Feb 27, 2023 3:52:42 PM

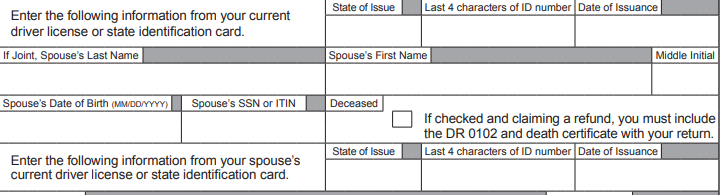

The 2022 Colorado Individual Income Tax Return requests a current drivers license or state identification card. See here.

If you mailed a Colorado state tax return for processing and the tax return reports an incorrect Social Security number, the state tax return cannot be correctly processed. It likely will be return to you in the US mail many weeks from now.

You should be able to submit a correct Colorado state tax return. Hopefully, you have access to additional copies of W-2's, 1099's, etc. to include with the tax return.

I would recommend that you include a letter with the Colorado state tax return outlining your situation. Hopefully, the Colorado Department of Revenue will be able to assist you.