Mar 7, 2023 10:00:14 AM

No, do not complete Form 4852. This is reported on a substitute 1099-R.

To enter foreign pension in TurboTax online program, you would NOT treat it as "other income," rather, you will create a mock form 1099-R.

On sidebar

- Select Federal

- Wages & Income

- Select Wages and Salaries, or Revisit

- Scroll to Retirement Plans and Social Security

- Select the type of income.

- IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Social Security (SSA-1099, RRB-1099)

- Canadian Registered Pension Income

- Get Ready to be Impressed - Continue

- Select [Change how I enter my form]

- Select [Type it myself]

- Who gave you a 1099-R? Select and continue

- You will post your information the best you can and continue through the interview

- If your foreign issue does not have an ID number, you can try entering nine 9s.

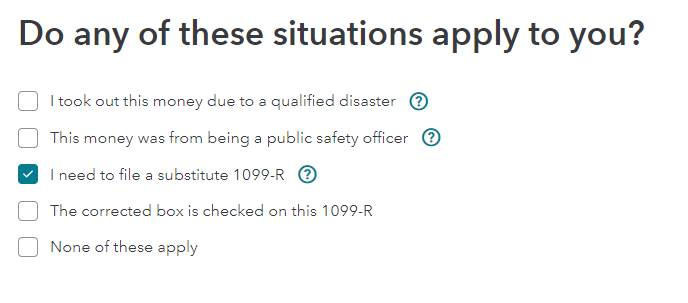

- You will come to a screen: Do any of these situations apply to you?

- Select I need to file a substitute 1099-R.

- Continue until you complete the process.