If you allocate 50% to your daughter, your daughter's 50% allocation of the 1095-A gets reported on her tax return.

Your daughter will need to enter your 1095-A when she prepares her tax return. Just like you, she will check the box indicating that the policy was "shared by somebody who is not on her tax return" and answer the allocation questions.

You and your daughter can choose the allocation, or you can claim 100% of the 1095-A. See the details at this section of the IRS Instructions for Form 8962 for detailed instructions.

Thanks, the policy is under my name only. She would still need to report her 50% on her return?

Thank you. When filling out the page on TT, I left the SLCSP box blank on both returns and entered 50% on the other two boxes. Is this correct? Thank you for your help.

You must enter the 1095-A exactly as it appears including the SLCSP. However, if there is a zero in any box, you can leave that blank in the program.

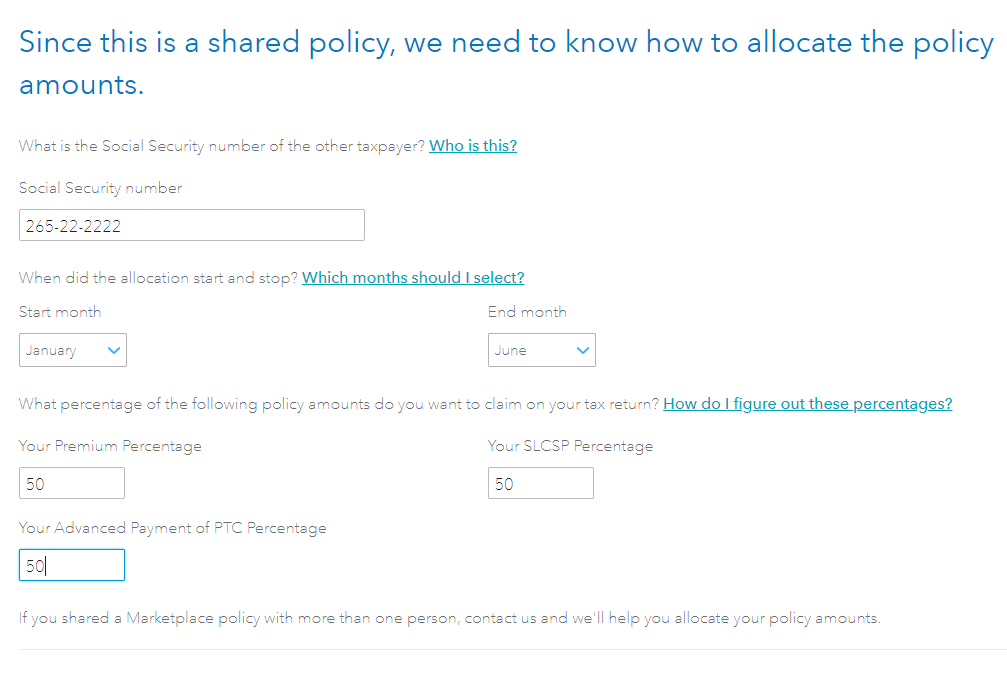

Is this the page you are referring to? Enter the percentage for every box.

When I do that, I have to pay and my daughter doesn’t. It doesn’t make sense.

If you paid all the premiums and got the benefit of the Premium Tax Credit, then you can allocate 100% to yourself and 0% to your daughter. The IRS says the family can allocate this any way they like.

This 100% - 0% is typical in situations like yours where there is an adult child still on the policy, but the parent was actually paying everything.

what is the problem that TurboTax have with Form 1095-A? or with dependents? I sent a Income tax it was pendent for 4 days and now is reject

I

@Berrygyrl59 wrote:I have an adult child that made less than $7000 in 2019. She is filing separately.

"Filing separately" doesn't mean anything. Does she qualify as your dependent? If you are not sure, what is her age and was she a full-time student for any part of 2019? Is her income over $4200?

Please review this Turbo Tax link to determine how to share allocations between you and your adult child. Your adult child will need a copy of the 1095A so they can report your share of the premium information.

Can the allocation be reversed? I take 0% and she takes 100%? Her income was lower than mine. It is my understanding that as long as she and I agree on this, we can do it.