Code T means an early withdrawal and it is unknown if the 5-year holding period has been met and an exception applies. If the holding period is not met, the earnings are taxable.

You can always withdraw contributions (but not earnings) that you made to your Roth IRA tax and penalty free at any time. Additionally, the Ordering rules for withdrawals from a Roth IRA are: first from regular contributions, then from Conversion and rollover contributions, on a first-in, first-out basis and finally from Earnings on contributions.

Please note: A qualified distribution from a Roth IRA is tax-free and penalty-free, provided that the five-year aging requirement has been satisfied and one of the following conditions is met:

- Over age 59½

- Death or disability

- Qualified first-time home purchase

A non-qualified distribution is subject to taxation of earnings and a 10% additional tax unless an exception applies. For Roth IRAs, you can always remove post-tax penalty contributions (also known as "basis") from your Roth IRA without penalty.

Thank you for replying, I guess I need to be more specific with my question. I believe there's a problem with the MA TT form. This withdrawal was a tax free inherited Roth IRA RMD which turbo tax federal form & questions put on my federal 1040 as non taxable. When the information is transferred to the MA form it just puts in amount for the RMD as taxable. The MA form does not ask any qualify questions on the withdrawal. Has anyone else run into this problem?

I've just come across the same scenario in 2022 TT. The Fed form correctly treats the RMD as non taxable but the MA state form taxes the amount.

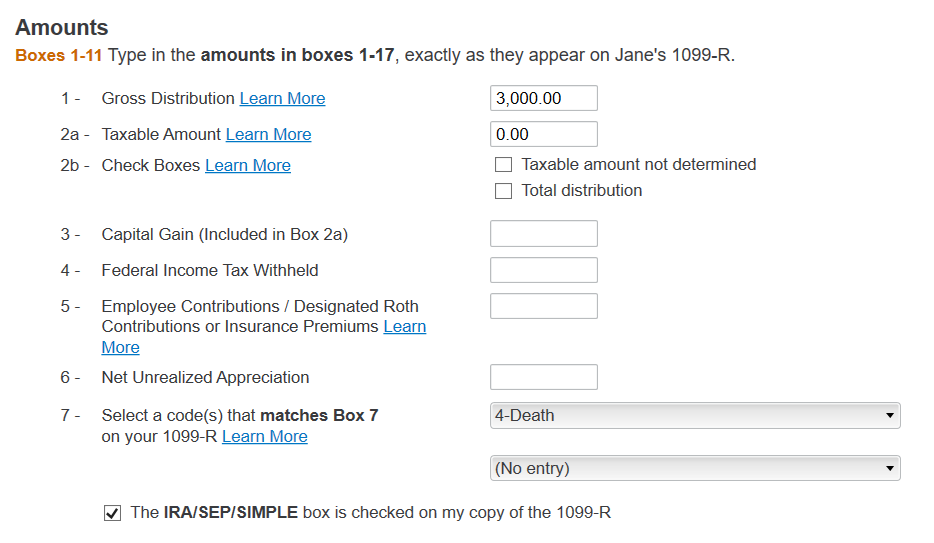

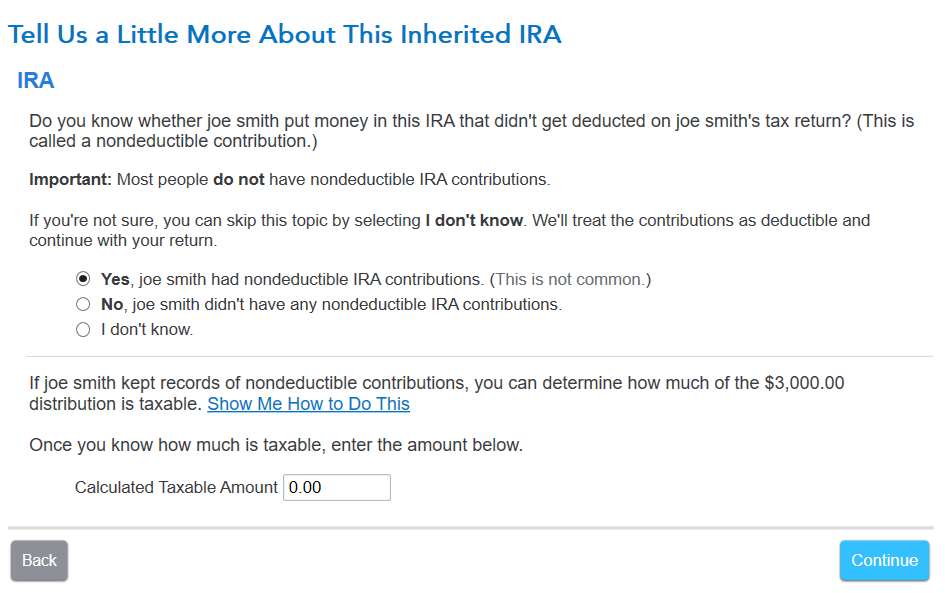

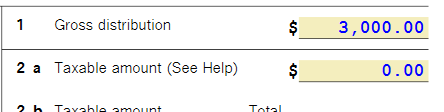

I am trying to duplicate your situation. I assumed code 4 and nonspousal IRA with MA tax paid on original contributions. When I enter the 1099R, I used a code 4 in box 7 since it is a beneficiary. I marked that it was non-spousal. I entered nondeductible IRA contributions existed. The calculated taxable amount is zero such that nothing is taxable on the federal.

When I go to MA adjustments, it shows the amount I entered as the basis showing in previously taxed by MA. Of course, if the IRA did not have MA taxes paid previously, the IRA would be taxable to MA.

When I look at the federal worksheet for the 1099-R, it has filled in the taxable amount as $0 when I had left the box blank on purpose during the interview, not knowing what you had done.

In MA, the return begins with the federal income on page 1. Income is added and subtracted according to state law. Schedule X contains the other income and I see where it is part of the total on line A but not on line H for taxable other income.

If you need additional help, please reply with more information.