It depends. What type of Business entity are you? Are you a C-Corp, S-Corp, Partnership, self- proprietor, or multi-member LLC?

Please clarify - have you entered the K-1 in the federal interview and are having trouble entering the Oregon-specific information in the state interview of TurboTax Business?

Entering the K-1 in the federal interview should prompt the program to ask for Oregon-specific information in the state interview.

At present, it appears that Oregon conforms with the federal tax code, with the recent, major exception of the Qualified Business Income Deduction (Section 199A) - Oregon does not allow this deduction.

This is a significant "disconnect", and the state interview will reflect it. See Oregon Income Tax Connection to Federal Law

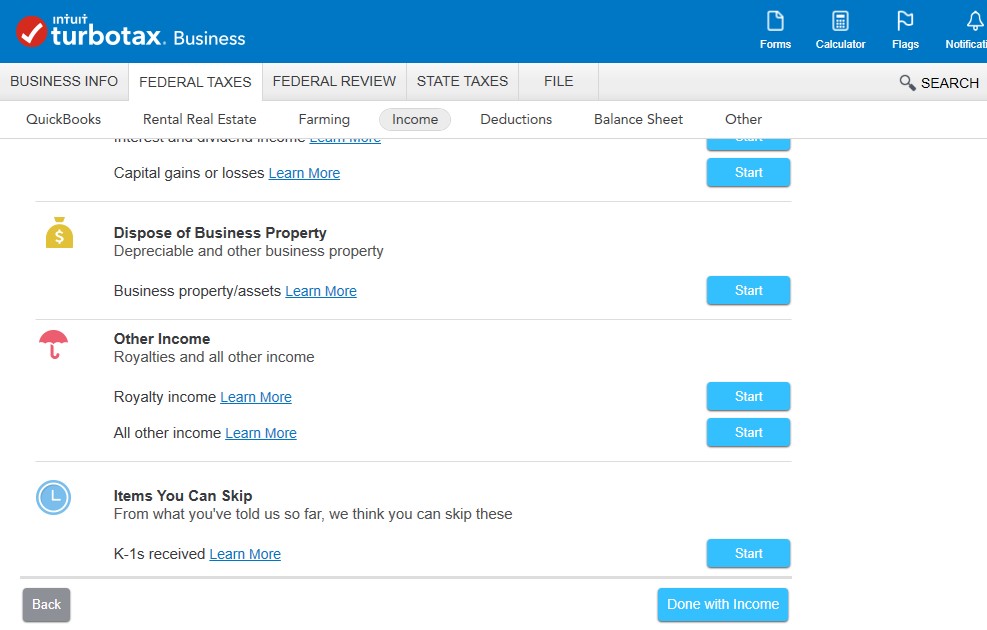

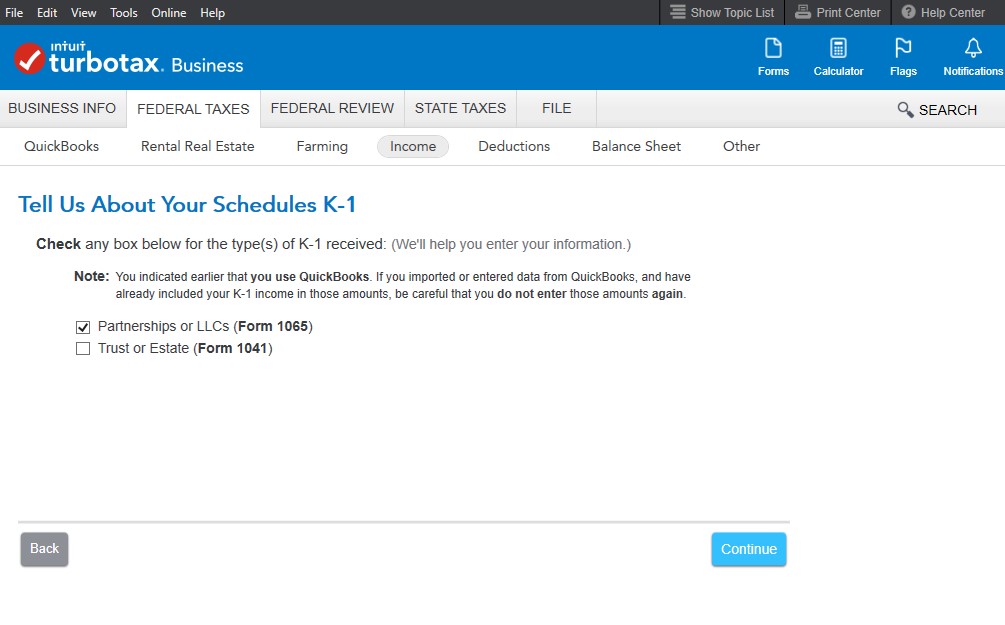

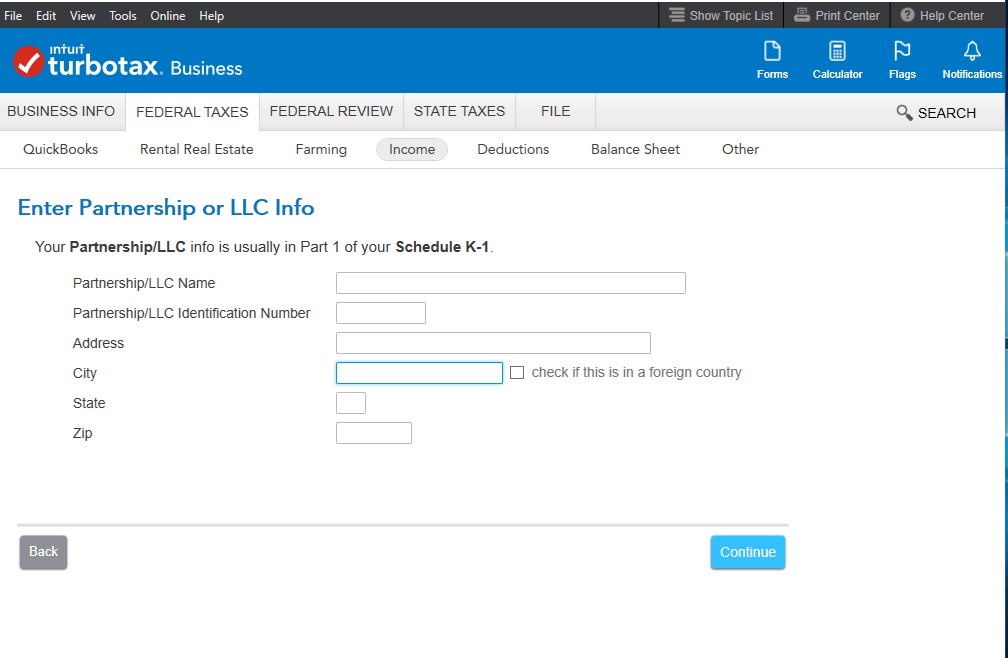

See the following screenshots for aid in navigating to the federal K-1 interview.

I moved twice during 2020. That means I lived and worked in 3 different states in 2020. I worked for the same company in 2 of the states, so they gave me a Federal K-1 with all my income from them reported, an Oregon K-1 with just the income I made in Oregon, and an Ohio K-1 with the income that I made in just Ohio. I entered the Federal K-1. I expected a prompt to enter the state K-1s when I prepared the Oregon and Ohio state returns, but I don't see anywhere to enter that information.

They are manual entries. You should have allocation screens in each of the state returns. These screens usually will have the total Federal amount reported for different categories of income, and you have the opportunity to input the state portions. For income reported on a W-2, this process is fairly automatic, because the states' income is usually specifically reported. For many other types of income, the program can also assign it fairly easily based on where the income is derived from (such as a rental). But with the K-1, that information is not provided automatically, so you will need to look for where you may enter it manually.