Just to clarify, we would like to take a deeper look at this. It would help to have a diagnostic file, which is a sanitized copy of your tax return that has all of your personal information removed but has all of the forms and numbers entered. This will allow us to trace where the medical deductions come from. You can send one to us by following the directions below and posting the token number here so we can access the sanitized return.

TurboTax Online:

- Sign in to your online account

- Click on Tax Tools on the left toolbar

- Select Tools

- In the pop-up screen, click on "Share my file with agent"

- Click OK on the message that a diagnostic file will be sanitized and transmitted to us

- Please post the Token Number

TurboTax Desktop/Download Versions:

- Open your return

- Click the Online tab in the top menu bar

- Select "Send Tax File to Agent"

- Click Send on the message, and the tax file will be sanitized and transmitted to us

- Please post the Token Number

Hello, thank you very much for your fast reply. I have sent the file; the token number is: 951631. Please let me know if you need any additional information. Thank you again!

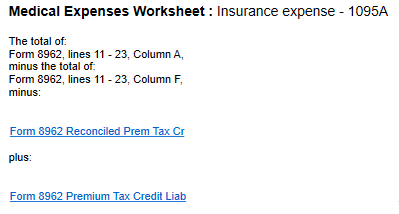

Thank you for providing that information. The amount in your Medical Deduction for Schedule A is higher than what you entered in the worksheet because it also includes the amount you paid for premiums for your health insurance + any excess Advanced Premium Credit that you had to repay. TurboTax automatically takes that information from your Form 1095-A and your Form 8962 and brings that into your Medical Deduction Worksheet. So, if your Form 1095-A form is correct, these numbers should also be good.