Is your program up-to-date? I have Home & Business and Box 18.

How do I update my TurboTax CD/Download software program?

Perhaps you did not scroll down on your screen all the way, or your monitor is cutting off the bottom.

It did download an update a few days ago, but as of last night there were no updates available. Mine does look different than yours, in terms of screen layout as well as the Box 18 issue.

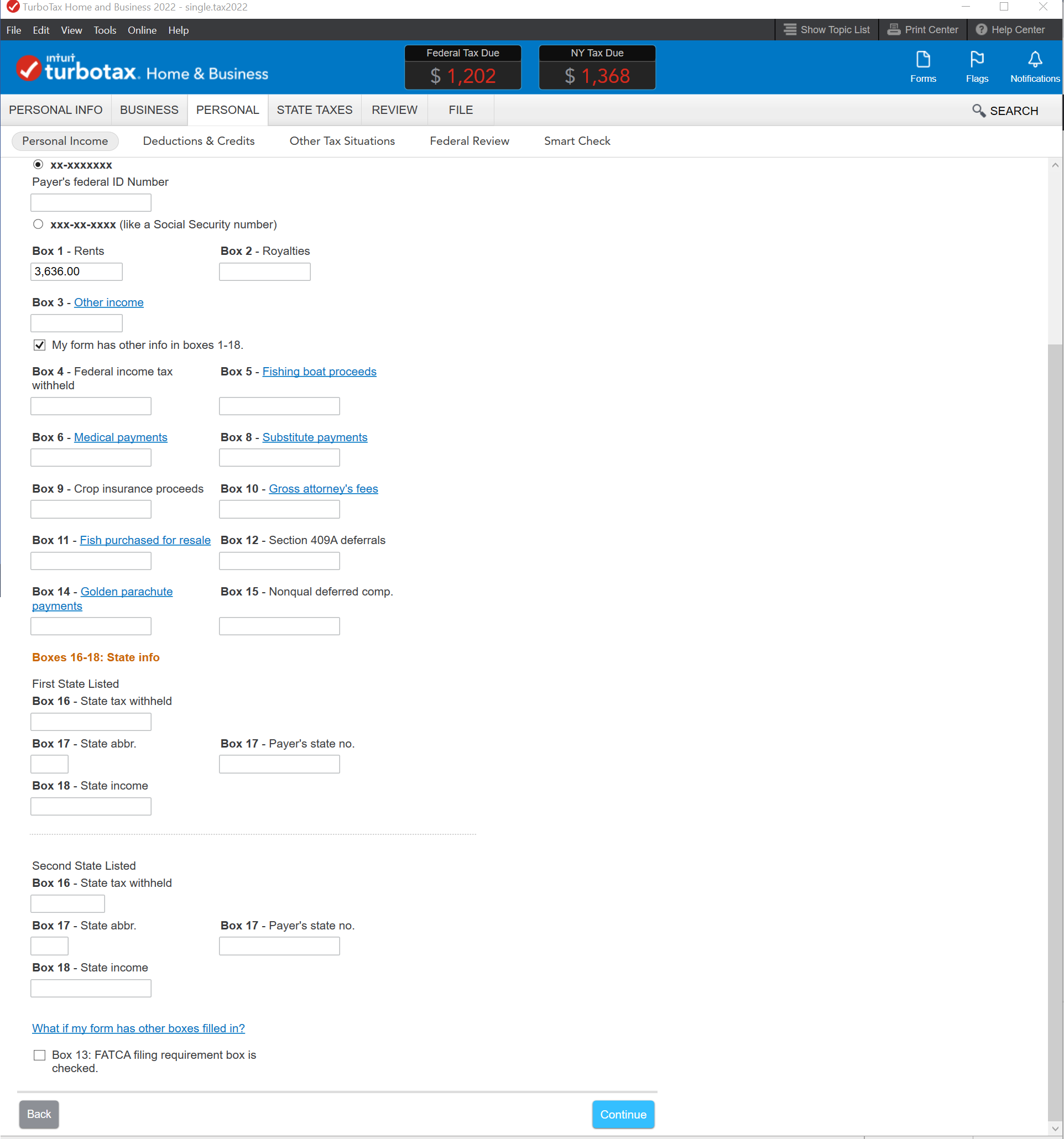

I just double checked, installed new updates, and went back to the form and there's still no Box 18. See attachment

If I open Home and Business Desktop/Download TurboTax and go to enter a Form 1099-MISC within the Rental section, on the Business tab, I do not have Box 18 showing either. You are quite right.

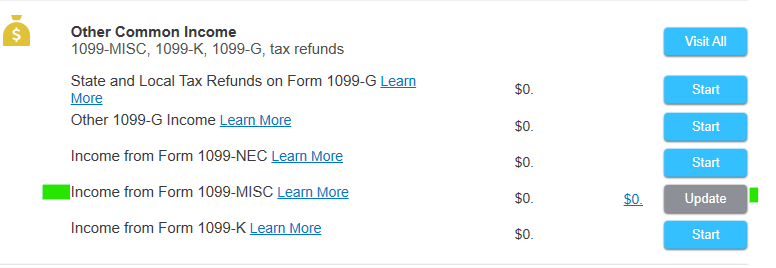

However, there are several places to enter a Form 1099-MISC and if I enter it in the Personal tab, under Other Common Income, it will show Box 18 and then the next screen asks if I want to link the form to the Rental section. This is a workaround to get your form entered properly while we examine the form inside the Rental section.

These are screens from the Personal tab.

@ParagonRob

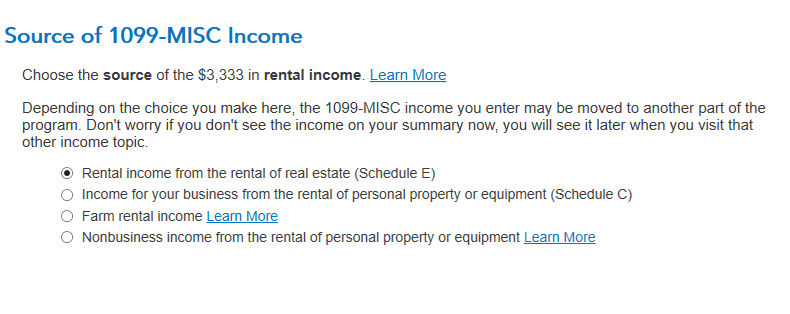

But this isn't for a rental. I'm an independent contractor and it's for work I did for a client. I'm aware that they should be using 1099-NEC for this, but their accountant sent me a MISC and I didn't notice it in time to have it changed, so I'm stuck at the moment, since I need to enter this under my business income/Schedule C.

Choose the 2nd option (Income for your business) instead of the first. The form will link to your Schedule C instead.