- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Re: SC Military Reserve Retirement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Military Reserve Retirement

Just found out my Reserve Retirement is not taxed by SC. Why is this not prominent in Turbo Tax? It is hidden in "Other Subtractions" and there is no help in figuring out what percentage is active duty and what percentage is reserve. If this truly tax free, I have way overpaid my SC taxes for a couple of years.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Military Reserve Retirement

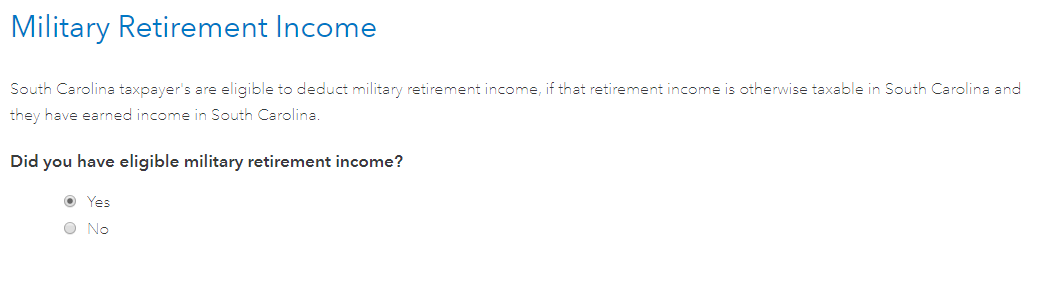

When you have retirement income on your tax return, one of the first questions you should see when you start the South Carolina interview is "Do you have eligible military retirement income?" on a screen that looks like the one below.

Do you not see this screen in your version of TurboTax? This screen opens the interview that allows you to deduct part of your retirement income connected to your prior service.

You are correct that retirement pay connected to full-time active duty as well as reserve service counts for this deduction.

The amount that is deductible has been increased in recent years and varies based on your age in the year the income is received. (There has been a gradual increase from a modest amount in 2015 to a full phase-in next year, 2020, of $17,500 for retirees under age 65 and $30,000 for retirees age 65 and older.)

Also note, you can amend your return for up to three years, using TurboTax's amendment software, if you overpaid your taxes in those years, to claim your refund. You can find the 2018 amendment software here, as well as a link to instructions for the other years: 2018 TurboTax Amendment Software.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Military Reserve Retirement

you missed the point. Reserve Retirement deduction would fall under SC1040 3.v. Other Subtractions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Military Reserve Retirement

Yes, you need to amend and SC 1040 instructions, top of page 18 says the deduction is for retirement income from the Reserves or National Guard.

- If you are under age 65, the deduction is limited to $14,600 for 2019.

- If you are age 65 and above, the deduction is limited to $27,000 for 2019.

This is considered self-prepared tax returns. We are happy to help and try to make things as clear as we can. You should have seen a page that says Here's the income that South Carolina handles differently. We have Learn More buttons as a guide.

At this point, you will want to amend the last 3 years for a refund.

Please see how to:

You will submit 2016, 201 and 2018 in separate envelopes and will want to have them tracked to be sure they arrive safely.

Most important, thank you very much for your service!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Military Reserve Retirement

When I looked at the SC tax code, it looks like deductions you refer to pertain to active duty retirement.

Thanks for the point to page 18 of the SC1040 instructions. It basically says the same as SC 117-640.3 "That portion of the pension or retirement income received by retried service personnel, residents of this State, that can be attributed to time served in the National Guard or Reserve components of the Armed Forces of the United States, is not taxable." I had 8 years of active duty and then 28 years of Reserve duty so I have a reserve retirement. That really changes my tax return.

Am I reading that right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Military Reserve Retirement

When you have retirement income on your tax return, one of the first questions you should see when you start the South Carolina interview is "Do you have eligible military retirement income?" on a screen that looks like the one below.

Do you not see this screen in your version of TurboTax? This screen opens the interview that allows you to deduct part of your retirement income connected to your prior service.

You are correct that retirement pay connected to full-time active duty as well as reserve service counts for this deduction.

The amount that is deductible has been increased in recent years and varies based on your age in the year the income is received. (There has been a gradual increase from a modest amount in 2015 to a full phase-in next year, 2020, of $17,500 for retirees under age 65 and $30,000 for retirees age 65 and older.)

Also note, you can amend your return for up to three years, using TurboTax's amendment software, if you overpaid your taxes in those years, to claim your refund. You can find the 2018 amendment software here, as well as a link to instructions for the other years: 2018 TurboTax Amendment Software.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Military Reserve Retirement

you missed the point. Reserve Retirement deduction would fall under SC1040 3.v. Other Subtractions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Military Reserve Retirement

I am reading the instructions for line v on page 18 (where the retirement for inactive Reserve and National Guard time is subtracted).

It appears to me to say that if you were in the military 20 years - 10 years active duty and ten years in the Reserves, that you would calculate the ratio of 10:20 and multiply the, let's say, $1,000 a month pension by 50% to get a subtraction of $6,000 a year on line v.

But is there any other situation other than active duty military and inactive Reserve duty (assuming that reservists called to active duty would be included as active duty)?

That is, what if you ignored the line v that you are referring to, and put the entire retirement on line p4 (which TurboTax does ask about, as you can see above)?

Would the final result be any different? Is there a reason from your calculations that the sum of line p4 and line v in your figuring would be different than the result that TurboTax would get if you just told it that all of the military retirement is nontaxable?

I am not saying this to avoid your point, but I am saying this as a potential workaround.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SC Military Reserve Retirement

Ah, I found it.

Unlike retirement from active duty military - which TurboTax has an explicit screen on - retirement from inactive Reserve and National Guard duty is reported in a separate place.

Open TurboTax and go to the South Carolina input screens. Proceed until you find the screen with the heading "Here's the income that South Carolina handles differently".

Scroll down to the subheading ":Misc". Then click on Start or Revisit for "Other Subtractions". If you click on the Learn More link, you will see that the seventh item in the list of other potential subtractions is "Reserves to National Guard retirement income..."

First you will use the formula in the instructions for line u (where the ratio of reserve/National Guard to active duty time to calculated and multiplied by your retirement income) to calculate the next amount of the retirement to be subtracted for reserve or National Guard duty.

Then on the next screen, you will enter the description and the amount - this will be added to Other Subtractions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

calderad07

Level 1

windtree4

Level 2

Stllwtrs

Level 1

4109e678d715

New Member

gavulic1

New Member