ww_big_al

Level 2

posted Mar 8, 2021 7:59:20 AM

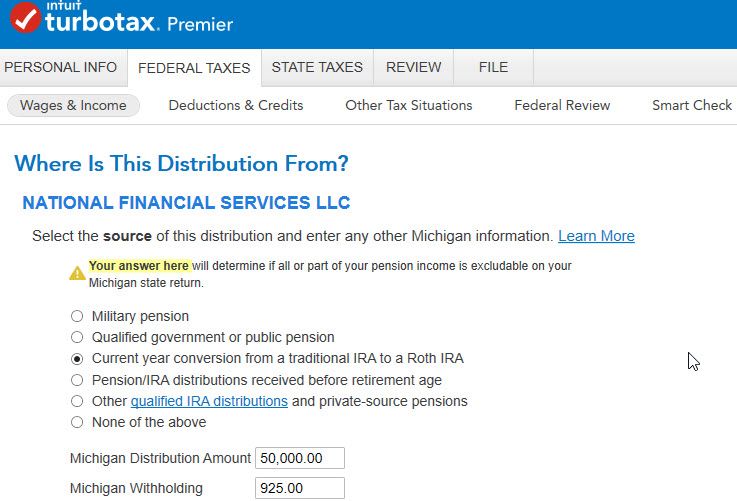

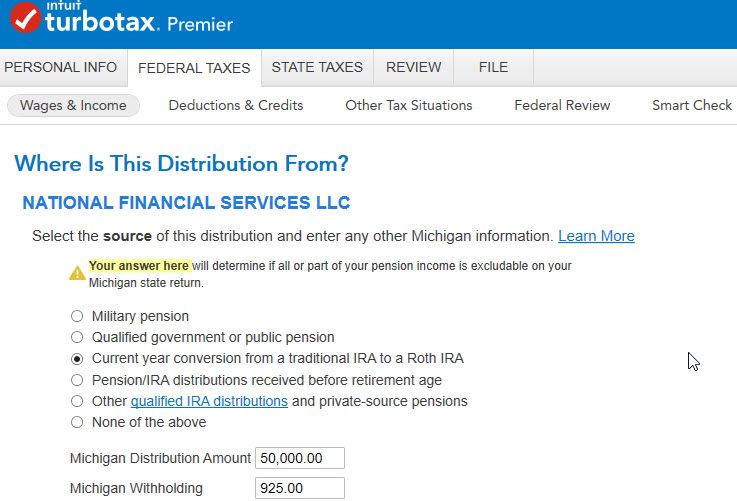

1099-R Split

Code C: (Current year conversion from IRA to Roth IRA)

I am working on the 1099-R section of the federal return. I do not understand how to fill this out. The 1099-R shows $50K removed form the IRA. $20K went into a savings account. $30K was conversion into a Roth. What do I put down for Michigan conversion amount? 20K, 30K or 50K?