- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

You should compare your tax returns that were generated by each TurboTax version, if you have copies of both of them to help determine what the difference is.

You could have made an entry error. The results should be the same if everything was entered the same.

To qualify for the retirement credit:

- You must be age 18 or older

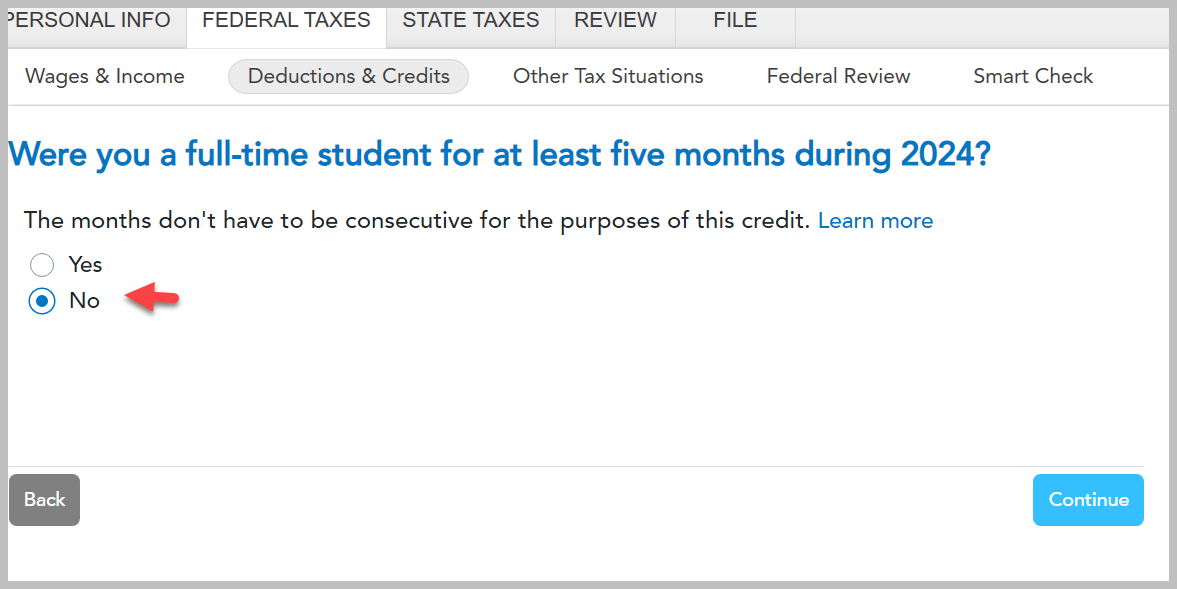

- You must not be a full-time student during five months of 2024

- You must not be claimed as a dependent on someone else's tax return

- You must have made your retirement contribution during the tax year for which you are filing your return

You can get back to your TurboTax entry screens for this credit by doing the following:

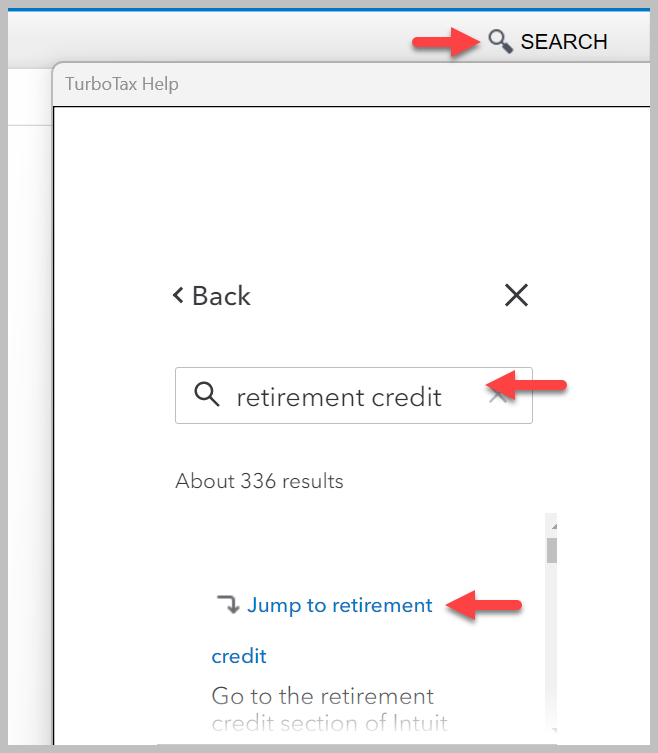

- Click on the search icon in the upper right of your TurboTax screen

- Type "retirement credit" in the search box

- Click on the link "Jump to "retirement credit"

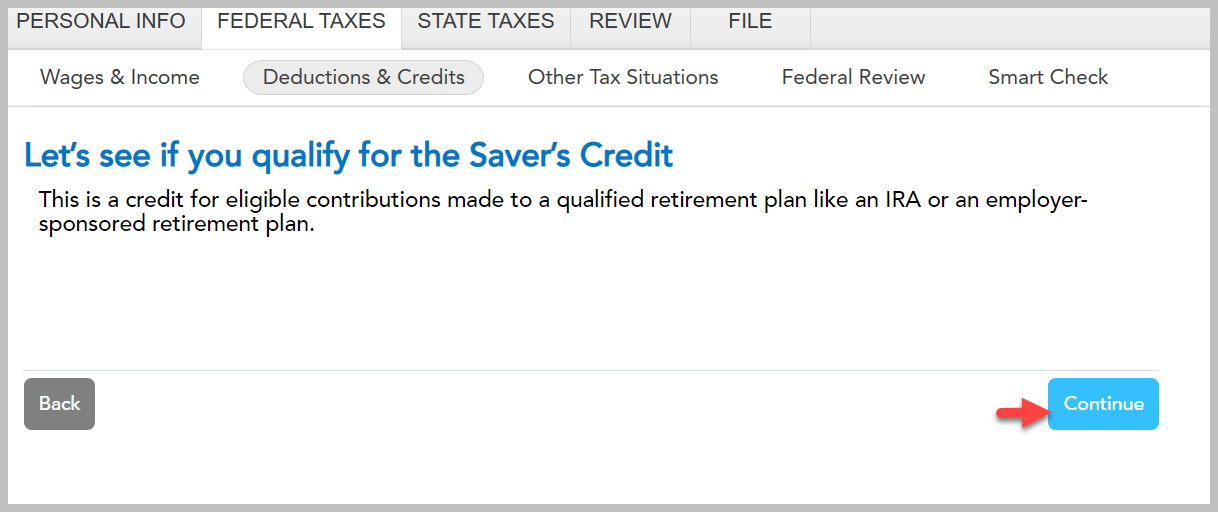

- This will take you to your TurboTax screens that determine your qualification for the "Savers Credit"

- Select "Continue"

If you can not resolve this, you can try contacting TurboTax Customer Service using this link: Turbo Tax Customer Service

Your TurboTax screens will look something like this:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 31, 2025

2:13 PM