ... Continue

-

The standard deduction is right for you ... Continue

-

GET A TAX BREAK FOR DONATING CASH TO CHARITY

-

Enter your amount

Online version

-

Go to Deductions & Credits

-

Scroll to the very bottom

-

Select Wrap up Tax Breaks (Online)

-

Continue through the interview to

-

Charitable Cash Contributions under Cares Act

-

Enter your donation.

I'm sorry, but I have to agree with the others. TurboTax should be handling this appropriately. Some of my charitable contributions are coming through via payroll deductions and therefore are on my W2. How do I remove that amount without falsifying what my W2 says? My state also uses the individual donation information for state deductions, regardless if my federal return used the information or not.

Again, as said multiple times, this solution does not work. Granted, it allows you to complete the federal return, it prevents you from having those deductions itemized on you state return. There has to be a solution that allows you to claim the standard on your federal return (and claim the $600) as well as itemize a larger value on your state

I way I got around it was to go into the forms view instead of step by step. Went to the line 12b on the 1040 form. Then I either clicked on it or right clicked I can't remember. It asked me if I wanted to overwrite the number and then I put in $600 instead of $300.

Turbo Tax that I would not be able to file electronically if I did that per the previous conversation, but I was able to file just file and the tax refund has already been processed. I do not have to file a state return and I don't know if that would have made a difference.

But I agree this is a software issue that needs to be fixes. You can NOT zero out any possible deductions as you never know if this will lead to a higher deduction than the standard or affect any other deductions or credits due.

The bug needs to be fixed and I don't understand why they have not addressed it yet. Seems like an easy fix.

For the 2021 tax return using the Married Filing Joint filing status, you are allowed to deduct up to $600 in cash contributions to charity without claiming itemized deductions.

If you are using the Married Filing Joint filing status AND using the standard deduction:

As you go through your Federal return and you have entered your charitable contributions, you will not see any additional questions regarding your inputs. If your state return also allows you to deduct charitable contributions, then the amounts you entered will be taken into account on your state return.

After you have finished your state return and you are getting ready to file, when you run the final Review, you will probably see this message:

1040/1040SR Wks: Charitable Contributions: Charitable contributions has an unacceptable value

You will also see a place at the top of the screen for Charitable contributions with '300' in the box. Below that box, you can see your Form 1040 line 12a which shows the amount of your cash contributions that you already entered.

If your line 12a is greater or equal to $600, enter '600' in the box at the top of the screen.

If your line 12a is less than $600, enter your line 12a amount in the box at the top of the screen.

After changing the input at the top of the screen to the correct value, proceed through any other errors that may pop up and then move forward to file your return. It is very important that you do not revisit any other section of your return before you file or the change may not be retained or able to be changed a second time.

See the screenshot below for reference: