- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

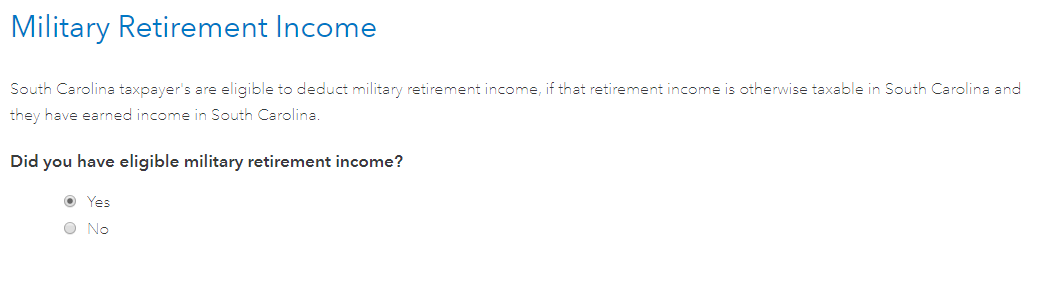

When you have retirement income on your tax return, one of the first questions you should see when you start the South Carolina interview is "Do you have eligible military retirement income?" on a screen that looks like the one below.

Do you not see this screen in your version of TurboTax? This screen opens the interview that allows you to deduct part of your retirement income connected to your prior service.

You are correct that retirement pay connected to full-time active duty as well as reserve service counts for this deduction.

The amount that is deductible has been increased in recent years and varies based on your age in the year the income is received. (There has been a gradual increase from a modest amount in 2015 to a full phase-in next year, 2020, of $17,500 for retirees under age 65 and $30,000 for retirees age 65 and older.)

Also note, you can amend your return for up to three years, using TurboTax's amendment software, if you overpaid your taxes in those years, to claim your refund. You can find the 2018 amendment software here, as well as a link to instructions for the other years: 2018 TurboTax Amendment Software.

**Mark the post that answers your question by clicking on "Mark as Best Answer"