May 8, 2021 4:26:59 PM

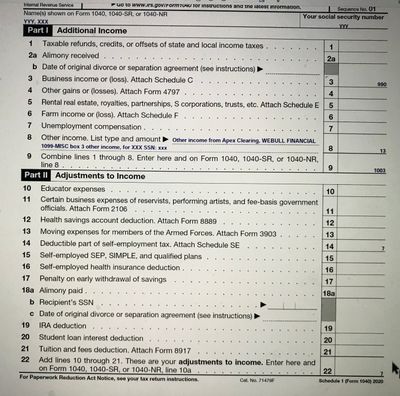

Describe exactly what the income is for. Your line 8 income has nothing to do with his business income. You would not enter it directly on the line but as other income.

- Wages & Income

- I'll choose what I work on

- Less Common Income select Start (or Update) for

- Miscellaneous Income.

- Other reportable income and you can enter your own description(s) and amount(s).

Business income is entered on Schedule C and the profit or loss flows to Line 3 Business income or (loss) on Schedule 1.

To set up your business:

- Open or continue your return.

- Search for schedule c and click the Jump to link in the search results.

- Answer Yes to Did you have any self-employment income or expenses?

- If you've already entered self-employment work and need to enter more, select Add another line of work.

- Follow the onscreen instructions.

GK04

Level 2

May 8, 2021 9:06:29 PM

I do not remember what this $13 income is for. it is mentioned on box 3 of 1099-MISC from WEBULL. it is most likely for a free stock. what should I mention in line 8 of schedule 1 for "list type and amount"

Does the following description look ok ?

also, please let me know if both spouses can use the same schedule 1