- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Surprised By Refund Calculator's Zero Result - Please Clarify

Hi all,

I just wrapped up a past-due 2018 return using the TT "Home & Business 2018" on pc.

Relieved that I don't owe for that year...

...but also wondering if, due to incorrect placement of expenses (which I'll clarify below), that the zero balance might be inaccurate? It might be absolutely accurate on the other hand and I'm just not familiar with what ensures money back during a tax year and what doesn't.

------------------------

I say "incorrect placement" because I ended up putting the bulk of my expenses in:

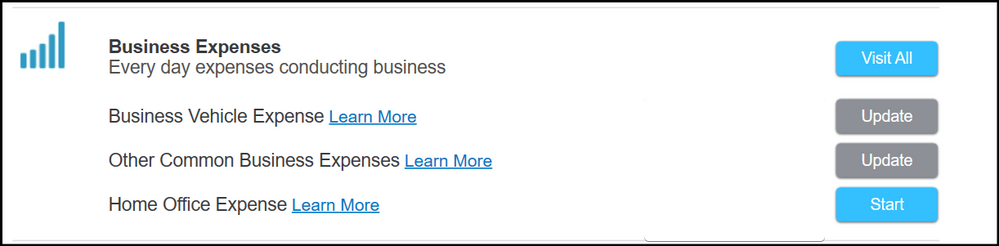

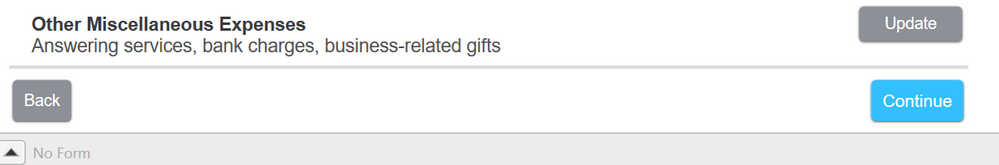

Business/Business Income and Expenses/[business name] Edit/Business Expenses/Other Common Business Expenses/Other Miscellaneous Expenses

Since the work is Rideshare, and my vehicle for the entire year was rented, not owned, I did not use "Business Vehicle Expense"...

...because its questions and subsequent screens assume vehicle ownership, leasing or "vehicle isn't mine", which is reserved for "expenses like gas, oil and repairs".

My main expenses were weekly rental fees, so Other Common Business Expenses/Other Miscellaneous Expenses..

...seemed like the next logical spot.

➡️ Did using this generic section instead of the more in-depth Business Vehicle Expense section affect how the deductions work? After everything was tallied, TT determined that there was a "NOL" (net operating loss) for that year...

➡️ Wouldn't "tax deductions that exceed the taxable income" during a particular year lead to a refund?

Thanks in advance...