The age at which early penalties for retirement plan distributions end is 59 1/2, not 55. You would have to have a special circumstance to avoid the early withdrawal penalty.

One way to avoid the penalty would be to make substantially equal payments over a period of 5 years, ending no later than when you turn 591/2.

Yes, I am aware and the Prudential Rep is aware of the 59 1/2 rule but since I retired from my Employer, he said there's no 10% tax penalty. Hmm....

He may be assuming you will make equal withdrawals as is typical for a pension plan, in which case you would not be subject to the penalty.

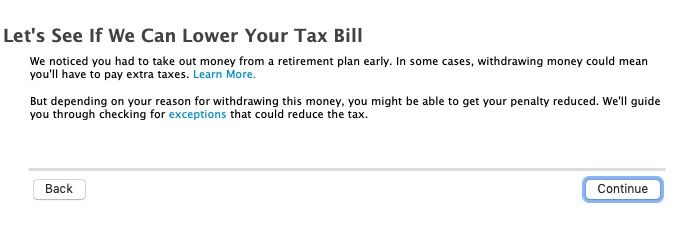

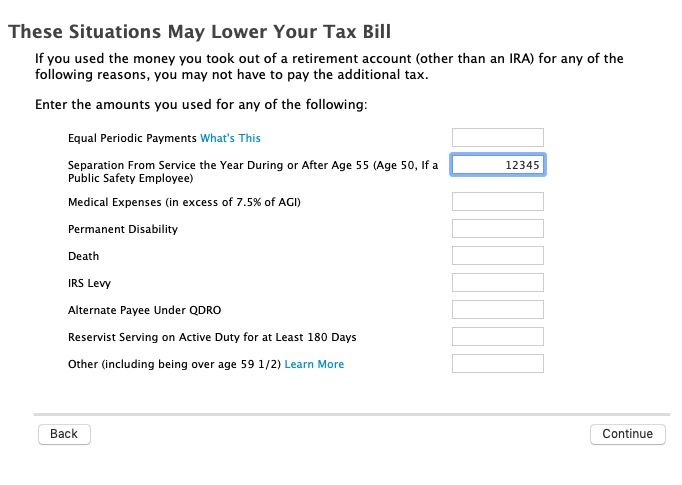

TurboTax asks "If we can lower yiur tax bill", then enter the box 1 amount from the 1099-R in the separation of service box.

The 55 rule is if you left the job that the 401K is attached to in the year you turned 55 ... but you left that job sometime ago and are now taking out a distribution so that exception doesn't apply.