Mar 8, 2024 11:25:25 AM

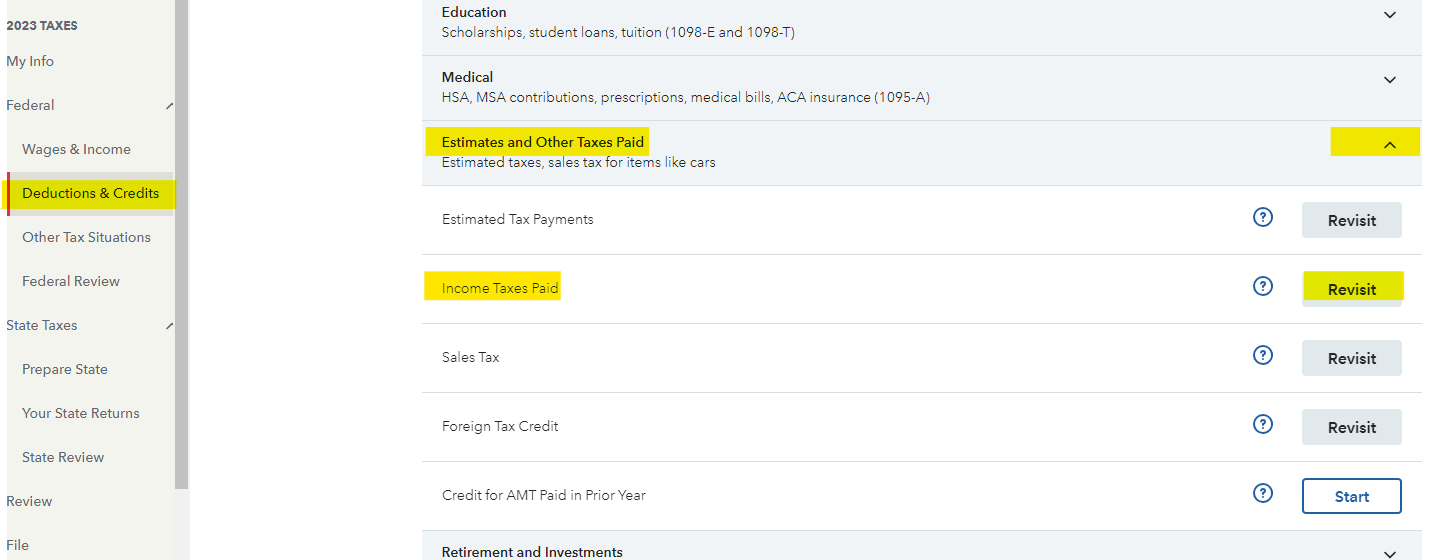

OR taxes paid are entered in the federal section. They will either be estimates paid or on a form, like w2. Return to the correct federal section and correct/enter as needed. You can change the state amounts in the federal section after filing since it should not have an effect. Be sure to save a copy of the federal you filed before making changes. Just in case it does change your itemized state and local tax deduction.

You can switch to the download version if you want -but that is extra work. See How do I switch from TurboTax Online to the TurboTax software?

For online, either revisit your W2 or select taxes paid.