ckoehncke

Level 2

posted Mar 20, 2024 11:48:21 AM

Virginia VA TurboTax Bug Form OSC

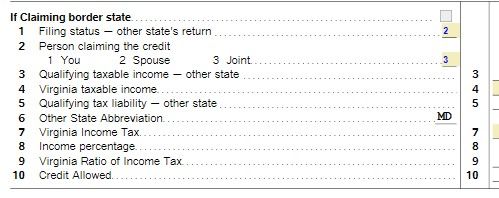

Schedule OSC (Credit for Tax paid to another state)

Summary: TurboTax does not seem to calculate the allowed CREDIT correctly in some cases.

Narrative:

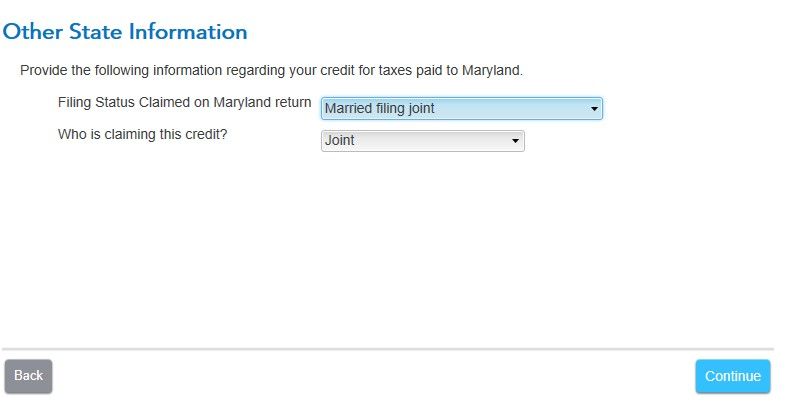

I completed my filing for VA with income from MD using the guided method and select "Who is filing credit?" as Jointly. TT passed it's review and filed e-filed. The State of VA notified me of an error and provided me an updated calculation.

After some investigation, I discovered by cycling the "Who is filing credit?" from Joint to BLANK and back to Joint. TT would recalculate the credit (which was in agreement with the State of VA).

I have uploaded my return as Token 1214097 and screen shot attached.

Note: This error is also reproducible in the Forms mode.