fanfare

Level 15

Feb 15, 2020 6:52:44 AM

file it as other income as per last year especially if the IRS accepted your 2018 return.

osmania4w

Level 1

Feb 15, 2020 10:11:58 AM

Thanks

Turbo tax giving me the run around and insisting on calling it business

how do I get out of that?

Feb 18, 2020 11:59:55 AM

I apologize for your frustration!

If I am understanding you correctly, you received Form 1099-Misc. for being a daycare worker.

If you earned the money as part of a self-employed business, you will need to input the information under the Federal interview section.

- Select Income & Expenses

- Select Self-employment income and expenses

- Proceed through the screens to enter your information.

If your income is not from self-employment, you will enter your information as follows:

- Select Income & Expenses

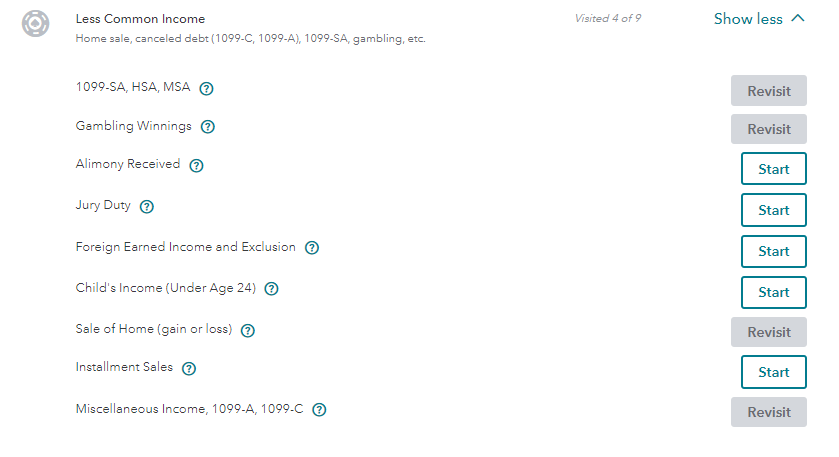

- Go to the All Income section and select "Less Common Income"

- Select "Miscellaneous Income"